Dividend.com analyzes the search patterns of our visitors every two weeks. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Apple has taken last place in the list, although the U.S. technology behemoth made headlines with its new services launches. First in the list, however, is Boeing, the aircraft maker which has been battling a PR crisis after one of its aircraft models was grounded the world over. Business development company Prospect Capital garnered views thanks to its high dividend yield, while the stock of chipmaker Broadcom surged after posting strong results.

Be sure to read our previous edition of trends here.

Apple Reveals TV App, News and Credit Card

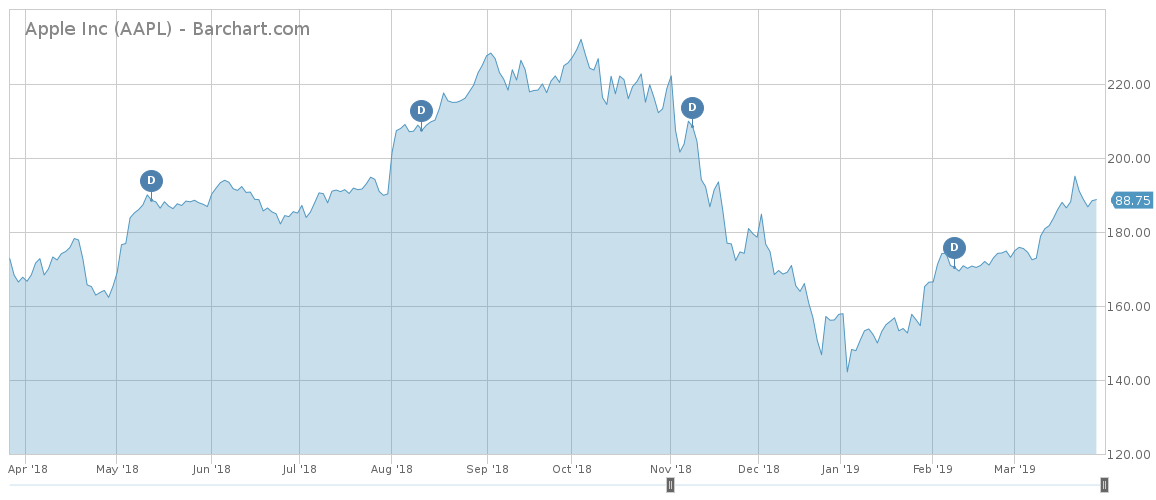

In another bid to boost sales as revenues from its flagship iPhone device are often unpredictable, U.S. technology giant Apple (AAPL ) launched a host of new services, including a TV app, a news app, a credit card and video game subscription. Investor reaction to the news was rather muted, although the stock remains up 20% year-to-date.

Apple has seen its viewership rise 23% for the week, taking fourth place in the list. However, Apple’s event was covered widely and made a lot of headlines.

Apple said its TV app will be available on all platforms and devices, including smart TVs of almost all brands, Windows and Android devices, starting in the fall. The company aims to produce original content and struck partnerships with Oprah Winfrey, Steven Spielberg, JJ Abrams and other Hollywood stars in what seems like an entrance into the streaming territory, currently dominated by Netflix. The app will also allow consumers to subscribe to third-party services such as HBO.

Apple also unveiled a news app containing publications such as The Wall Street Journal and The Los Angeles Times. The app will cost $10 per month and bring together as many as 300 titles. Big publishers such as The New York Times and The Washington Post are not part of the service.

Further stepping into the financial sector, Apple launched a credit card in partnership with Goldman Sachs. The card will be integrated into the Apple Pay services on the iPhone and have a 2% cash back with no annual charges or late fees. Later this year, the company will also launch a new video gaming subscription service named Arcade.

Apple currently pays an annual dividend of 1.55%, with its payout ratio at around 25%.

