Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Tesla has made the headlines in recent weeks after Founder and CEO Elon Musk proposed a controversial buyout plan, which was later dumped. Tobacco products-maker Altria took first place in the list as the company continued to hike its dividend. Defense firm Lockheed Martin trended as the company is on track to finalize a capsule to carry astronauts to the moon and back. Netflix trended third, followed by Tesla.

Altria

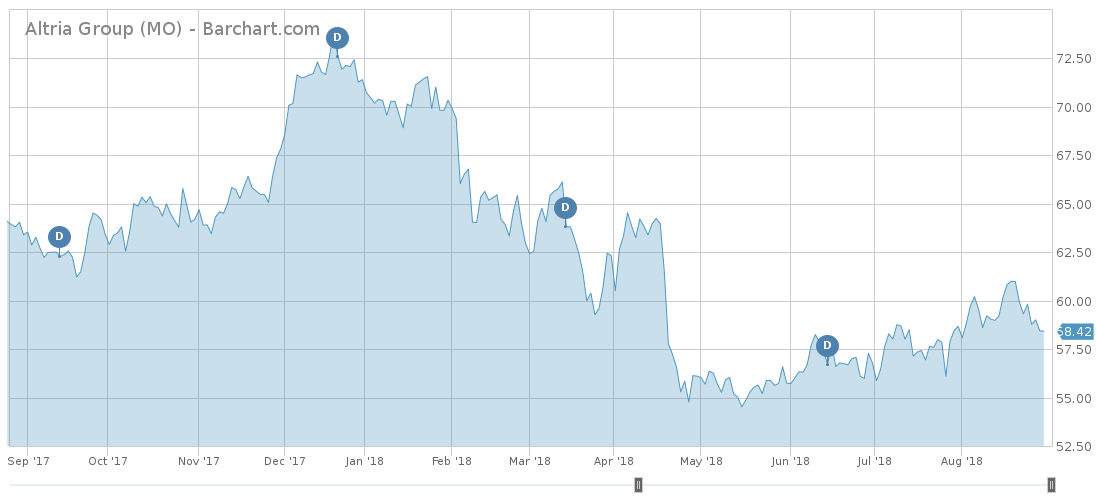

Altria Group (MO ), the holding company for Philip Morris USA, has seen its viewership rise 72% this week, as the company increased its dividend for the second time this year. In March, the company hiked its quarterly dividend by 6.1% to $0.70 per share. Six months later, shareholders received another positive surprise after the firm increased its payout by another $0.10 per share to an annual yield of 5.5%.

The tobacco industry has been undergoing difficult times as younger customers are not joining the ranks of smokers, while older ones look to quit amid high prices and health concerns. As a result of the headwinds, the company has invested heavily in alternative products, such as IQOS, a heated tobacco technology, and vaporisers. The company has already launched IQOS in some international markets, but it is still waiting approval in the U.S. from the Food and Drug Administration, with the decision already delayed.

Altria, which has a payout ratio of 80%, has seen its stock price decline more than 9% in the past 12 months, making for a total shareholder return of negative 3%.

