Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Macquarie Infrastructure trended the most this week as its stock tumbled on disappointing dividend guidance. Giant brick-and-mortar retailer Walmart was second in the list as investor fears are growing that the company will lose the online battle with Amazon. Warren Buffett’s Berkshire Hathaway reported solid financial results thanks to the new U.S. tax code, while Teva Pharmaceuticals got a boost after Berkshire Hathaway revealed a sizable stake.

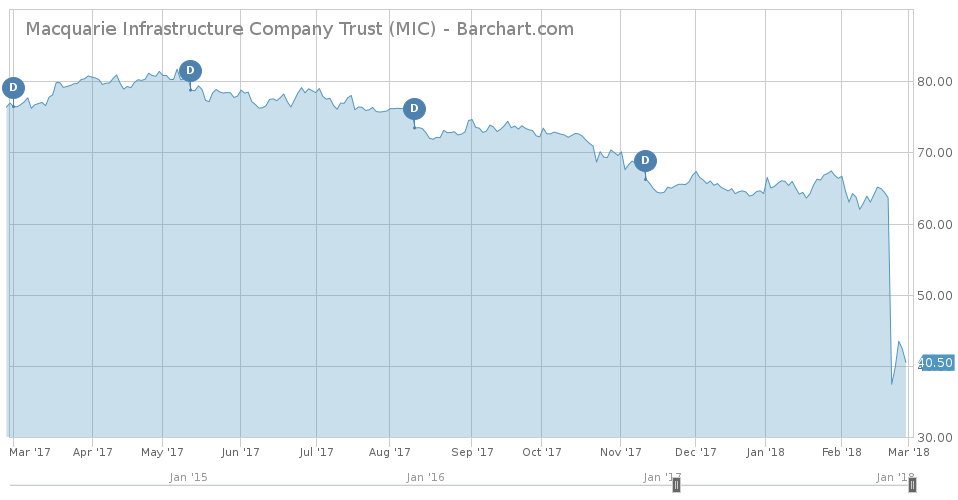

Macquarie Drops After Dividend Cut

Macquarie Infrastructure (MIC ) has seen its viewership advance 214% in the past week, as investors turned their attention to the big drop in the stock price. Macquarie has fallen 32% in the past five days after it published a downbeat earnings report and cut its dividend.

The firm, a holding company providing a range of infrastructure services for bulk liquid terminals and airports, slashed its guidance for 2018, predicted its revenues will fall compared to 2017. As a result, Macquarie cut its dividend from a quarterly $1.44 to $1 per share, a move that disappointed investors. Following the cut, the company’s dividend will yield around 10% from around 14% previously, although it could rise if the stock price continues to decline. Macquarie is expected to go ex-dividend today.

The company said that it needs additional cash to repurpose assets at International-Matex Tank Terminals and take advantage of new growth opportunities stemmed from the U.S. tax reform. Despite an upbeat scenario sounded out by the company, short interest increased to the highest levels since 2010, according to data from IHS Markit.

The company now faces the prospect of a credit downgrade, which would potentially lead to higher interest rates. Macquarie has a long-term debt of $3 billion, representing around 60% of its market capitalization. Given the high leverage ratio, the $1 dividend may also be at risk.

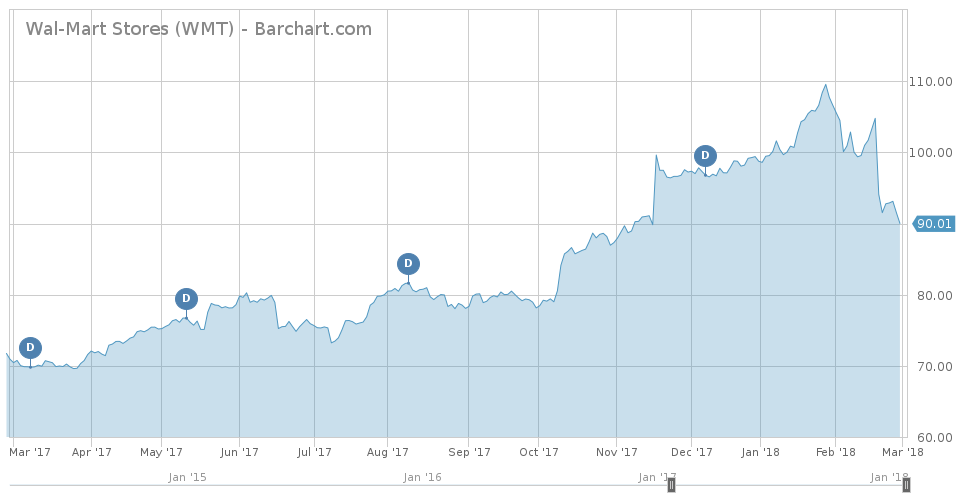

Walmart Losing Online Battle With Amazon

Giant brick-retailer Walmart (WMT ) has announced disappointing results for its online business, triggering an abrupt decline in the stock price. The drama attracted a 97% increase in traffic over the past five days. Walmart’s stock has tumbled around 15% in the past month, as investors increasingly view the company as unable to compete with Amazon (AMZN) in the online realm.

For instance, the company’s e-commerce growth slowed to 23% in the fourth quarter of 2017, due to an underwhelming holiday period. However, revenue and same-store sales came in better than expected, although the bright picture on that part of the business mattered less to investors.

Gross margins, in particular, took a beating during the quarter, as the company invested heavily in advertising and fresh inventory. The higher costs are attributed to an ongoing war with Amazon, which recently made a foray into the food space with the acquisition of Whole Foods Market.