You can use our Dividend Screener to find high-quality energy dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Boeing

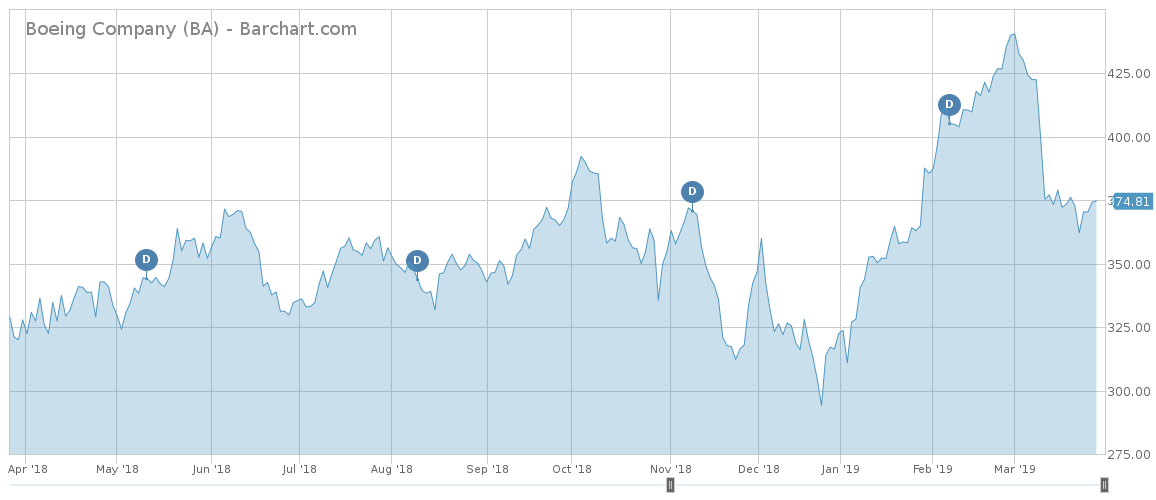

Boeing (BA) has been scrambling with a PR scandal, after a software malfunction in one of its aircraft models was linked to two fatal crashes, causing countries all over the world to ban the jet. The aircraft manufacturer has seen its viewership rise 69% over the past two weeks, taking first position in the trends list.

Boeing was quick to issue an upgrade to its software that was blamed for the crashes of planes operated by Lion Air in Indonesia and Ethiopian Airlines, although it made clear that this was not an admission that the software flaw was the reason for the crashes.

Before the planes will be cleared to carry passengers again, the Federal Aviation Authority (FAA) will certify the changes. This includes the installation of the new software, followed by feedback on its performance and pilot training.

Shares in the company have declined more than 12% since the scandal broke and countries started to ground Boeing 737 Max aircrafts. In addition to the costs involved with the grounding of the current planes, the company’s nearly 5,000 orders are at risk of being canceled. Indonesian airline Garuda canceled orders for 49 planes.

Airbus, the firm’s European arch-competitor, is expected to benefit from the fiasco in the near term. Over the long term, Boeing may fix its issues, with the current debacle likely providing a good entry point in the stock.

Boeing has a dividend yield of 2.2% and gives back to shareholders more than half of its profits.