Lockheed Martin

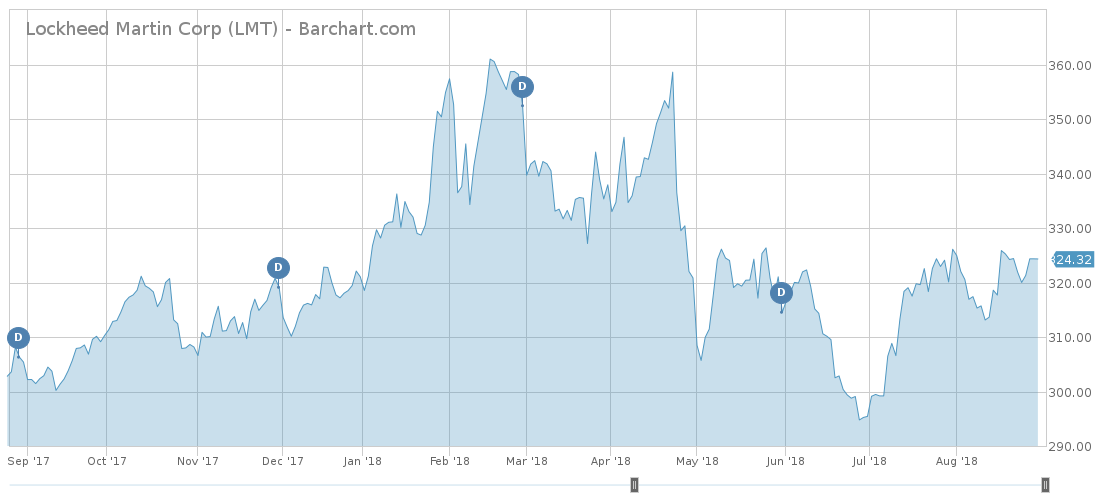

U.S. defense company Lockheed Martin (LMT ) has garnered 35% more interest from our readers this week, partly thanks to news that it finished a spacecraft capsule that will return astronauts to the moon. Lockheed said the capsule will be sent to Florida for final assembly into a full spacecraft, which will be used for NASA’s Orion Exploration Mission. The spacecraft aims to take astronauts back to the moon for the first time in 40 years and further into the solar system, including Mars.

Back on earth, Lockheed has benefited from heightened geopolitical tensions across the globe and from commitments from NATO members to hike their military budgets. UBS recently said it expects overall aerospace & defense sales to grow 5% annually through 2020 in no small part thanks to the Department of Defense’s commitment to increase its weapons budget by 40% in three years.

Lockheed Martin pays a solid dividend of 2.5%, returning roughly half of its earnings per share to investors. Shares in Lockheed are up just 1% year-to-date.

Netflix

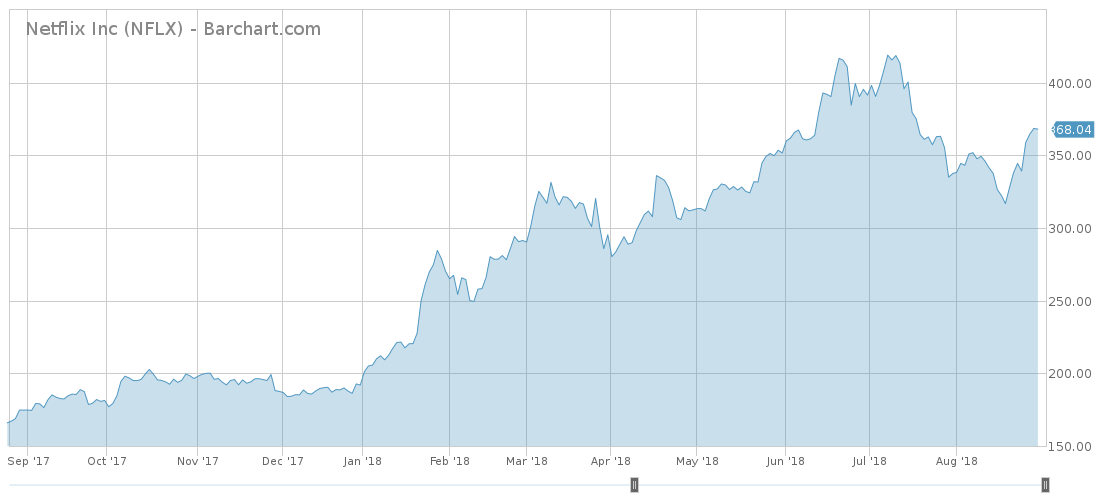

Netflix (NFLX) has crushed it in the past five days, as it staged a recovery from a disappointing quarterly report that was well-below expectations. With the viewership numbers up 18% in the past week, Netflix is driving interest from our readers. The streaming giant has surged more than 8% in the past five days, extending year-to-date gains to as much as 91%. At $368 per share, the stock remains well-below the record high reached in mid-July of $420.

