Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

As investors are returning to their desks, the broad market is experiencing a rebound, but not Vodafone Group. The U.K. telecommunications company is first on the list this week as its stock was recently downgraded. Pharmaceutical company Abbvie follows in second, as it shocked markets with big asset impairment. Department store retailer Target is third as the company’s stock may benefit from strong digital sales. Last in the list is Netflix, which made headlines after raising subscription prices.

Check out our previous edition of Trends here.

Vodafone

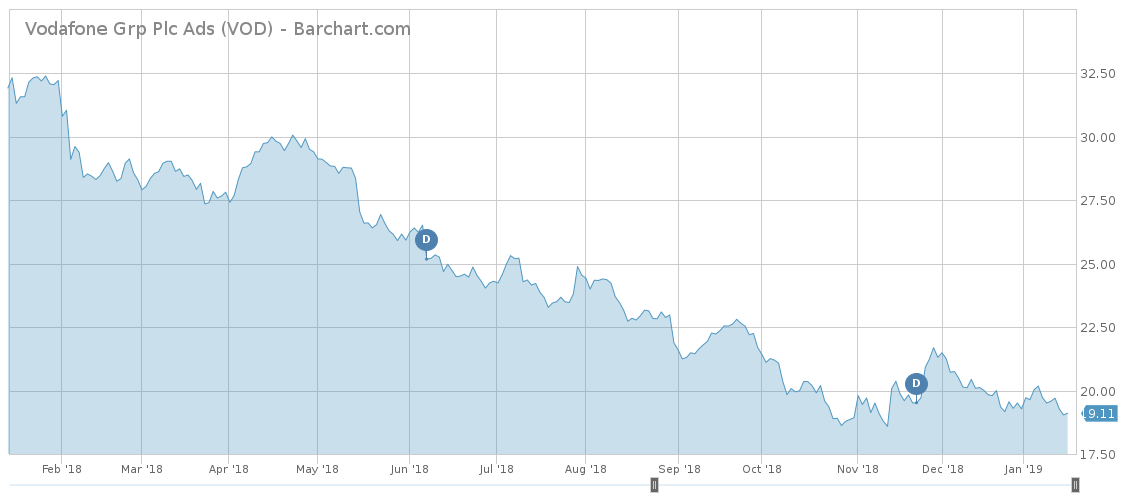

Vodafone Group (VOD ) has seen its viewership surge 40% in the past two weeks, as the company has been downgraded to ‘underperform’ by Canadian bank RBC Capital Markets. The U.K. group’s juicy dividend of 5.5% may be at risk due to a host of challenges. Although the company said it would keep its $4.1 billion annual payout intact, further increases are unlikely, particularly given the underperforming stock price.

Vodafone shares have declined as much as 5% over the past 30 days, extending trailing year losses to as much as 40%. Further declines are possible. The company is facing strong competition in Germany, license fees in the U.K. and large one-time costs with 5G spectrum, estimated between $4.5 billion and $12 billion.

A potential economic slowdown would also negatively affect the company’s business, as well as a hard Brexit. Many European stock markets are already in a bear market and the negative sentiment could move across the Atlantic.

