AT&T Inc. (T ) is the second-largest telecommunications company in the world and provides voice, data and television services to both consumers and businesses. The company was originally founded in 1885 and stands for American Telephone & Telegraph. Today, it is a variation of many mergers and acquisitions of companies over the last 130+ years and now has a market capitalization of nearly $200 billion.

AT&T has been in the news over the last few years after its announced $85 billion proposed merger with Time Warner. The merger would allow AT&T to be a global leader in both the telecommunications and media space, allowing both companies vertical integration of each other’s products. However, President Donald J. Trump has been making public statements calling the deal “anti-competitive,” which has led to the trial involving the Department of Justice. We are yet to hear a final decision on the trial.

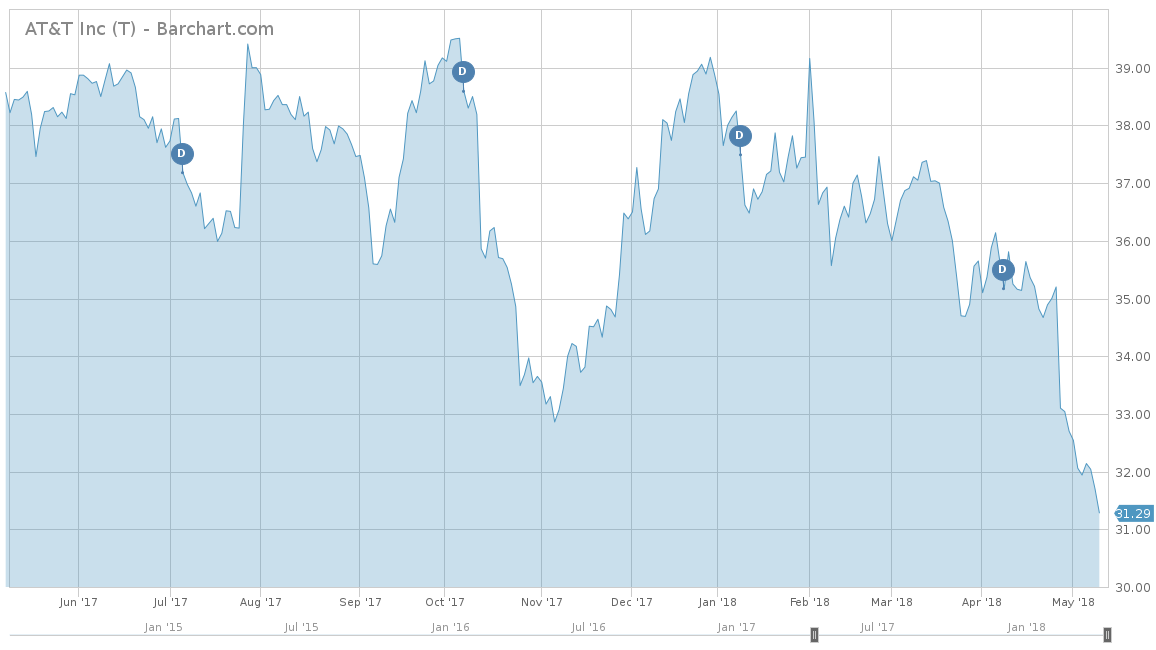

On a year-to-date basis, AT&T has really struggled in comparison to the S&P 500 and is down 19.47% versus the S&P 500’s return of positive 0.95%. Over the trailing one year, AT&T has had continued struggles with a return of negative 18.08%, which was 30% lower than the return of the S&P 500 for the same time. Over the long term, AT&T has been one of the few stocks that have not increased over the trailing five years and is down 16.13%. This is considerably lower than the S&P 500’s total return of 65.96% for the same time. Comparatively speaking, AT&T’s largest competitor Verizon Communications Inc. (VZ ) has not fared much better. On a year-to-date basis, VZ is down 12.62%. Over the longer term, Verizon is down 0.37% for the trailing one year and down 12.20% for the trailing five years.

Verizon is a member of the Dow 30 dividend-paying stocks list. Check out other stocks in the list here.

Fundamentals

Over the last five years, AT&T has had a steady flow of revenues that averaged 4.7%. However, 2017 showed a different tale as the company saw a drop in revenues by 2.0% from 2016, the first decline in over five years. This drop in revenue was caused by declines in legacy wireline services and wireless service revenues. Same goes for the first quarter of 2018, where AT&T reported revenues of $38.04 billion, which was lower than the expected $39.31 billion. This most recent drop, which was a continuation of last year’s, was caused by a decline in its DirecTV segment losing customers as well as its wireless segment losing market share to the lower priced T-Mobile. Analysts expect AT&T to have a tough year in terms of revenue in 2018, with estimates coming in at $155.41 billion, which would be a 3.30% decline from 2017. Same goes for 2019, where analysts only see a modest uptick to $156.49 billion, an increase of 0.7% but still lower than 2017’s total of $160.54 million.