Looking ahead, Netflix is set for a wild ride as Walt Disney unveils its own streaming service and pulls out content from the Netflix platform. Other content creators, including AMC, are also looking at launching their own streaming services in order to have multiple distribution platforms.

Netflix is not sitting idle while competitors are building their own platforms. The company is boosting its investments in content, hoping to keep its growth rate intact. Another advantage for Netflix is its international presence.

Tesla

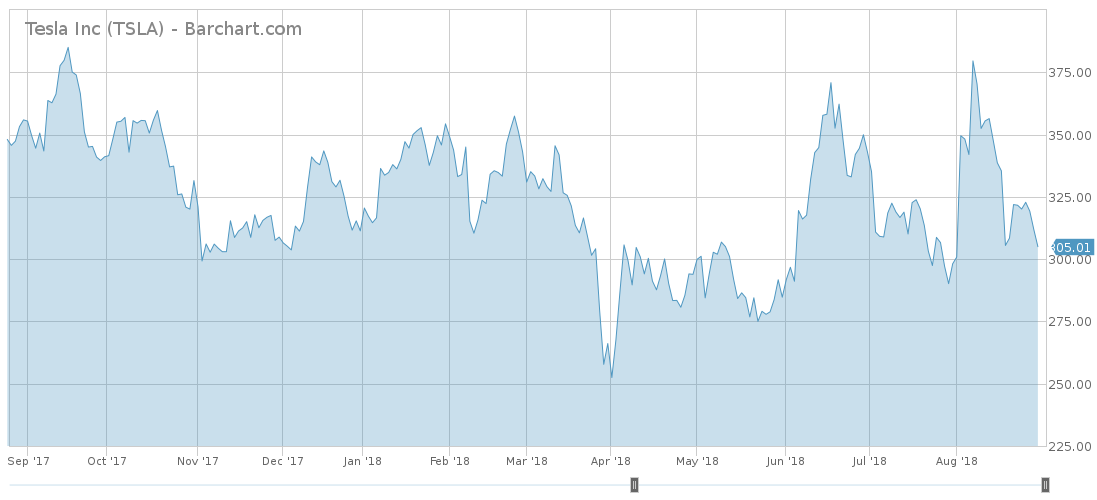

Tesla (TSLA) has grabbed the headlines lately with an attempt by Founder and CEO Elon Musk to take the company private. It all started with Musk tweeting that he had funding secured for an $80 billion buyout, triggering a rally in the stock price. Musk’s tweets drew not only the attention of investors but also that of the Securities and Exchange Commission, which is investigating the CEO for possible market manipulation.

Musk decided not to take the company private in the end, saying a lot of investors asked him to keep the company listed. ARK Investment Management publicly urged him to keep the company public, contending the stock may appreciate ten times. The letter has been a rare display of support for Musk, who ARK called a “visionary leader,” as he and Tesla face heavy criticism from a number of short sellers.

The criticism from short sellers partly prompted Musk to try to take the company private and out of the public’s eye. It is yet unclear whether he indeed had funding secured for the buyout, as the move also left Tesla’s board surprised. The transaction lacked details, but the CEO said existing shareholder willing to stay invested could do so via a private equity vehicle, leaving many observers skeptical about such a possibility.

The Bottom Line

Tobacco company Altria Group pleasantly surprised investors with a second dividend hike this year, although the underlying business faces minor headwinds with revenues flat over the past three years. Lockheed Martin has finished building a capsule that will send astronauts to the moon. Netflix’s stock reversed some of the losses experienced following a disappointing earnings report. Tesla is finally seeing off the management buyout attempt debacle, although an investigation by the U.S. regulators remains on.