Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Amid the coronavirus pandemic, some companies are trying to preserve cash by cutting shareholder payout, while others scramble to maintain it. Technology juggernaut Apple is among the few companies that can afford to continue its payouts without endangering its financial position. Store Capital, second in the list, reaffirmed its dividend recently, while Royal Dutch Shell, third in the list, cut it for the first time since World War II. But first in the list is oil storage provider Nordic American Tankers, whose stock has rallied in the current market environment.

Don’t forget to read our previous edition of trends here.

Nordic American Tankers

Nordic American Tankers (NAT) has seen its viewership rise 346% over the past two weeks, the highest increase by far. This is unsurprising, as Nordic American has been one of the few beneficiaries of the oil glut in global markets, stemming from a collapse in demand due to the COVID-19 pandemic.

Shares in Nordic American rose 171% between March 20 and April 28, as rates for storing oil skyrocketed. Demand for storage was so high that WTI’s May futures contract plunged into negative territory for the first time in history, meaning sellers had to pay buyers in order to take oil from them.

Indeed, Nordic Chairman Herbjorn Hansson said in an interview on CNBC that the company is “making a lot of money at this time” and he has “never seen such a strong market.” Nordic expects first-quarter revenue to increase 65% to $88.5 million. Hansson said the company will use the proceeds to improve the balance sheet, pay down debt and prioritize its dividend. As of the end of 2019, Nordic had $367 million in debt.

However, as oil prices started to recover and rates for tankers fell, Nordic American stock followed suit, dropping nearly 30% over the past five days.

Nordic yields a strong dividend of 9.3% and its payout ratio is nearly 55%.

Source: barchart.com

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Store Capital

Store Capital (STOR) has taken second place in the list with an increase in traffic of 51%. Store, in March, declared a dividend of $0.35 per share, unchanged from the previous one. As a result, Store’s dividend yield rose to more than 7.5% as the company’s stock halved in value following the market sell-off induced by the COVID-19 pandemic.

Store has suffered from the closure of non-essential retail locations, as most of its portfolio is geared toward that part of the market. However, its unique business model could help it come out of the crisis in a good shape, although its high debt level could place added pressure. Unlike other REIT operators, Store Capital takes rent payments directly from its tenants’ business operations, which means it gains access to its clients’ financial statements.

On May 5, CEO Christopher Volk said the company “fortified” its balance sheet with additional liquidity. Its revenues for the first quarter increased by 14%, to $178 million, primarily driven by the growth of its investment portfolio.

Source: barchart.com

Check out our latest Best Dividend Stocks List here.

Royal Dutch Shell

Royal Dutch Shell (RDS-B) has taken the third place in the list with a 41% rise in viewership as the company reduced its dividend for the first time since the Second World War. Shell said it would now pay 16 cents per share, down from 47 cents, or a cut of 66%. The reduction is a testament to the damage that the COVID-19 pandemic is inflicting on the world economy and, particularly, the oil markets, which was already suffering from a chronic supply glut.

The company initiated the cut by saying the deterioration in the macroeconomic outlook and the outlook for oil and gas prices was unprecedented. It added that it expected the harsh conditions to extend well into next year and, as a result, maintaining the current level of shareholder distributions is not prudent.

Shares in Shell have declined 47% so far this year, and in mid-March reached a low not seen since 1995. Shell’s dividend yield reached nearly 11.5%.

Source: barchart.com

Apple

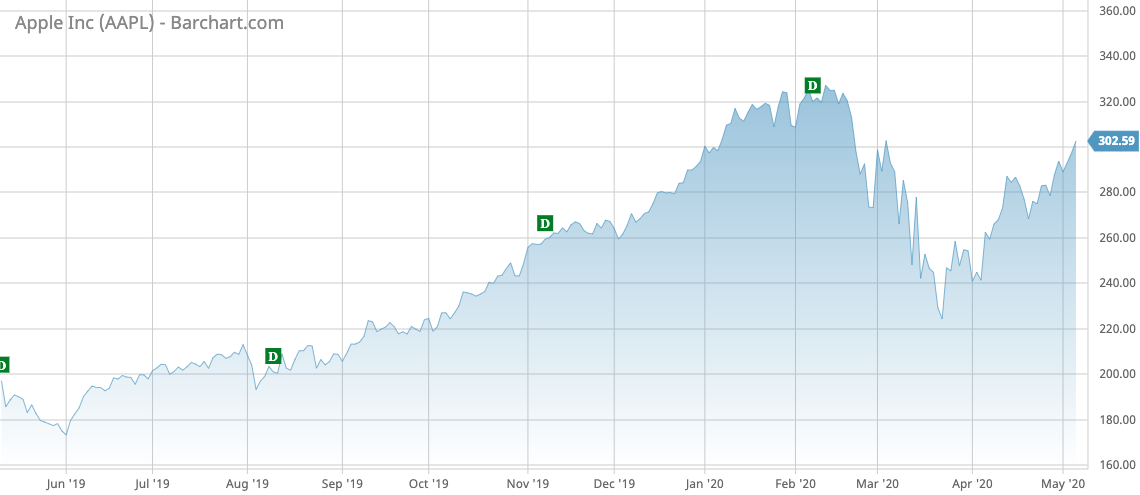

Apple (AAPL) is fourth in the list with a 36% advance in viewership. Apple is one of the few companies that has outperformed the S&P 500 Index this year, largely thanks to its strong balance sheet. Apple stock is flat year-to-date, while the S&P 500 lost 11%.

Apple has taken advantage of the low interest rates and raised $8.50 billion by selling four different bonds with maturities ranging from three to 30 years. Its three-year $2.25 billion bond yields just 0.75%, while the five-year one is a little above 1.1%.

Apple said it will use the proceeds to pay dividends and finance share buybacks. For the six months ended March 28, Apple spent $38 billion on share repurchases. Apple’s dividend yields 1.1% and its payout ratio is 26.5%.

Source: barchart.com

The Bottom Line

Nordic American Tankers stock has posted wild swings lately as the rates for oil storage fluctuated dramatically. Real estate firm Store Capital has suffered from closures of non-essential retail locations. Shell cut its dividend for the first time in 70 years – a testament to the hard times experienced by the oil and gas markets. Finally, Apple issued bonds at very low interest rates to finance share buybacks and dividends.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.