Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Mortgage real estate investment firm Annaly Capital Management tops the list of the first edition of Dividend.com’s trends article this year, as the company recently announced a share repurchase program. Cisco Systems is second in the list as the U.S. telecommunications equipment icon continues to struggle in the coronavirus pandemic. EPD Enterprise, an energy pipeline that is third in the list, could be one of the best dividend plays this year. Finally, drugmaker AbbVie is facing a challenge to its key drug Humira as other competitors joined the highly lucrative market.

Don’t forget to read our previous edition of trends here.

Annaly Capital Management

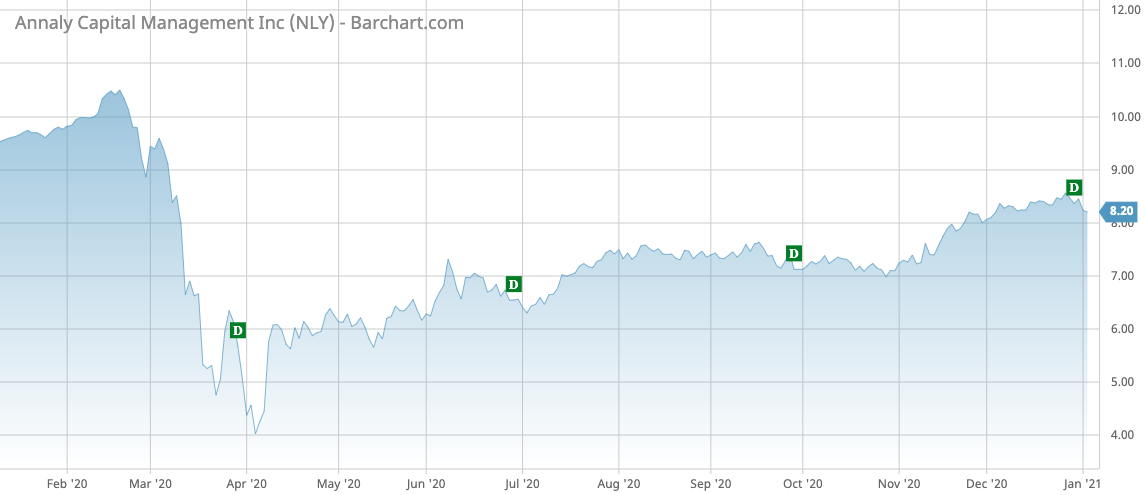

Mortgage real estate investment trust Annaly Capital Management (NLY) has seen its viewership surge around 30% over the past two weeks.

The stock is still in recovery mode after it plunged to record low levels in March at the height of the COVID-19 pandemic. The stock trades at about $8.23 per share, which is still around 25% below pre-pandemic levels. Annaly, which has a market capitalization of more than $11 billion, yields an impressive 11%, with the dividend yield boosted by the weak stock price. Its payout ratio stands at around 80%, suggesting the company can still afford the high dividend.

Annaly pleased investors at the end of 2020, announcing a new share repurchase program for 2021 of around $1.5 billion. This replaces the existing program of $1.5 billion, which expired on December 31. Weeks before, Annaly kept its dividend stable at a quarterly rate of $0.22 per share.

Annaly shares have grown steadily since the abrupt decline in March as the financial environment has stabilized. Mortgage REITs such as Annaly typically profit from the variance between the difference in long-term interest rates and short-term interest rates. In times of stress, this discrepancy gets smaller, a phenomenon also known as the flattening of the yield curve. This puts in jeopardy mortgage REITs’ financial standing, and its stock suffers as a result.

The recovery in the financial markets was swift, although the real economy still faces challenges.

Source: Barchart.com

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

Cisco Systems

Cisco Systems (CSCO) is second in the list over these past two weeks with an advance in viewership of 28%. Cisco has faced mixed fortunes over the past year. Its shares have fared relatively well during the pandemic sell-off in March 2020, but it recovered quickly.

However, as the company’s results continued to disappoint, Cisco stock started to fall again in August, and at the end of October came within a whisker of hitting the pandemic lows. With a payout of around 45%, Cisco’s dividend yields 3.2%. Cisco also gravely underperformed its technology peers, as it failed to extract the benefits from the coronavirus pandemic.

One reason for the underperformance is that Cisco still relies on legacy hardware sales, which have taken a huge blow after the COVID-19 pandemic forced companies to slash IT budgets and employees worked from home. The company is still in transition to new software and the cloud, and its Webex teleconferencing tool experienced a boost in the stay-at-home economy, but not enough for the stock price to perform well. Webex’s rival, Zoom Video Communications, has seen its stock surge over 400% the past year.

