Altria Group Inc. (MO ) is the largest brand in the U.S. tobacco market, with more than a 50% share. Its most recognizable and profitable brand is Marlboro, which has been the top cigarette brand for the last 30 years and currently maintains a 44% market share. The company also owns several other companies under the Altria name, such as Philip Morris USA, U.S. Smokeless Tobacco Co., John Middleton, Nat Sherman, NuMark and Ste. Michelle Wine Estates. Altria also owns 10.5% of Anheuser Busch Inbev NV (ADR) (BUD ), which gives the company exposure to the global beer market.

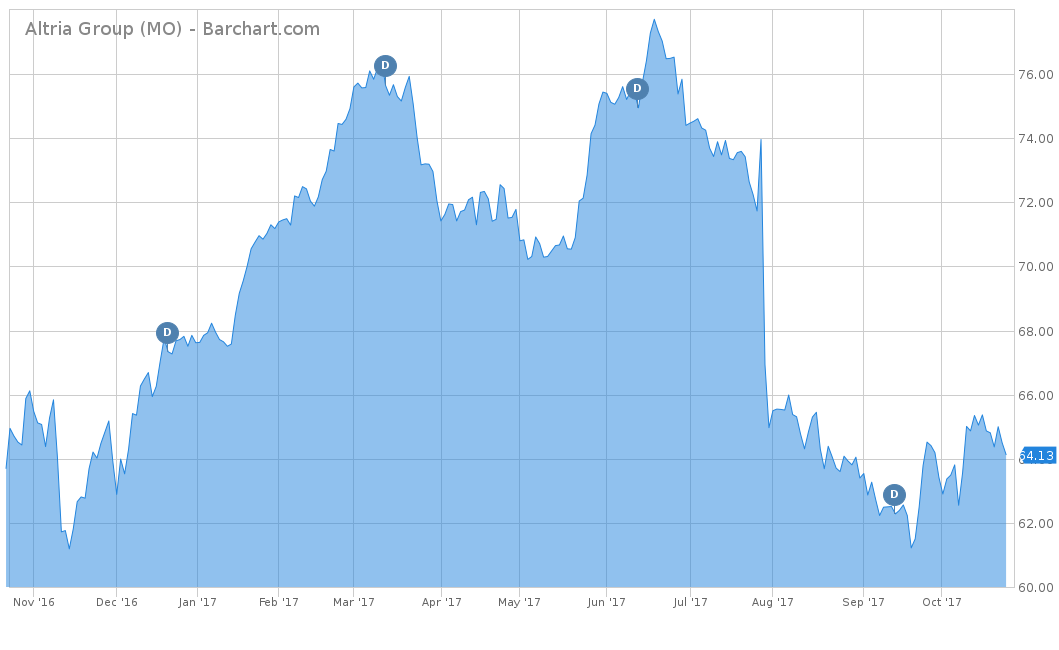

Altria Group has been a very popular choice for income-seeking investors over the years, due to the company’s dedication to return roughly 80% of net income in the form of dividends. Currently, the stock has a fairly high yield at 4.14%, paying shareholders $2.64 on an annual basis. However, the company’s stock price has not fared well recently and is down 5.16% on a year-to-date basis. This is significantly lower than the S&P 500’s return of 14.75% or even one of its cigarette competitors British American Tobacco PLC (ADR) (BTI ), which is up 12.29% for the same time. In late July 2017, Altria’s stock price dropped nearly 20% due to the FDA releasing a new plan to reduce nicotine levels over the next several years. However, Altria has only underperformed in the more recent term, with a much better cumulative trailing five-year return of around 100%.

Fundamentals

In a marketplace where the government and FDA are continually putting up roadblocks to reduce cigarette usage in the United States, Altria Group continues to shine. In the last five years, Altria has had annual revenue growth of 3.1%, showing increases every year from 2012 to 2016. Analysts are positive on Altria’s 2017 total revenues to grow 2.13% from the year prior to $19.75 billion. The same goes for 2018, where analysts expect revenues to reach $20.15 billion, an increase of 2.03% from 2017.