Broadcom Surges After Strong Results

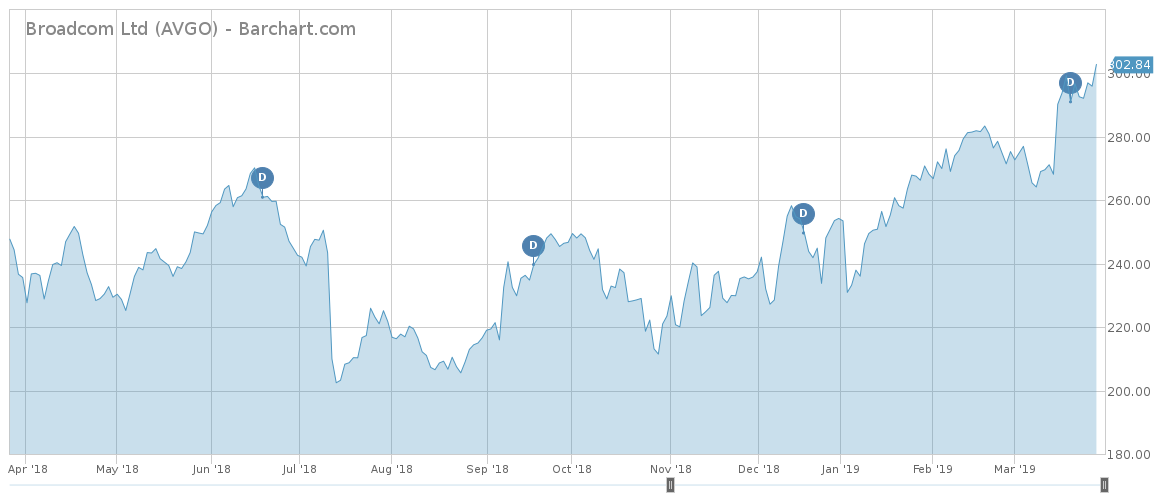

Broadcom’s (AVGO ) bet on software is paying off generously, as the company’s stock has jumped to record highs since it reported strong results despite a declining core semiconductor business. Broadcom has seen its shares advance nearly 10% over the past month, extending year-to-date gains to nearly 18%. Broadcom’s viewership has risen 39% in the past two weeks.

The company’s revenues from semiconductors declined 12% in the quarter ended February 3, but software revenue came in 17% ahead of expectations, largely due to the contribution of its recent acquisition CA Technologies. The firm’s operating income jumped 18% in the quarter compared to the same period last year.

Broadcom’s stock has surpassed the trading levels when the company was considering a hostile buyout of Qualcomm, a deal that was eventually shot down by the U.S. government. Given Qualcomm’s myriad of issues resulting from court battles with its customers, walking away from the deal was a blessing for Broadcom.

Broadcom’s current dividend yield stands at 3.58% with a payout ratio of nearly 59%.

Prospect Capital

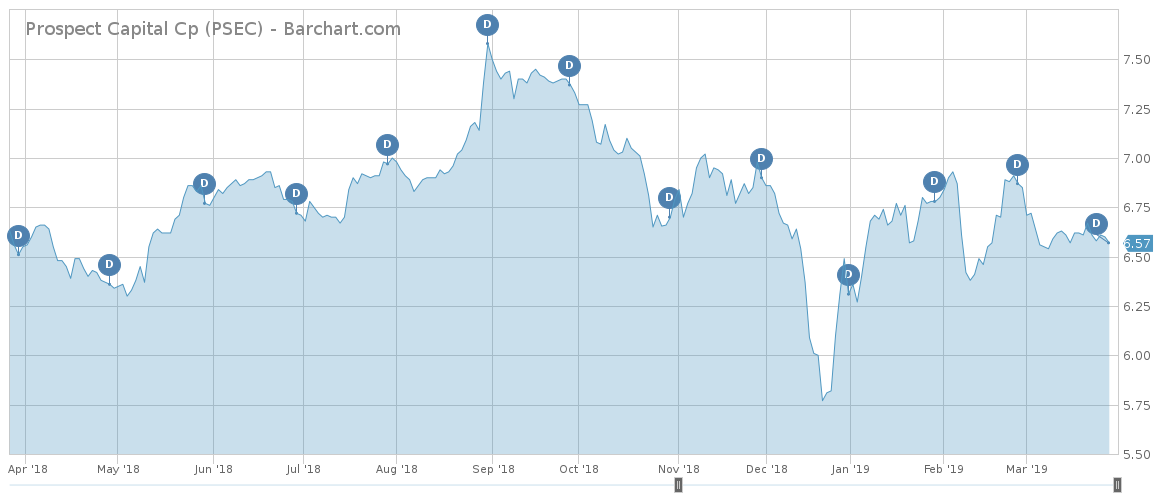

Business development company Prospect Capital (PSEC ) has seen its viewership advance 39% over the past two weeks. Prospect has recently announced a public offering of $150 million of convertible notes due 2025 with the aim of repurchasing a portion of its senior convertible notes due 2020.

Prospect, which currently pays an impressive dividend of around 11% and has a payout ratio of 84.7%, makes equity and debt investments in a range of industries, although its portfolio companies largely operate in the energy and healthcare technology sectors.

The company’s shares have declined around 4% over the past 30 days, extending two-year losses to 27%.

The Bottom Line

Apple unveiled a suite of new services, including a TV app, a news app and a credit card, in another attempt to diversify its revenues away from its flagship product, the iPhone. Boeing is trying to contain a PR crisis after an aircraft model was grounded due to it being culpable for two deadly crashes. Broadcom already felt the positive effects of its latest acquisition, while business development company Prospect announced a public offering of debt.

Keep track of the latest news in our News section, where we regularly publish the latest around dividend investing.