Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The central theme this week was outperformance. Auto insurance company Progressive announced a massive dividend hike after posting better-than-expected revenue growth. Intel’s financial results for the fourth quarter beat analyst forecasts despite some issues related to some of its chips. 3M – an industrial conglomerate that manufactures a broad range of products – continued to stun investors with robust earnings, while Netflix skyrocketed after massive subscriber growth.

You can view our previous Trends article here, which centered on Ford’s intention to exit the mass-market vehicle segment.

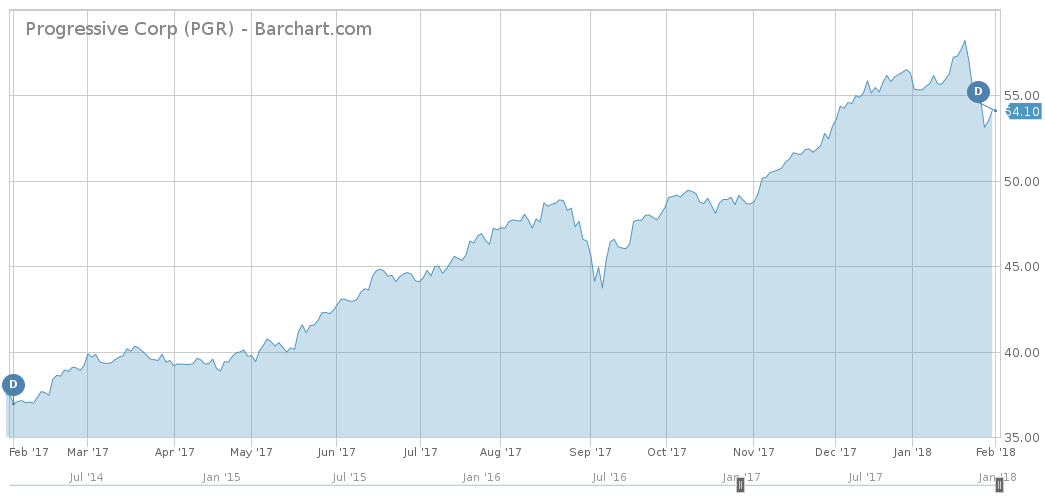

Progressive Ups Dividend

Progressive Corp (PGR ) took the first spot in the trends’ list this week with a 177% rise in viewership as the fourth largest auto insurance company lifted its annual dividend by a staggering 65% to $1.12 per share. The company, which pays a dividend once per year based on income performance, announced impressive results for December and the fourth quarter.

Net premiums earned rose 17% in December 2017 compared to the same period last year and advanced by the same amount in the fourth quarter. As a result, net income surged 61% in December to $161 million and 50% for the quarter to $383 million. Thanks to the results that beat estimates, the dividend was raised to $1.12 per unit and is expected to be paid on February 9. The dividend represents an annual payout of over 2%.

The auto insurance market has had a great year as the global economy fired on all cylinders and demand for cars increased. However, long-term threats to the industry exist in the form of increased automation of cars with a potential to reduce risks of accidents. In addition, customers have increased expectations from their providers and competition in the insurance industry is rising. Most of Progressive’s business is in personal and commercial vehicles but it also diversified into home insurance through its subsidiary ASI, which is a top 20 U.S. property insurer.

To view other dividend-paying Property & Casualty Insurance stocks, click here.