Abbvie Hit by Impairment Charge

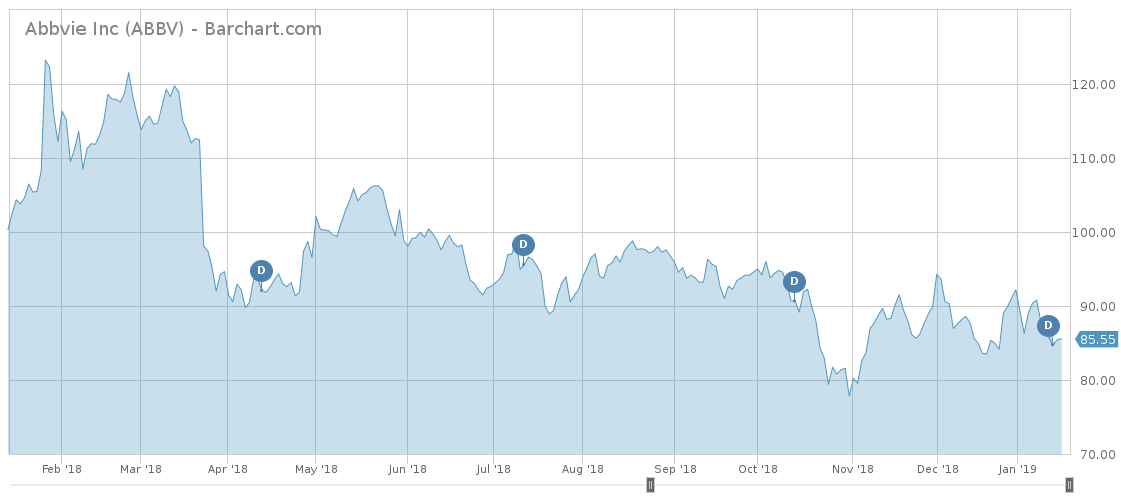

U.S. drugmaker Abbvie (ABBV ) has had a rough start to the year, after the company realized a huge impairment charge. Abbvie stock has fallen nearly 6% since the beginning of the year, underperforming the benchmark S&P 500, which advanced 4.5%. As such, Abbvie has seen its viewership advance 35% over the past two weeks.

On January 5, the company said it wrote down $4 billion of assets related to its acquisition of Stemcentrx in 2016 after it halted a program developing therapies for advanced small-cell lung cancer. Abbvie has said it will monitor another $1 billion with a view to realizing another impairment.

Abbvie, a $128 billion market capitalization company, yields an annual dividend of more than 5%. It pays out to shareholders more than half of its profits, with the rest invested in acquisitions and R&D. In 2016, the company acquired Stemcentrx with the aim of diversifying into cancer therapies and reducing reliance on its hit product Humira, which treats arthritis.

You can use the Dividend Screener tool to explore dividend-paying securities that fit your investment criteria.

Target

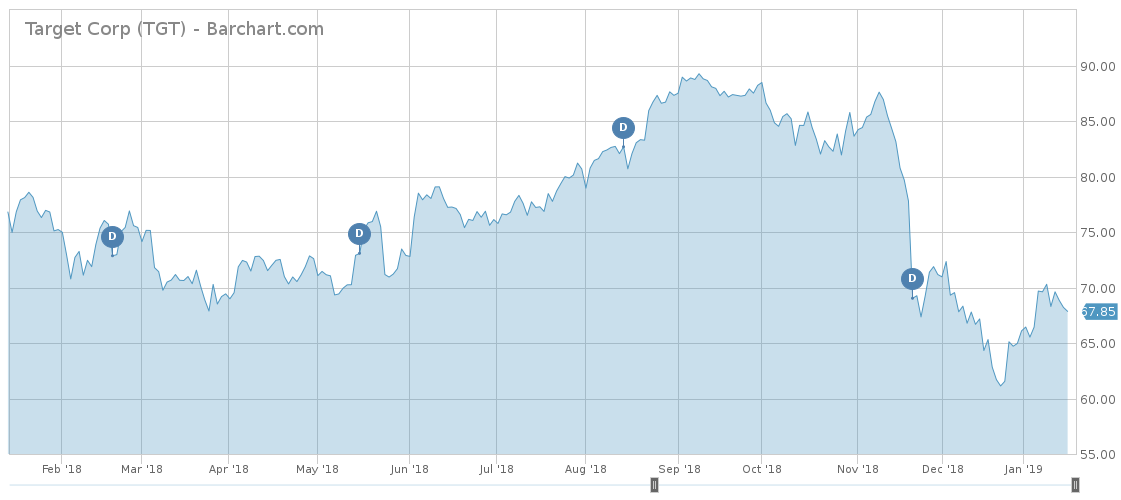

Target (TGT ) was the third-most popular topic with 33% rise in traffic. The big U.S. retailer recently reported strong sales during the holiday period and saw its stock price advance more than 4% since the beginning of the year.