In the year ahead, Walmart expects to increase investments in online apparel retailing and plans to sell merchandise owned by Hudson’s Bay on its website Jet.com, as it tries to compete with Amazon. In recent years, Walmart has undergone a host of structural changes that would allow it to better compete with Amazon, which has been increasingly attacking its turf.

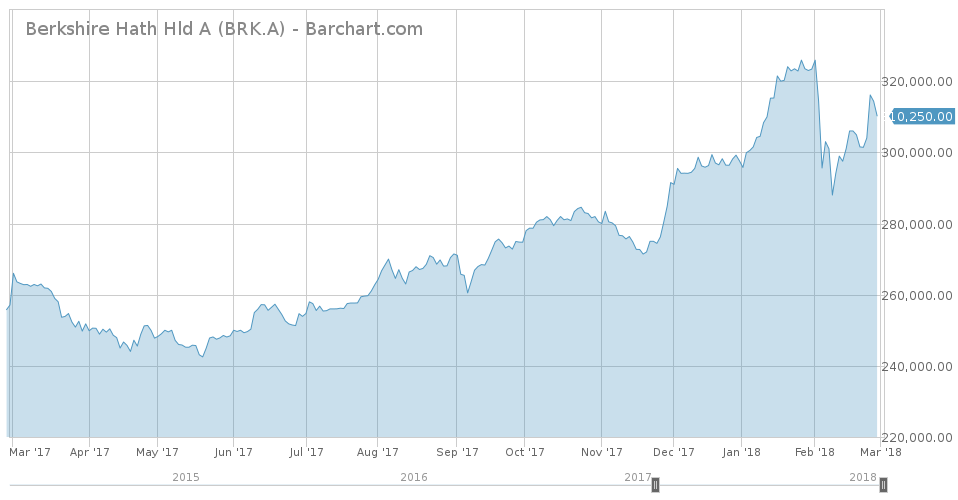

Buffett’s Berkshire Gains on Tax Reform

Warren Buffett’s Berkshire Hathaway (BRK-A) has seen its viewership rise 83% this past week, as the legendary conglomerate published its long-awaited annual results and letter to shareholders.

The company’s fourth-quarter profit more than quadrupled, thanks to the one-off benefit of the tax reform, with the firm’s overall corporate tax falling from 35% to 21%. Berkshire, which does not pay a dividend despite its huge cash reserves, earned $32 billion in the fourth quarter compared to just $6 billion during the same period last year. Overall, the company posted annual earnings of $44 billion versus $24 billion in 2016 on revenues of $242 billion. The solid results for both the year and the quarter came in despite weakness in the firm’s insurance underwriting business, where it lost more than $2 billion after taxes – the first full-year loss for this segment since 2002. The insurance unit was hit by rising claims related to the hurricanes in Florida, Texas and Puerto Rico.

Buffett’s track record as an investor is one of the most admirable on Wall Street. Berkshire returned 2,404,748% since inception in 1964 compared to 15,508% for the S&P 500.

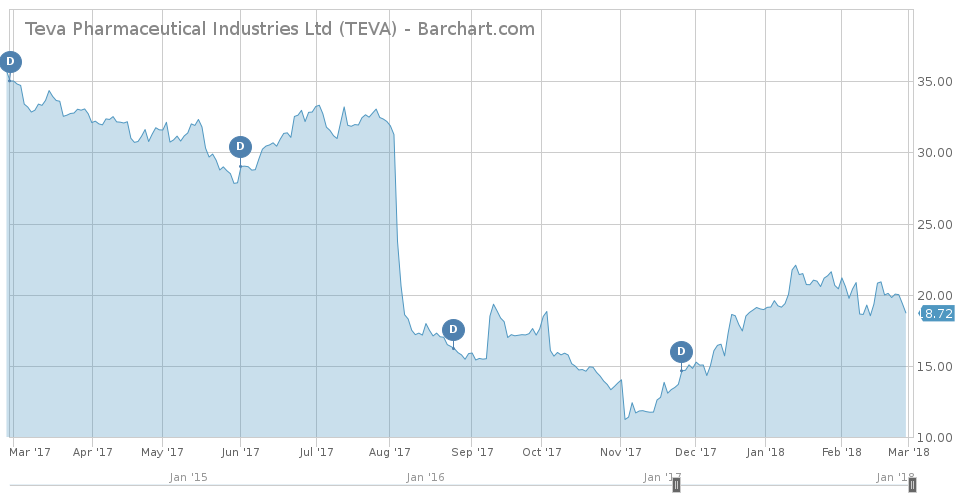

Teva Struggle Attracts Berkshire

Struggling pharmaceutical company Teva Pharmaceutical (TEVA) has seen its traffic rise 73% this week, in no small part thanks to news that Berkshire Hathaway invested in the company. Teva was the only new investment reported by Berkshire in the fourth quarter and it was quite small at $357 million or 1.86% of the company’s stock.

Buffett publicly said the investment was not his idea, and the stock lost some of its momentum. The Sage of Omaha typically selects Berkshire’s largest investments and lets his lieutenants pick the smaller positions.

Teva’s stock has tanked 46% in the past year as falling sales and ever-rising debt put a strain on the company’s finances. The company had borrowed heavily to make copycat medicine, but its strategy hit a snag after the U.S. markets deteriorated and its blockbuster drug Copaxone was marred by competition. Teva currently yields 1.54%.

The Bottom Line

Macquarie Infrastructure reduced its dividend this week, causing an abrupt fall in its stock price. Walmart, meanwhile, reported underwhelming results for its online business, triggering fears it may be losing the battle with Amazon. Berkshire Hathaway made the headlines recently, both with solid financial results for 2017 and for an investment in debt-strapped Israeli pharmaceutical firm Teva.