As a result of the poor performance, Cisco is now restructuring its operations. Management decided to draw the curtain on its initiative for smart cities named Kinetic for Cities. Cisco acquired privately-held Jasper Technologies in 2016 to help it speed up its smart city offering, but is now pulling the plug as it wants to become more focused on its evolving market needs and customer requirements.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

EPD Enterprise

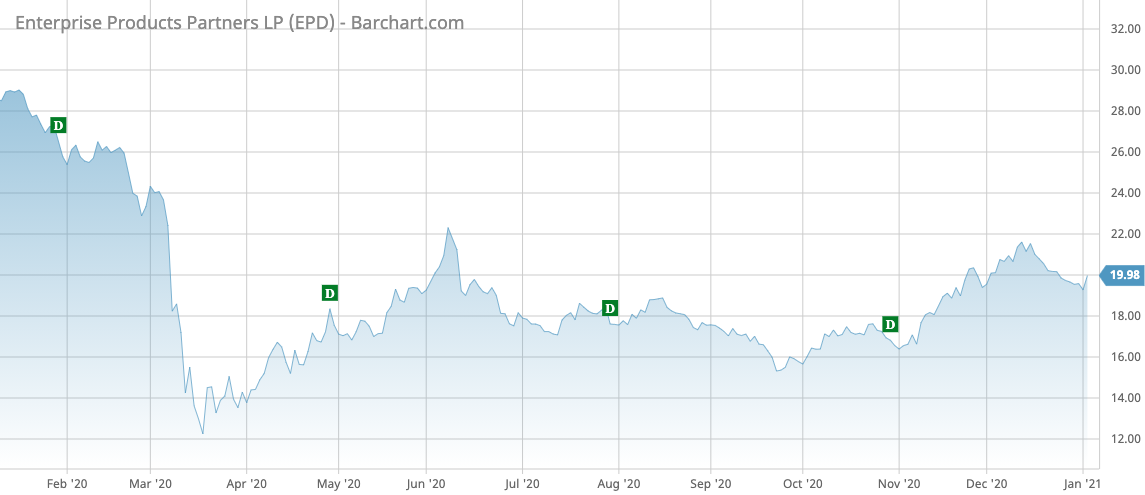

Energy pipeline Enterprise Products Partners (EPD) is third in the list with an increase in viewership of 23%. Pipeline operators like Enterprise Products have largely suffered this year as oil and gas prices have been pummeled. Enterprise Products’ revenues have declined every quarter in 2020, with the largest drop of 30% occurring in the June quarter.

Enterprise Products has a dividend yield of more than 9%. Although that typically indicates the company will be forced to cut it, Enterprise Products appears to be in good shape. The company generates its profits from the fees it charges on the oil and gas that flows through its pipes, and as a result is less exposed to the market fluctuations of the underlying products.

Indeed, the distribution coverage has been a strong 1.6 times, which in the midstream space is considered very healthy.

Source: Barchart.com

AbbVie

Pharmaceutical giant AbbVie (ABBV) is fourth in the list with a jump in viewership of 18%. AbbVie has increased its dividend by 10.2% in October to an annualized $5.20. The company’s dividend now yields close to 5%.

While AbbVie has increased its dividend for the past 49 years, it now faces questions from investors over its ability to overcome current headwinds from growing competition for its hit drug Humira, which is expected to bring in nearly half of the company’s $45.6 billion in sales in 2020. However, as exclusivity for the therapy – which treats diseases ranging from arthritis to Crohn’s – ends in a few years, the arrival of biosimilars on the market is expected to dent sales and profitability.

In mid-December, management attempted to soothe investor concerns, arguing that sales of two new drugs named Skyrizi and Rinvoq will more than offset the expected drop in Humira sales.

Shares in AbbVie have appreciated by nearly 20% in 2020, beating the S&P Pharmaceuticals by around five percentage points.

Source: Barchart.com

The Bottom Line

Mortgage real estate investment trust Annaly Capital is still reeling from a brutal market sell-off in March, and recently launched another share buyback program to help its recovery. Cisco Systems was caught wrong-footed by the coronavirus pandemic, despite some of its telecommunications software businesses benefitting from the stay-at-home economy. EPD Enterprise has a very high dividend but the company is in a strong position. AbbVie again increased its dividend, although the company is facing some imminent business challenges.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.