Online sales increased as much as 29% year-over-year in the last three months of the year, with total comparable sales growing by 5.7%. All five of the company’s merchandise categories saw growth, while seasonal gifts, toys and baby items, were the strongest. As a result of the strong sales, Target was able to reaffirm its full-year guidance of 5% year-on-year growth in comparable sales. Earnings for the full year will come in the range of $5.30 and $5.50, largely in line with analysts’ expectations of $5.39.

Target’s holiday season was among the strongest of its peers. Kohl’s (KSS ) reported 1.2% growth in comparable sales, while L Brands (LB) reported 1.6%.

Target returns almost half of its profits to shareholders via dividends. Its yield is 3.72%, above the average for services of 2.02%.

Netflix Raises Subscription Prices in U.S.

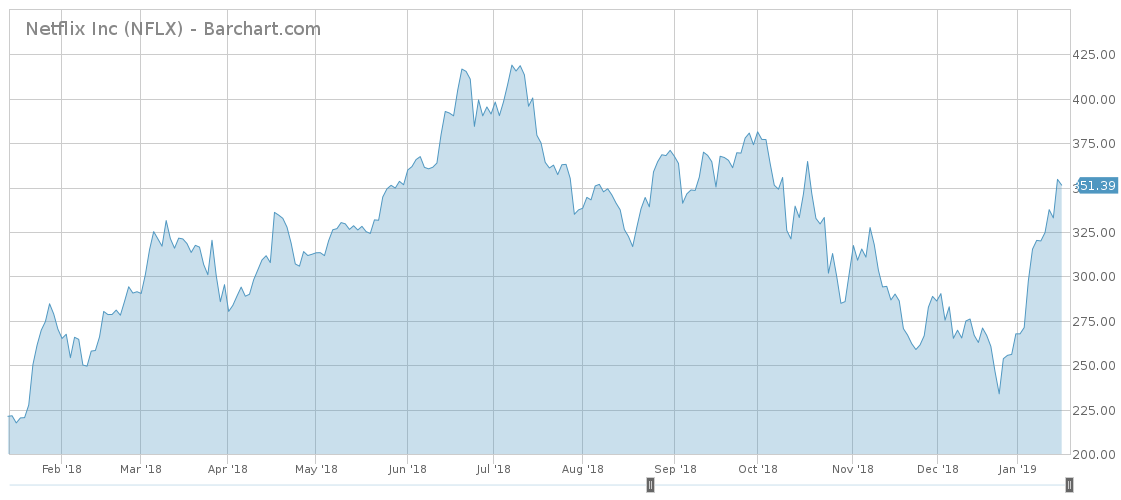

Streaming giant Netflix (NFLX) is fourth in the list with a 20% increase in viewership as the company made headlines with a plan to raise prices for U.S. subscribers. All three of the firm’s subscription plans will increase by $1 or $2, with the standard plan increasing from $11 per month to $13.

The price hikes come as the company is spending heavily on new content. It estimated last year that it splurged as much as $8 billion, with a good chunk of the money borrowed from markets. In October 2018, the company said it planned to take on an additional $2 billion in debt.

Although the price hikes are bad news for consumers, investors were happy. Indeed, the stock price jumped around 37% since the beginning of the year, amid high volatility. As the company is in growth mode, a dividend is not yet in sight. Netflix, however, has been rewarding investors with impressive capital appreciation. The stock is up 162% over the past two years.

Check out our complete list of Best Dividend Stocks.

The Bottom Line

Vodafone has been downgraded by RBC Capital Markets as the telecommunications firm faces a host of headwinds, including costs with 5G spectrum and high license fees. Abbvie, the pharmaceutical company, registered a huge asset write-down as it killed the development of a therapy for cancer. Target has benefited from strong holiday sales, while investors were happy with Netlifx’s plans to raise subscription prices.

Be sure to visit our News section to catch the latest on dividend investing.