Walt Disney Company (DIS) is a brand that needs no introduction, as it is known as the company “Where Dreams Come True.” The company was founded in 1923 by brothers Walt and Roy Disney, and was originally known as the Disney Brothers Cartoon Studio. Today, the company is an entertainment conglomerate that not only owns the Disney-branded name and amusement parks but also media networks like ABC and ESPN.

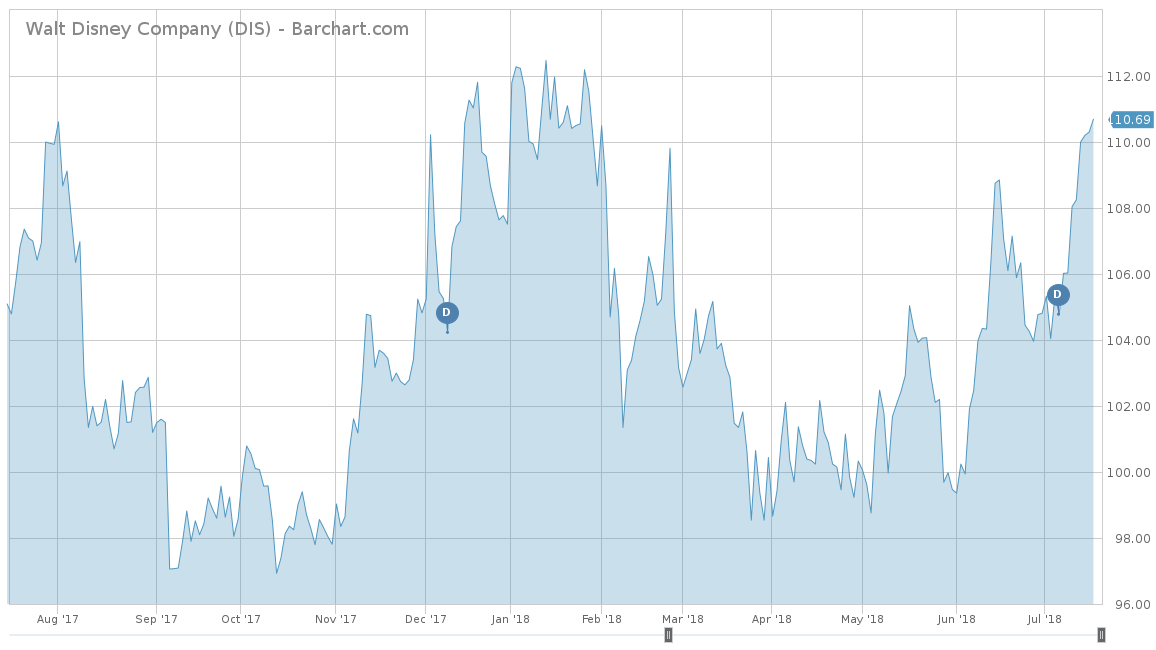

On a year-to-date basis, Walt Disney has done moderately well and is up 2.96%. Disney has had moderate returns for the trailing one-year of 4.67% and 68.17% for the trailing five-years. Compared to the S&P 500, Disney has underperformed in the shorter term, as the S&P had returns of 5.31% and 14.43% on a year-to-date and trailing one-year basis, respectively. However, for the longer term, Disney outperformed the S&P 500, which had a trailing five-year return of 66.67%.

Fundamentals

Over the past five years, Disney has had rock solid revenue growth with an average of 5.5%. In fact, Disney has not had one negative year in revenue growth until 2017, when it saw a slight drop off of 0.9% due to declines in its Studio Entertainment and Consumer Products & Interactive Media divisions. In the last quarter, Disney saw a nice increase of 21% on a year-over-year basis in revenues to $2.45 billion, thanks to the success of Marvel’s “Black Panther” movie. Analysts are banking on the Marvel franchise to push revenues to $59.05 billion this year, which would equal a 6.85% increase. The “Avengers: Infinity War” crossed the $1 billion threshold on a global scale in just 11 days, which should help drive revenues. For 2019, Disney also expects a slight bump in revenues of 2.40% to $60.48 billion.

On an earnings-per-share basis, Disney has really excelled with an average growth rate of 12.7% for the last five years. Again, like its revenues, the only down year was in 2017, which saw a slight drop of 0.7%, caused by a lower segment operating income and higher net interest expense. In the last quarter, Disney again beat earnings, reporting $1.84 per share versus the $1.70 per share analysts expected. For the remainder of 2018, Disney is expected to see $6.55 per share, which would be a significant gain of over 14%. Same goes with 2019, where analysts expect Disney to increase its earnings by 7.79% to $7.06 per share.

Strengths

Disney is broken down into four distinct segments, with the largest revenues coming from Media Networks, which accounts for 42% of the total. Its crown jewel of the networks side is undoubtedly ESPN, which dominates sports television. ESPN also has exclusive rights to the NFL and college football and currently has the highest affiliate fees per subscriber of any cable channel from adult males ages 18-49. Although ESPN has seen some declines in the last few quarters, Disney has taken a massive effort to lower its expenses and increase margins.

The company’s next largest segment is the Parks and Resorts division, which recently saw a 13% increase on a year-over-year basis. This segment represents 33% of Disney’s total revenue and is obviously tied to the Disney World and Disneyland resorts that are across the globe. In fact, Disney has seen some international growth thanks to its Disneyland Paris and Hong Kong Disneyland Resort, which both had higher occupancy rates in the last quarter.

Growth Catalyst

The biggest growth for Disney is undoubtedly from the Studio Entertainment division, which only represents 16.8% of total revenues. However, this segment was the largest driver of the company’s last quarter revenue and earnings growth, thanks to outstanding ticket sales of “Black Panther.” In the last quarter, the Marvel movie “Avengers: Infinity Wars” was released and currently has reached over $2 billion in global ticket sales, which will undoubtedly trickle down to Disney’s bottom line. Disney has other movie franchises to bank on too, like the LucasFilms “Star Wars” franchise and the very successful remake of “The Beauty and the Beast.”

Dividend Analysis

Disney has an adequately sized dividend that is currently yielding 1.50%, equal to $1.68 per share. This is slightly below the average of the Best Entertainment – Diversified Dividend Stocks, which has a yield of 1.58%. The company has only one year of consecutive dividend hikes, which was due to a drop off from 2015 to 2016. If everything plays out as expected, shareholders can soon see another dividend hike in the near future.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk to Disney is the growing competition it is seeing thanks to very aggressive mergers between AT&T and TIme Warner and bidding battles with Comcast. However, Comcast recently announced it was backing off from the Fox deal, as it will focus solely on Sky, the European satellite broadcaster.

The Bottom Line

With its very successful Marvel franchise selling out box offices and ESPN cutting costs to increase margins, Disney looks to be back on track to see some serious upside. Analysts expect both earnings and revenues to see a fair amount of growth in the coming years, which would help management foster the decision to increase the company’s dividend for the second year in a row. Disney stock is an absolute buy before the third-quarter earnings come out, which will obviously reflect the record-breaking sales of the newest Avengers flick.

Check out our Best Dividend Stocks page by going Premium for free.