Bank of America Corp. (BAC ) is a major bank and financial company that offers a variety of financial products and services to consumers and businesses all across the United States. It is currently the second largest bank in the United States, with over $2.32 billion in total assets as of Q1 2018. The company serves over 47 million consumer and small business relationships with 4,400 retail financial centers and 16,000 ATMs.

The bank has seen very tough times over the last decade since the financial crisis. Poor acquisitions in Merrill Lynch and Countrywide FInancial have held the company back, cutting into the company’s margins through legal and regulatory issues. The same goes for the term of CEO Brian Moynihan, who came on board in 2010. Moynihan inherited the issues from his predecessor, Ken Lewis, that the former initially struggled to overcome. In 2014, Bank of America reached a $16.65 billion settlement with the federal government over accusations that it had misled investors into buying cratering mortgage securities prior to the financial crisis, many of which were originally sold by Countrywide Mortgage.

However, over the last few years, Moynihan has turned things around at the bank and returned value back to shareholders in both price appreciation and dividend income. The bank is also back to good form, in a leaner and more profitable way, with both revenues and earnings increasing for the last few years.

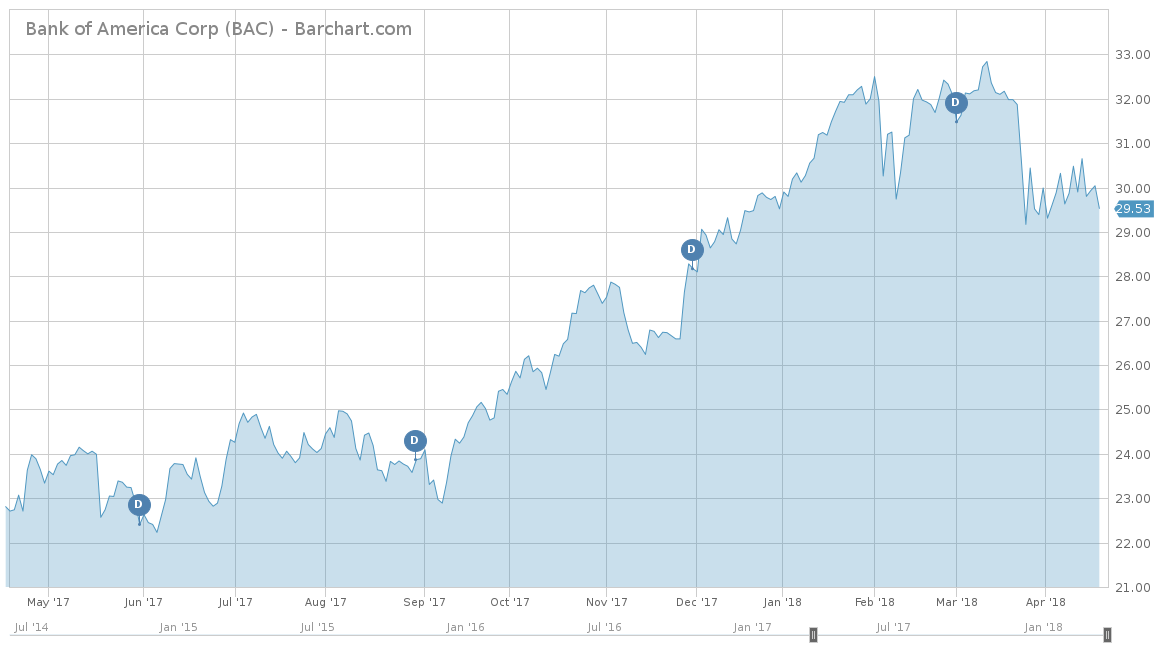

On a year-to-date basis, Bank of America’s stock price is up slightly at 0.03%, underperforming the S&P 500’s year-to-date performance of 1.31%. However, over the longer term, Bank of America has performed twice as well as the S&P 500. Like other financial stocks, Bank of America performed really well after President Donald Trump was elected into office. Since Trump’s election, the stock has surged more than 50%. Both Trump’s Presidency calling for a reduction in banking regulations paired with the Fed’s plan to raise interest rates have helped the bank to reach its pre-crisis levels.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, BAC has had slight revenue growth of 1.5% on average. The company struggled in 2014 and 2015 with legal and regulatory issues, but has bounced back ever since then. Most recently in 2017, the bank had its best revenue growth since 2013, with 4.4% growth. So far so good in the first quarter of 2018 as well, which was release on April 16, 2018. Revenues came in at $23.1 billion, beating estimates and representing growth of 4% on a year-over-year basis. This came primarily from a 9% increase in its consumer banking business and a 13% increase in its net income interest in the same segment.

Analysts expect the rest of 2018 to come in at around $92.79 billion, making it more than a 4% increase from 2017. This last quarter marked the 13th consecutive quarter of positive year-over-year operating leverage, which shows that the company is running more efficiently than in the past and analysts believe Bank of America will take advantage of this in the future. The same goes for 2019, where analysts expect BAC to grow nearly 4.9% to revenues of $97.3 billion.

