Johnson & Johnson (JNJ ) is one of the world’s largest manufacturers of medical devices, pharmaceuticals and consumer health goods. The company can trace its origins all the way back to 1885, when Robert Wood Johnson and his two brothers created a line of ready-to-use surgical dressings. Two years later, in 1887, the company was incorporated and became one of the clear leaders in the health industry. Today, JNJ has a market capitalization of nearly $350 billion and has many well-known brands including Acuvue, Aveeno, Band-Aid, Imodium, Tylenol and Visine.

The company operates in three segments, with the largest revenue coming from its pharmaceutical division, which makes up nearly half of its sales. Its second largest segment is medical devices, which currently contributes nearly one-third of its sales. Consumer health brands contribute to the remaining sales. With all three segments contributing a diverse revenue base, Johnson & Johnson is able to withstand almost any economic cycle while being able to maintain its long 55-year track record of raising its dividend.

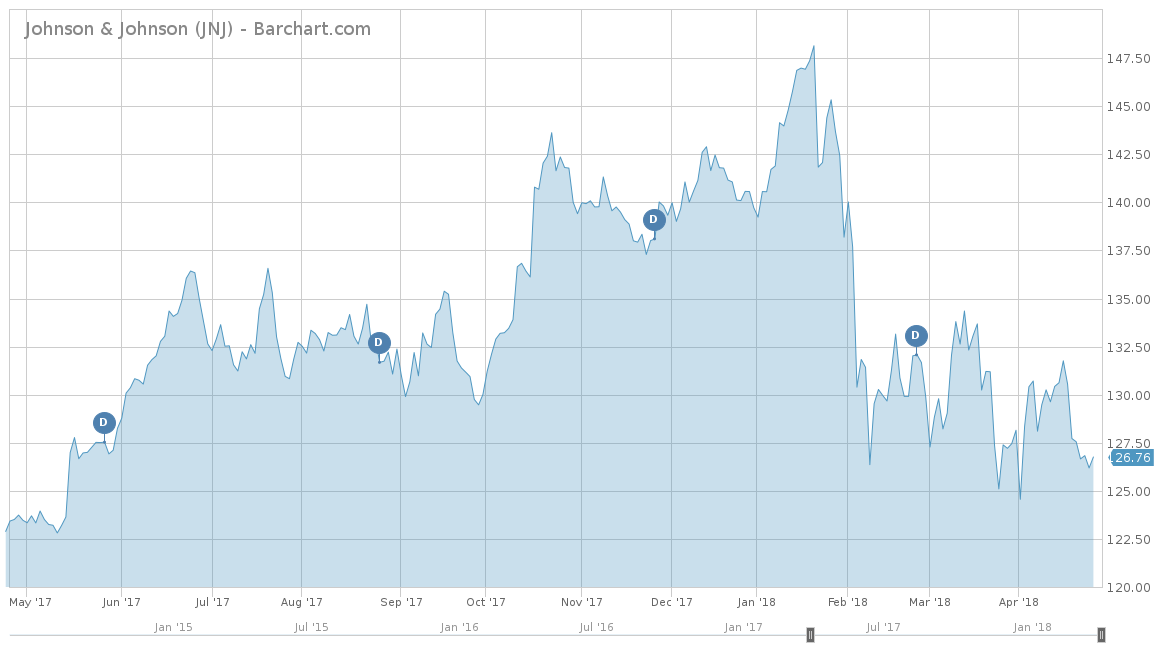

On a year-to-date basis, JNJ’s stock price has struggled and is down 9.28%, vastly underperforming the S&P 500’s year-to-date performance of negative 1.28%. Over the longer term, JNJ has also struggled to shine. Over the trailing five-years, the company is up only 48.74%, considerably lower than the S&P 500’s return of 66.51% for the same time. However, when compared to its large pharma competitors, JNJ looks to be the best of the lot. Over the trailing five-years, JNJ has outperformed Pfizer Inc (PFE ), Merck & Co Inc. (MRK ) and Novartis AG (NVS ), which each had returns of 21.22%, 25.93% and 4.56%, respectively. One reason for the struggles over the last few years in the pharmaceutical industry can be traced back to drug pricing gouging issues – a popular debate topic during the Presidential election in 2016.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

