Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Telecommunications equipment provider Cisco has taken the first spot on the list this week as the company released a weak earnings report. Walt Disney, meanwhile, jumped after earnings and revelations that its new streaming service got traction with customers. Walmart reported another quarter of sales growth, while Occidental Petroleum is still facing a potential challenge from activist investor Carl Icahn.

Don’t forget to read our previous edition of Trends here.

Cisco

Tech giant Cisco (CSCO) has seen its viewership increase 125% over these two past weeks, nearly triple the amount of the second contender. Cisco has reported weak results for two consecutive quarters, with the last one less than a week ago triggering a 7% drop in the stock price.

Cisco said that customers grew more cautious due to a host of macroeconomic issues, including weak confidence, uncertain trade deal negotiations between the U.S. and China, growing protests in Hong Kong and concerns around Brexit. CEO Chuck Robbins said a return to normal levels of growth was possible if geopolitical issues become resolved.

Cisco predicted that its revenues in the second-quarter will decline between 3% and 5% compared to the year-ago period. This means around $11.9 billion in losses and compares poorly with analysts’ forecasts of $12.8 billion. Meanwhile, earnings per share are expected to be in a range of $0.75 – $0.77 versus $0.79 forecasted by Wall Street analysts.

Although the company predicted a bleak outlook for the forthcoming period, Robbins said he expects the company’s profitability to improve because the company is selling more software.

Cisco stock has advanced around 6% so far this year, underperforming the S&P 500 by 18 percentage points. Cisco had outperformed the S&P 500 for the better part of this year, but performance turned for the worse when Robbins warned about a tough environment ahead.

Cisco’s dividend yield is 3.10% and the company’s payout ratio is 45%. The company has been growing its dividend for the past eight years.

Walt Disney

Walt Disney’s (DIS) traffic rose 45% over these past two weeks, as the company finally launched its long-awaited streaming service Disney+ and reported strong results for the fiscal fourth-quarter. The company reported adjusted earnings per share of $1.07, beating analysts’ estimates of $0.97, while revenues of $19.1 billion were largely in line with predictions.

Disney+, which costs $6.99 per month, is featuring content from Disney, Pixar, Marvel, Star Wars and others. It launched in the U.S., Canada and the Netherlands, with other countries expected to follow suit. CEO Bob Iger said on a conference call that a test in the Netherlands was “quite successful,” with the demographics using the service “far broader than a lot of people expected them to be.”

With the launch of Disney+, the company challenged established players such as Netflix (NFLX Amazon (AMZN) and insurgents like HBO Max and Apple (AAPL). However, Iger dismissed concerns about competition.

While all the other business segments posted strong results, the company’s Disney Park in Hong Kong has suffered due to protests and a fall in tourism.

Disney stock has continued its ascent over the past two weeks, extending year-to-date gains to 36%, well above S&P 500’s 24% gain.

Disney’s dividend yield stands at 1.2% and its payout ratio is 30.50%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Walmart

Grocery retailer Walmart (WMT) has reported strong third-quarter earnings, triggering a rise in viewership of 40%. Although revenues were worse than expected at $128 billion, earnings per share of $1.16 beat analysts’ expectations of $1.09. Same-store sales in the U.S. were up 3.2%, while a strong grocery market led to a 41% increase in online sales.

Walmart CEO Doug McMillon said in the earnings statement that the firm is prepared for a strong holiday season and he continues to see “good traffic” in stores and growing market share in key food and consumables categories, including fresh goods. Yet, for all the growth in online sales, this division has been losing money despite large investments in brand acquisitions and speed delivery.

Walmart has been competing with Amazon in grocery delivery. In October, Amazon started free delivery for its Prime members in 2,000 regions, ditching its additional $14.99 monthly membership for access to Amazon Fresh. Walmart’s InHome membership costs $19.95 per month and has been using its 2,700 grocery pickup locations.

Walmart has also said that it now expects earnings per share for fiscal 2020 to slightly increase compared with last year. Before that, its forecast was oscillating between a slight decrease to a slight increase.

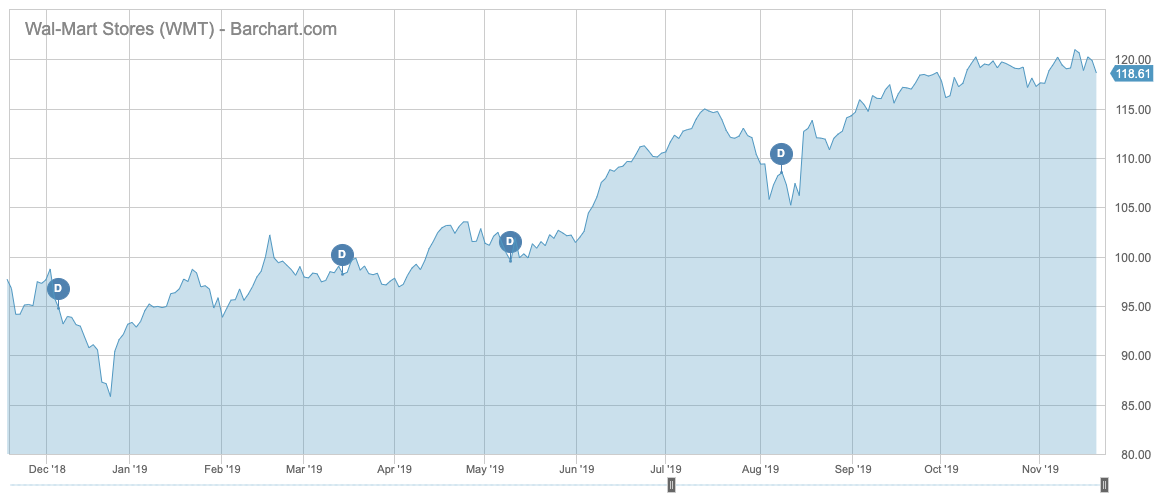

Walmart shares have maintained their upward trend, rising more than 28% since the beginning of the year and outperforming the S&P 500. Walmart has been increasing its dividend for the past 44 years.

Check out our latest Best Dividend Stocks List here.

Occidental

Occidental Petroleum (OXY) has been in the news in recent weeks, after its plan to cut capital spending to reduce debt triggered by renewed interest from activist investor Carl Icahn. To reduce its pile of debt incurred as a result of its monumental acquisition of Anadarko Petroleum, Occidental reduced its budget for capital spending from $9 billion in 2019 to $5.5 billion next year.

Icahn, who opposed the deal with Anadarko, in part because Occidental did not provide a shareholder vote, was not impressed. Icahn said the company will be forced to divest its assets at fire-sale prices in order to hit the company’s target of divestments of $10 billion to $15 billion by the middle of 2020. Icahn decreased his stake by nearly four million shares to around 23 million shares, but said he still plans to replace four Board Directors via a consent solicitation.

Occidental’s dividend yield currently stands at 8%, as the company’s stock took a plunge after the Anadarko deal. The company’s payout ratio is 153%.

The Bottom Line

Cisco again reported a downbeat forecast for its earnings, setting off a decline in the stock price and leading to a severe underperformance relative to the S&P 500. Walt Disney reported another batch of strong results and it launched its long-awaited streaming service Disney+. Walmart earnings were solid, with its online sales rising at a brisk pace, but the company faces questions over the high investment costs. Occidental launched a program to cut capital spending, although its outspoken critic Carl Icahn was not impressed.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.