From an earnings perspective, Bank of America has a deceiving five-year average track record of 44.2%. The company saw a 60% drop in 2014 with an EPS of $0.36 per share, mostly due to the $16.65 billion Countrywide settlement. Then in 2015, the company came back roaring with an EPS of $1.31 per share, which was an increase of over 263%. Since then, it has maintained growth on a steady basis, with 2017 seeing a 4.0% increase to $1.56 per share. This was especially impressive since the company was hit with a $2.9 billion charge from the new tax plan. This success has carried over in 2018, with the first quarter beating expectations and reporting at $0.62 per share, instead of the Street’s expected $0.59 per share. This recent winning streak exemplifies Moynihan’s initiative to cut costs and increase margins. This is another reason why analysts are expecting earnings to continue its growth, with estimates of $2.46 and $2.76 in 2018 and 2019, respectively.

Strengths

When it comes to the banking industry, banks can grow through things they can control. Interest rates, banking regulations and the state of the economy are all out of a bank’s control, so CEO Brian Moynihan decided to take matters into his own hands. Over the last few years, Moynihan has focused on increasing synergies and efficiencies in the company. There has been a big increase in technology and convenience. For instance, the bank now processes more than 25% of its consumer sales digitally. The company has also shut down nearly 25% of its unprofitable branches since 2009 and repositioned them into new cities with much higher growth potential.

While decreasing its costs and increasing its efficiencies, Bank of America has also increased its quality. The company has substantially improved its Tier 1 Capital ratios from 2009’s levels below 8% to the more than 13.4% as of Q1 2018. This higher level helps the bank pass the Fed’s annual stress test, which helps to determine a bank’s financial stability during times of crisis so there is not a repeat of financial institutional failure like what happened to Lehman Brothers. Along with the Tier 1 ratio, the bank has also taken a more conservative approach to its lending. The bulk of the company’s consumer lending is made to customers with a FICO score of over 750, nearly 50 points higher than the average American’s score. This helps ensure that the bank will not undergo the mistakes it had with the poor underwriting issues it had with its Countrywide FInancial mortgage crisis.

Growth Catalyst

The biggest growth for Bank of America will come from a combination of the new tax reform and the rising interest rate environment. Bank of America said that the Tax Cuts and Jobs Act will create an ongoing reduction of 9% in its effective tax rate. As an estimate on how it will affect the bank’s bottom line, Bank of America’s pre-tax income for the first quarter of 2018 was $8.4 billion. A 9% reduction in the effective tax rate translates into $756 million in additional net income, which is more than $3 billion on an annualized basis.

Like the financial industry as a whole, a rising interest rate environment allows banks to create a larger spread between what the bank makes on its interest investments and what it lends to customers. With one rate hike already in 2018, most economists believe there will be two to three more for 2018. This will only further increase the spread for Bank of America, thus increasing their margins.

Dividend Analysis

Bank of America stock has a yield of 1.61%, which is considerably lower than the Financial Sector average of 3.28%. Although this yield is not near the financial sector average, it plays upon the fact the company is maintaining its newly developed conservative ways and not overextending itself. The bank has been able to raise its dividend every year for the last four years, to its now annual payout of $0.48 per share. Although it probably won’t maintain the same rate hike increase of 60% like it had in 2017, if earnings continue to grow, expect the dividend to grow in sync with them.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

A couple of factors could derail the positive outlook that Bank of America has been seeing, like a major downward shift in the economy or regulatory issues. If the economy begins to falter, the banking industry tends to be hit first. The stock market falls, interest rates drop and credit dries up, which are all negative outcomes for Bank of America. However, if the economy does see a correction in the near future, Bank of America’s conservative nature should help them weather the storm, unlike in 2008.

Another major risk to Bank of America is continuing regulatory or legal issues. With the Countrywide Financial problems in its rearview mirror, having another problem would continue to hinder the company’s growth. With rival banks like Wells Fargo Co. (WFC ) facing damage from its cross-selling practices, Bank of America should be aware of the vulnerabilities present in its operating environment.

The Bottom Line

Overall, Bank of America has come a long way from the financial crisis and is on its way to becoming the great bank it once was.

However, the bank faces a lot of competition in this area, with rivals like JPMorgan Chase & Co. (JPM ), Wells Fargo and Citigroup (C ). The company’s assets have been relatively flat for the last 10 years, so maximizing its current efficiencies will only create additional earnings for so long a time. Eventually, the bank must gain more customers and assets to increase its bottom line.

The stock is considered more of a hold opportunity, rather than a flat out buy. As a result, unless the bank drastically improves its operating profile there shouldn’t be too much upside as it is trading just around 10% below its 52-week high. The stock would be more attractive if its dividend yield was higher, like its competitors JPMorgan and Wells Fargo that both yield greater than 2.0%. If Bank of America can continue to increase its earnings along with its dividend rate, the stock should rise. Just don’t expect it to do so in a quick manner.

Check out our Best Dividend Stocks page by going Premium for free.