From a revenue perspective, JNJ has a steady but unimpressive five-year average of just 2.6%. This average would be much higher if it wasn’t for the sole decline in 2015, when revenues dropped 5.7% mostly due to currency headwinds that the company had little control over. Most recently in its Q1 2018 earnings announcement, JNJ beat expectations with revenues of $20.0 billion versus the expected $19.46 billion. This was attributed to strong pharmaceutical sales, which was up over 15% year over year on a global level, as well as its vision care segment that was up nearly 34% year over year. Analysts expect JNJ to continue its strong momentum throughout the course of 2018, with year-end expectations of $81.47 billion, equalling a 6%+ gain. In 2019, analysts also expect an uptick in revenues but expect the company to lose a little steam, with estimates of $84.02, representing a nominal increase of just over 3%.

On an earnings-per-share basis, Johnson & Johnson has a deceiving five-year average of negative 34.4%. This is deceiving because the company just had a 92.1% decline from its 2016 measure of $5.93 per share. In the Q4 2017, JNJ saw a loss of $3.99 per share, leading to an EPS of $0.47 for the whole of 2017. This was specifically caused by a one-time $13.6 billion charge due to recent tax law changes. However, the company now has an effective tax rate of 16.5% to 18%, considerably lower than in years past. Analysts fully believe that JNJ will bounce back, as shown by its Q1 2018 earnings beat of $2.06 per share versus $2.02 estimate. Analysts expect the tax reform will help JNJ have a breakout earnings year, with estimates coming in at $8.08 per share. In 2019, analysts also see the company continuing its earnings growth success by 6.56%, to $8.61 per share.

Strengths

The largest strength for JNJ is that it has multiple businesses that help generate substantial cash flow for the company, year after year. This diversified blend of income helps offset any down years a particular segment might have. For example, in the first quarter, Consumer Products and Medical Devices only saw growth of 1.3% and 3.4%, respectively. However, the company was able to beat both revenue and earnings thanks to its 15.1% increase in its Pharmaceutical division. In addition to its three large segments seeing growth, JNJ’s sub-divisions have been seeing significant upticks, like in Oncology, up 37%, and Vision Care, up 34%.

One possibility for JNJ is to spin off its Consumer Health Products division so that the company can focus on its two more profitable segments, i.e., Pharmaceuticals and Medical Devices. In the most recent quarterly report, the segment saw a drop off to 18.0% from 20.2% on a year-over-year basis. When breaking down the sector, several of the areas have seen negative growth, like in Wound Care, Baby Care and Women’s Health. With its strong brand names like Clean & Clear and Neutrogena, Johnson & Johnson should consider breaking this segment off.

Not only is JNJ diverse in its business lines, it is also on a global scale. Last quarter, the company only saw total operational growth of 6% on a year-over-year basis from its U.S. business. Certainly not bad but the company’s international segment saw a nearly 11% increase for the same time. This was led by large increases observed in Asia-Pacific, Africa and Europe. These contributions from its ex-U.S. business segments help JNJ improve worldwide sales by almost 8.5%. In fact, its international business has grown at more than twice the pace of its domestic leg in the Pharmaceutical and Medical Device divisions.

Finally, JNJ has also seen growth through mergers and acquisitions. Small biopharmaceutical companies lack the resources and marketing reach that large companies like JNJ have, making them prime M&A candidates. For example, in February 2018, JNJ announced that it acquired the French company, Orthotaxy. The company develops software-enabled surgery technologies and is currently developing an early-stage total and partial knee replacement technology. This gives JNJ early access to the emerging space of robotic-assisted surgery market. In fact, JNJ has also formed in a joint venture, called Verb Surgical, with Alphabet, Inc. (GOOG) in this space in December 2015. With this, JNJ looks to leverage its surgical device knowledge and combine with Alphabet’s artificial intelligence capabilities to enter into a lucrative market by 2020.

