The COVID-19 crisis has impacted nearly every part of the economy, but few industries have been harder hit than restaurants. Aside from mandatory closures in many states, restaurants that remain open have seen sharply lower foot traffic, higher input costs and thinning margins.

Let’s take a look at the impact of COVID-19 on restaurant and fast food chains and their dividends, as well as the implications for income investors.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

How COVID-19 is Affecting Restaurants

Many states shut down dine-in options at bars and restaurants through April. States that have allowed restaurants to reopen have introduced restrictions designed to limit dine-in occupancy to half of their normal levels. While takeout and delivery options remain, these orders tend to be lower margin.

According to the New York Times, foot traffic at Texas restaurants (that have been reopened) was still down 20% compared to early-March levels. The high unemployment rate could also dampen spending on restaurant meals as consumers look to cut their discretionary spending.

Many restaurants are also facing higher input costs. Fresh meat prices rose 8.1% at the end of April with experts warning that they could rise further in May. Meat plants have been forced to close due to COVID-19 outbreaks in recent weeks, causing fresh meat prices to skyrocket as demand outstripped supply.

Don’t forget to check our Restaurants page to explore more stocks.

Impact on Restaurant Dividend Policies

Many restaurants have cut or suspended their dividends in response to the COVID-19 crisis.

The most prominent dividend cuts include:

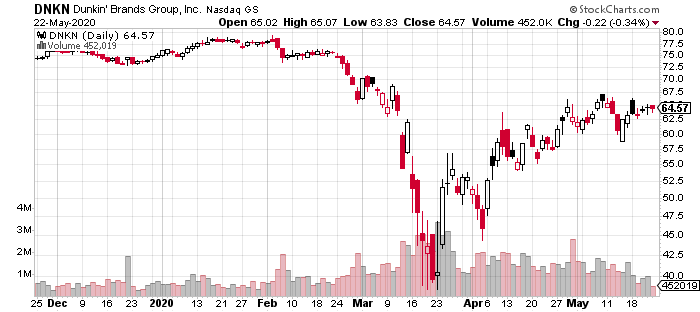

1. Dunkin’ Brands Group Inc. (DNKN)

Dunkin’ suspended its quarterly dividend and share repurchase programs on April 30, which will save $33 million in the second quarter. Comparable store sales fell nearly 20% during the last three weeks of the first quarter as the COVID-19 pandemic hit.

2. The Wendy’s Company (WEN)

Wendy’s lowered its quarterly dividend to five cents per share and suspended share repurchases to shore up its balance sheet. The company also drew down $120 million under a revolving financing facility and reported $365 million in cash on hand.

3. Cracker Barrel Old Country Store Inc. (CBRL)

Cracker Barrel deferred its dividend scheduled for May 5, 2020, until September 2, 2020, and suspended all further dividend payments and share repurchases until further notice. The company also drew down credit facilities to bolster its cash position to $400 million as of March 24, 2020.

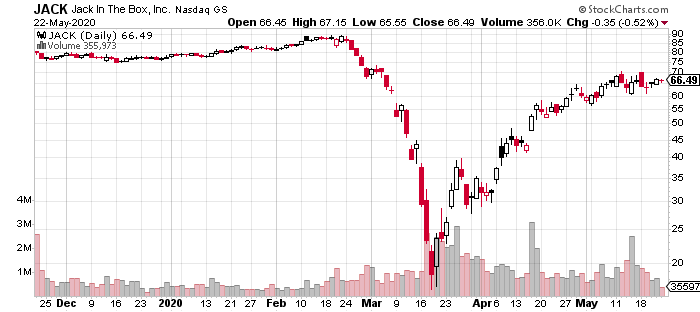

4. Jack in the Box Inc. (JACK)

Jack in the Box has temporarily suspended its dividend and share repurchases until further notice. Same-store sales fell 4.2% during the first quarter as the COVID-19 crisis hit. At the end of the quarter the company reported $169 million in cash on its balance sheet.

5. Bloomin’ Brands Inc. (BLMN)

Bloomin’ suspended its dividend and drew down substantially all of its credit facility to bolster its cash position to over $400 million.

6. The Cheesecake Factory Inc. (CAKE)

The Cheesecake Factory suspended its quarterly dividend and share repurchases to preserve capital after comparable store sales fell 12.9% during the first quarter amid the ongoing COVID-19 crisis. The company reported $81 million in cash and $380 million in debt as of March 31.

7. Dine Brands Global Inc. (DIN)

Like some of its peers, Dine temporarily suspended its quarterly dividend and terminated all outstanding orders for repurchases of its common stock to preserve capital. The company also drew down $220 million from a revolving credit facility to bolster its cash position to $395 million as of March 31, 2020.

Implications for Income Investors

Income investors may want to consider transitioning out of the restaurant industry as revenue dries up. While some investors are bullish on a near-term comeback, some analysts project that pre-crisis profits may not return until as late as 2022. And dividends will be one of the last things to come back.

If investors are still looking for restaurant exposure, they may want to consider tech-savvy names, like Wingstop (WING), and delivery and takeout businesses, like Domino’s Pizza (DPZ) and Papa John’s International (PZZA). These companies have been among the top performers throughout the crisis.

Fast food restaurants could also outperform casual dining firms that rely on sit-down consumers. That said, the franchisees of many fast food brands may suffer and put pressure on the model, while these stocks tend to trade at higher multiples, which creates a trade off for investors.

The Bottom Line

The COVID-19 crisis has disrupted many different industries, but few as much as the restaurant business. While some states are allowing restaurants to re-open, early data shows a steep decline in foot traffic, and it could be until 2021 or 2022 until profits return to pre-crisis levels.

These dynamics suggest that many companies may continue to suspend their dividends for an extended period of time. Income investors may want to look elsewhere for yield or consider tech-savvy, take-away or fast food chains that may be better positioned than sit-down restaurants to weather the crisis.

Be sure to visit our complete recommended list of the Best Dividend Stocks.