From an earnings-per-share perspective, AT&T is a different story with a very volatile history over the last five years. On average, AT&T has had earnings growth of 30.7%, which sounds good on paper. However, the company has seen massive fluctuations in its earnings since 2013. Starting in 2013, earnings grew 171% and then dropped 64.9% in 2014. The following year in 2015, AT&T bounced back with a 99.2% return but then saw an 11.4% decline in 2016. Finally, in 2017, with earnings of $4.76 per share, AT&T saw a nice recovery of 126.7%. This huge bounce-back was due to the fourth-quarter 2017 EPS of $3.07 per share, thanks to a $20.3 billion increase in net income from the new tax plan and new accounting standards. However, along with its first-quarter 2018 revenues, earnings also missed with a $0.85 per share versus the expected $0.87 per share as AT&T could no longer hide under the guise of the tax-reform changes. Analysts expect it to trend downward from its high 2017 measure but up from its 2016 readings, with EPS estimates of $3.33 per share and $3.38 per share in 2018 and 2019, respectively.

Click here to learn why telecoms and media stocks could get a big boost going forward.

Strengths

The largest strength for AT&T has been from its largest segment, the wireless unit that currently makes up around 45% of revenue. Although it is the number two wireless provider in the country, second only to Verizon, both companies maintain dominance in the space.

The AT&T Mobility unit currently has seen $17.4 billion in the first quarter, marginally from the same quarter in 2017. In total, the company added 2.6 million net customers during the quarter, putting the total base to nearly 144 million. Its postpaid net additions saw more than 300,000 increase on a year-over-year basis while also adding more than 500,000 additional smartphone gross additions and upgrades for the same time. However, even though AT&T is still managing to grow its customer base, it is losing traction to competitors T-Mobile (TMUS) and Sprint (S), which are offering lower priced plans with similar service.

Growth Catalyst

In October 2016, AT&T announced an $85 billion merger with Time Warner, which would create the largest distributor of media content in the world. However, the Department of Justice went to trial with AT&T on March 19, 2018, indicating that the deal is in violation of antitrust laws stating that the combined company would jack up prices for rival programmers and not be in the best interest of consumers.

This merger is a major growth catalyst as well as a risk for AT&T, as if it was to pass through, it would make AT&T a new powerhouse in the telecommunications and media industry. This would allow AT&T to vertically integrate its operations, thereby seeking synergies from both the revenue and cost fronts.

Along with the pending merger trial, AT&T has been hinging much of its future on building the world’s first gigabit network. AT&T is working to expand its Fiber network, which is currently marketed to 8 million customer and business locations across the country. This should help provide the backbone of the gigabit network and provide both consumers and business with ultra-fast internet data speeds. Along with Fiber, AT&T has been working on expanding its 5G presence through the 5G Evolution. It has been building the foundation and is currently available in 141 markets and is opening Mobile 5G in a dozen cities throughout the course of 2018.

Another differentiator is that AT&T partnered with FirstNet, which is the nation’s first dedicated wireless broadband network for first responders. This network allows law enforcement, fire and emergency medical services to easily communicate across jurisdictions to help service emergency situations.

If AT&T can get a successful outcome of the DOJ trial as well as continuing to build out its 5G network, it should bounce back in terms of revenue and earnings. If not, expect both to continue to struggle and the stock to continue its downward trend.

Dividend Analysis

One of the bright spots for AT&T is its very high dividend. Currently, the stock has a yield of 6.25% which is equal to a $2.00 per share annual payout. This is considerably higher than the telecom dividend stock average of 3.04% and also higher than rival Verizon’s dividend yield of 5.03%. Another benefit of AT&T is its commitment to raising its dividend, as evidenced by its 33-year track record of rate hikes.

Click here to know how inelastic demand allows telecom companies to offer attractive dividend yields.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

AT&T faces a large risk of the Time Warner merger being reversed by the DOJ. Although the merger never officially took place, a negative outcome would scare off investors from owning the stock in fears of a major pullback. Plus with so many benefits to the merger, any negative decision would undoubtedly hurt AT&T both in the short and long term.

Another major risk is the company’s wired business, which seems to be struggling to keep its revenues growing to the positive. Landline voice business has been on the decline, now that consumers are leaning toward only having a cell phone as opposed to a landline for their homes. AT&T’s DirecTV and UVerse have also been struggling due to lower cost competitors like cable companies as well as other cable-cutting alternatives.

Finally, a potential merger between T-Mobile and Sprint would disrupt the potential growth in the 5G world for AT&T. If the merger were to take place, the new combined company would have two times the spectrum of AT&T and two and half times more spectrum than Verizon. This new company would make the T-Mobile/Sprint combination the clear leader by far in the 5G network and seriously stunt any growth that AT&T might have in this space. As AT&T is already losing customers to both T-Mobile and Sprint due to the unlimited wireless data pricing, it would need to make similar or better changes to its pricing plans to retain customers.

Want to know more about the T-Mobile and Sprint deal. Read here.

The Bottom Line

Overall, AT&T has taken a hit, especially on a year-to-date basis. The company keeps missing both revenue and earnings, so from a fundamental point of view, it looks like a stock to avoid.

However, with the DOJ trial currently happening and some of the other 5G projects that AT&T has in the works, the stock might be priced right to sit and wait. Investors who are patient and optimistic about the Time Warner merger ruling will be rewarded with the company’s 6%+ dividend, which has no signs of going away any time soon.

Find out all the companies that have increased their dividends for more than 25 consecutive years, in our 25-year dividend-increasing stocks page, and for more than 10 consecutive years, in our 10-year dividend-increasing stocks page.