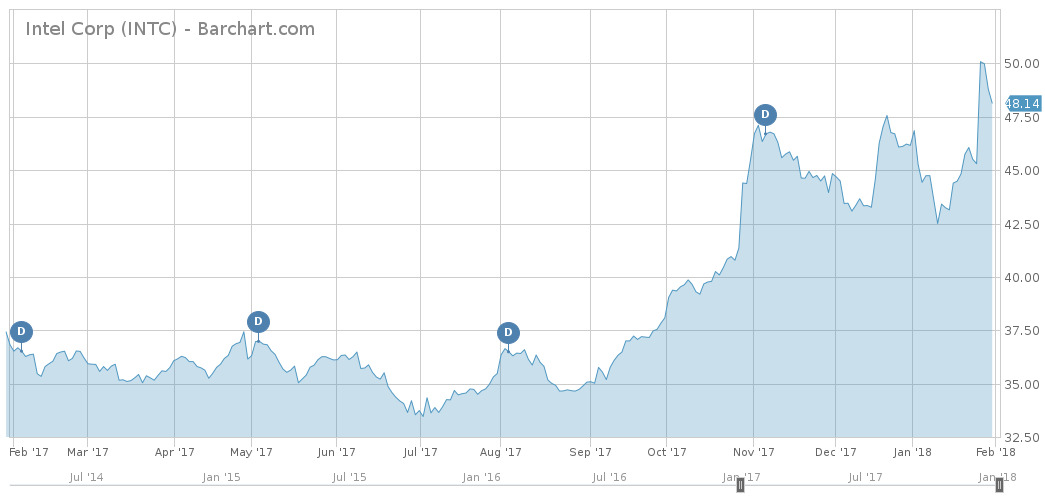

Intel Soars on Update Results

Legendary chip-maker Intel (INTC ) has seen its traffic advance 168% in the past week, taking second place on the list. Intel’s stock has surged more than 6% in the past five days, after the company announced strong earnings results, despite mounting pressure surrounding its failure to reveal security issues on several of its chips.

Intel, which has its next ex-dividend date on February 6, posted earnings per share of $1.08 for Q4 2017 compared to $0.86 expected by analysts. Revenues of $17.05 billion comfortably beat forecasts of $16.35 billion. Income from the Client Computing Group – Intel’s biggest segment – dropped 2% in Q4 compared to the same period last year, while revenues from its Data Center Group – the second biggest segment – rose 20% to $5.6 billion.

Intel has been plagued by a scandal relating to its failure to disclose ‘Meltdown’ and ‘Spectre’ vulnerabilities, with the company forced to acknowledge that it might face litigation battles in the future. However, investors temporarily discarded the issue, choosing to focus on the company’s spectacular results.

For the other semiconductor stocks that do pay a dividend, click here.

3M Earnings Best Estimates

3M (INTC ), the industrial conglomerate that makes everything from laminates to dental products, has seen its viewership rise 76% this past week, as the company again impressed analysts with strong financial results for the fourth quarter. 3M’s stock has risen more than 7% since the beginning of the year, with most of the gains taking place after reporting a rise in quarterly sales across the board, despite investors questioning the conglomerate structure.

Meanwhile, General Electric (GE ), 3M’s more famous peer, reported flat sales as it battles to lift a stock price that has performed horribly in a strong bull market.

The bulk of 3M’s revenues come from its industrial division, which grew by 4.9% in 2017. The company’s fastest-growing division is electronics and energy with growth of 11%. 3M, which has its next ex-dividend date on February 15, has been successful over the years in expanding its margins and sales thanks to timely divestitures of slow-growth businesses and acquisitions of quickly growing companies. In addition to a successful M&A strategy, the storied company has a strong record of growing organic sales.

Check out our list of other conglomerate stocks here.

Netflix Up on Robust Subscriber Growth

Content streaming provider Netflix (NFLX) continued its march upward this week, passing the $100 billion market capitalization mark after posting strong subscriber growth both in the U.S. and internationally. The entertainment company saw its viewership rise 66% this past week, as it added 8.3 million new subscribers worldwide, whacking analyst estimates of around six million.

Although the firm continued to impress on the income front, its profitability leaves much to be desired, attracting detractors. Matthew Harrigan, an analyst at Buckingham Research, downgraded the company’s stock, citing overvaluation and looming competitive pressures from players such as Walt Disney (DIS ), which seeks to create its own streaming platform.

The company burnt $2 billion in 2017 and is expected to increase its burn rate to up to $4 billion in 2018 as it expands its content creation capabilities.

For the top 11 Internet software stocks that do pay a dividend, click here.

The Bottom Line

Auto insurance firm Progressive increased its dividend by 65% in 2017 on strong results in December and Q4 2017. Legendary chip firm Intel reported a robust earnings report while it tries to quell backlash from its failure to inform about vulnerabilities in some chips. Conglomerate 3M continued to beat estimates, proving once again that its structure is sustainable, while Netflix added more subscribers than expected in the fourth quarter although it is still far away from profitability.

For more Dividend.com news and analysis, subscribe to our free newsletter.