Growth Catalyst

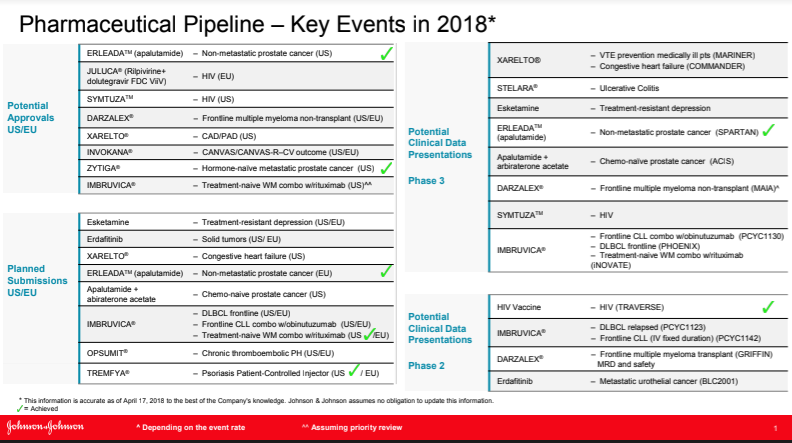

The largest growth potential is the same as it would be for any pharmaceutical company: its drug pipeline. This was most notably mentioned in the most recent earnings call, where CEO Alex Gorsky stated that the recent tax reform allows the company to invest more than $30 billion in research and development over the next four years. This is equal to a 15% increase and should help the company find the new blockbuster drugs that will help support its future revenue streams.

For 2018 alone, JNJ has a healthy pipeline of eight different drugs that are seeing potential approval by the U.S. and European Union. Both ZYTIGA and ERLEADA have already been approved and look to combat the effects of prostate cancer. If JNJ can have just a few of these drugs turn into a blockbuster, expect the Pharmaceutical segment to reach new highs.

Dividend Analysis

Johnson & Johnson stock has a yield of 2.61% and has a higher yield than the Healthcare & Medical sector dividend stocks average of 0.73%. This payout equates to an annual payout of $3.36 per share, which is paid as $0.84 per quarter. As mentioned previously and after a successful Q1 2018, Johnson & Johnson has a 55-year track record for raising its dividend. Typically, it issues a rate hike in May every year, so expect the Board of Directors to issue the company’s 56th consecutive rate hike in the upcoming month.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

Like the pharmaceutical industry in general, Johnson & Johnson faces several risks to its future growth. The largest and the biggest threat continues to be the idea that government regulation will limit the pricing on its drugs.

In February, the White House released a report titled “Reforming Biopharmaceutical Pricing at Home and Abroad” that outlined the administration’s plans to reduce drug prices. The President was due to address this article in a speech to the country on Thursday, April 26, 2018, but has since postponed it to an undisclosed later time. If the President continues to act on his plan to reduce drug pricing, it will undoubtedly hurt Johnson & Johnson’s stock price.

This risk is particularly important to Johnson & Johnson since the company has been increasing its revenues in Pharmaceuticals, with now 46.5% of the total. If it begins to focus all of its sales in this segment and a major drug pricing reform is passed, JNJ could be devastated due to the regulations.

The Bottom Line

From a fundamental standpoint, Johnson & Johnson looks to be outstanding in the upcoming year, with it bouncing back in a big way after the tax reform charge of $13.6 billion in the final quarter of 2017. It also has seen recent success with its pipeline approvals, having two of eight already completed for 2018.

However, with all this in mind, Johnson & Johnson should be considered a hold recommendation. There is too much downside risk with the President ready to denounce the pharmaceutical industry for its price gouging. Regardless of the outcome and whether or not regulation actually gets in place, it still has a negative effect on Johnson & Johnson. Investors that own it should hold on, collect the consistent dividend and let the company weather the storm. For those that don’t own it, use the upcoming debate as a buying opportunity to invest in a fundamentally strong company that will undoubtedly increase over the long term.

Check out our Best Dividend Stocks page by going Premium for free.