On an earnings-per-share basis, Altria also continues to show growth, with a five-year annual EPS growth rate of 34.7%. From 2015 to 2016, Altria’s EPS increased by over 172%, from $2.67 per share to $7.28 per share. This large increase was primarily contributed from the completion of the Anheuser-Busch InBev’s business combination with SABMiller. Although analysts do not expect a similar jump in EPS growth in 2017, they are expecting earnings to be around $3.27 by the end of the year. Although this is a decline from the very high $7.28 per share reading in 2016, it would be more consistent of the previous year’s EPS growth trend. Analysts also believe that EPS will report at $3.56 in 2018, making it an 8.87% increase.

According to Morningstar, with a price over earnings (P/E) multiple of 8.6, Altria Group is far below the S&P 500’s current P/E of 25.58. Again, this figure was most likely altered by the high earnings in 2016, as it is more likely to be consistent with the five-year average of 19.5 and with the P/E of the consumer staples sector, which is currently at 23.10.

Strengths

The biggest strength for Altria is management’s commitment to build long-term growth for the company’s shareholders. The company does this in three ways: through maximizing income from its core tobacco businesses, growing new income streams from new tobacco products and successfully managing a strong balance sheet. Obviously with nicotine usage expected to fall consistently in the future in the United States, Marlboro still remains the top dog in the cigarette game. With increasingly more difficult marketing restrictions making the tobacco industry have a very high barrier of entry, Marlboro looks to maintain the top spot with very little new competition.

However, cigarettes are not the only income stream for Altria. The company has a leading share of the smokeless tobacco market, with Copenhagen and Skoal brands currently maintaining over 50% market share. Altria has also released several e-cigarette brands like MarkTen and Green Smoke, which could help recapture some of the diminishing traditional cigarette business.

One of the reasons why Altria is able to have sustainable revenues and earnings growth is its ability to manage the company’s balance sheet with great success. Altria went through a $2 billion cost-saving plan that help expand operating margins, which are reaching nearly 48%. Management also believes there is an additional $300 million they have yet to capitalize on in cost-savings in the near future. These cost-savings help offset the declining sales of the cigarette industry to consistently deliver the 80% dividend payout ratio that the company is known for. Management also announced it is raising the company’s plan to repurchase stock from $3 billion to $4 billion, which is expected to be completed by the end of the second quarter of 2018.

Growth Catalyst

The current growth catalyst for Altria is if the U.S corporate tax rate is cut in the near future. Since Altria is a U.S.-based company, it pays a considerably higher tax rate of 35%, much higher than its offshore competitors. If the corporate tax rates were cut to 20%, analysts expect EPS and dividend growth to grow by more than 20% in the following months.

Dividend Analysis

Even though Altria’s stock price experienced a large setback from the FDA report earlier this year, the company is known for its consistent dividends. The company has raised its dividend consecutively every year since 2009 and it has raised its dividend a total of 51 times in 48 years. Altria has had an average dividend growth rate of 8.3% over the last five years, with a more recent 8% rate hike after its second quarter earnings this year. Currently, the stock is yielding 4.12% with an annual payout amount of $2.64 per share. If revenues stay on track, expect more rate hikes on the horizon for Altria.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

Most notably, the largest risk to Altria is the looming threat of increasing regulation and litigation in the United States. This, in turn, leads to a declining market of cigarette and tobacco users, who were once tied to the addictive qualities of nicotine and are now focusing on health. Although cigarette usage is growing outside of the United States, Altria does not compete in this marketplace after spinning off Philip Morris International Inc. (PMI). This declining revenue stream will make it difficult for Altria to keep up profitability over the long term. Although the smokeless tobacco and e-cigarette brands have been growing in market share, it is not nearly enough to replace the revenues brought in by Marlboro and the other nicotine-based brand names. If Altria does not find a way to navigate these eventual changes, the company will have a tough time growing its earnings like it did in the past.

The Bottom Line

Overall, Altria is a well-managed company whose brands are the leaders in each of their respective marketplaces. However, with cigarette usage on the decline, Altria must find a way to generate new streams of revenues. In the meantime, Altria’s management continues to flourish with growing revenues and earnings, rewarding shareholders with stock dividend hikes and share repurchases.

Check out our Best Dividend Stocks page by going Premium for free.