Procter & Gamble Company (PG ) sells some of the most recognizable brand-name consumer goods like Tide, Gillette, Pampers, Charmin, Bounty, Pantene, Olay and Pepto Bismol.

The company can trace its beginnings back to 1837 with its founders, William Procter and James Gamble. The two partners began the business by selling soap and candles, which eventually saw enough success to give birth to the Procter & Gamble Company. Today, P&G is one of the largest consumer goods makers with a total market capitalization of over $206 billion. P&G’s purpose is to provide branded products and services of superior quality and value that improve the lives of consumers across the world.

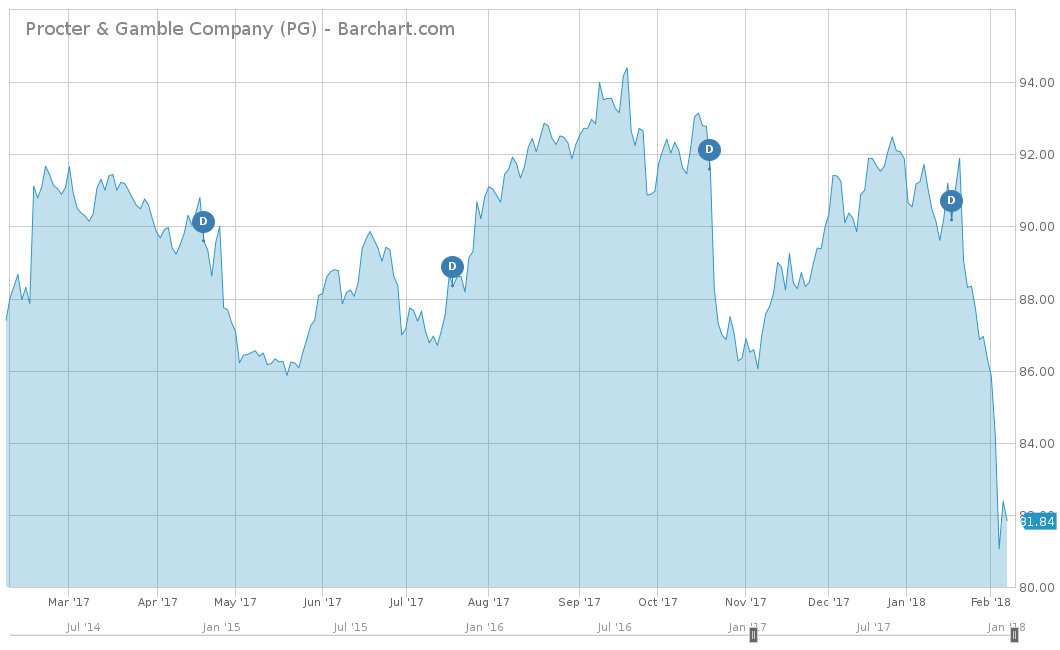

Through the first week of February 2018, Procter & Gamble stock has come down with the rest of the market and is down 10.48% on a year-to-date basis. It also vastly underperformed for the trailing one-year with a negative 7.01% return. This is considerably lower than the S&P 500’s 16.95% return for the same time. Over the longer term, P&G also underperformed with a trailing five-year return of only 7.47%, again lower than the S&P’s 77.67% return for the same time. P&G also did not fare well against its competitors like Unilever PLC (UL ), which was up 28.65% for the trailing one-year and up 35.51% for the trailing five-years.

Fundamentals

Over the last five years, P&G has shown real struggles with its revenues. The company has averaged a negative 4.5% average growth during that time period, with its last positive growth occurring in 2013. However, analysts are fairly optimistic for 2018 (ending July 2018) with an average revenue estimate of $67.07 billion. This would be quite a turnaround, equalling a 3.06% gain and the first in over five years. In 2019 (ending July 2019), analysts expect P&G to continue its upward trend with revenue estimates at $69.06 billion, an increase by another 3%.

From an earnings-per-share (EPS) perspective, Procter and Gamble has fared much better than its revenues. Over the past five years, the company has averaged a 3.8% earnings-per-share growth, with the company peaking in 2017 with a $5.49 per share report. However, 2017 had a very large second quarter, thanks to the divestiture of several of the company’s beauty brands. So far, for the first two quarters of its fiscal 2018, P&G has beaten expectations with a Q1 EPS of $1.08 and Q2 EPS of $1.14. Analysts expect P&G to close out 2018 with a total of $4.21-per-share estimate and 2019 with a $4.54-per-share estimate.

From a price-over-earnings perspective, P&G comes in at around 21.91, which is lower than the 25.17 of the S&P 500. However, when compared to Unilever, which has a P/E of 21.61, P&G looks to be right in line with its peers.

Strengths

Although the company has been struggling to increase its revenues, it has done an excellent job of scaling down to focus on higher returning opportunities. It has reduced its total product categories from 16 to 10 and its total brands from over 170 to 65 in the last five years. This has allowed the company to focus and market its more successful brands. The company’s most successful division is its Fabric and Home Care segment, which attributes to nearly 32% of total sales. Its second segment is its Baby, Feminine and Family Care segment, which makes up 28% of total sales. Many of these brands also carry consumer brand loyalty like Pampers, Tampax, Gillette and Tide. With more competitive pricing and a more targeted approach, P&G has been able to improve its margins.

Over the last year, P&G has made the news thanks to the activist investor, Nelson Peltz, from the Trian Fund who was looking to aggressively gain a seat on the board. Peltz believes the company has been mismanaged from the top down, leading to slow growth and almost very little return for its shareholders. In October 2017, Nelson and the current P&G management team had the largest proxy battle in history, with Nelson narrowly losing out a seat on the board. However, due to the close margin of votes and after several negotiations with Peltz himself, P&G made the decision to increase its board of directors to include Peltz. With his board seat official as of March 1, many investors are curious to see if Peltz can make an impact on P&G’s future.

Growth Catalyst

The major growth for P&G will come from management’s ability to succeed with its cost-cutting initiative, which is projected to save up to $10 billion from 2017 through 2021. Management has already seen the proof of this savings, as it has already saved $10 billion from 2012 through 2016. It has and will continue to save through four elements: cost of goods sold, marketing spending, trade spending and overhead spending. The savings should lead to both top- and bottom-line growth for years to come.

Dividend Analysis

Although P&G’s stock has struggled, the company has maintained its commitment to its shareholders by continually increasing its dividend for the last 61 years in a row. The stock currently yields 3.40% for an annualized payout of $2.76 per share. This yield is considerably higher than the 1.93% average yield of the best Personal Products Dividend Stocks and slightly higher than Unilever’s yield of 3.34%. Regardless of how its revenues are doing, P&G has always managed to find a way to reward its shareholders with a dividend increase year-after-year.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk to P&G has been foreign-exchange rate changes that could negatively impact the company’s bottom line. Around 45% of P&G sales are derived from outside North America and leave the company exposed to currency risk.

Another potential risk could be the internal battle that Nelson Peltz could begin now that he has a seat on the board of directors. Although he has every intention of trying to maximize the value of the company for shareholders, he could derail many of the initiatives that current management has in place. Having a huge shift like this could end any momentum that P&G has gained over the last year.

The Bottom Line

Over the last five years, Procter & Gamble has struggled when compared to its peers and most of the S&P 500. However, it has been making positive strides to focus on its core brands and products, which have shown increased margins and led to increasing earnings. If P&G can continue to improve its bottom line with its $10 billion savings initiative, the stock should see a turnaround soon.

Check out our Best Dividend Stocks Page by going Premium for free.