Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center around the release of second-quarter earnings reports and the pharmaceutical sector. The FDA came out with a new multi-year plan to reduce nicotine levels in cigarettes, causing Altria shares to drop. Apple beat expectations and increased its future estimates, making the stock hit a new all-time high. Pfizer trended as the drug giant missed on its revenue expectations. AstraZeneca stock price rebounded after the FDA approved two of its pipeline treatments.

You can view our previous trends article here, which highlighted Netflix remaining to be the most dominant force in the streaming world after it surpassed the 100 million subscriber mark. Lockheed Martin’s stock soared as the company beat expectations. Lastly, P&G faced shareholder activism, while Bank of America stock tumbled after it missed quarterly net interest income targets.

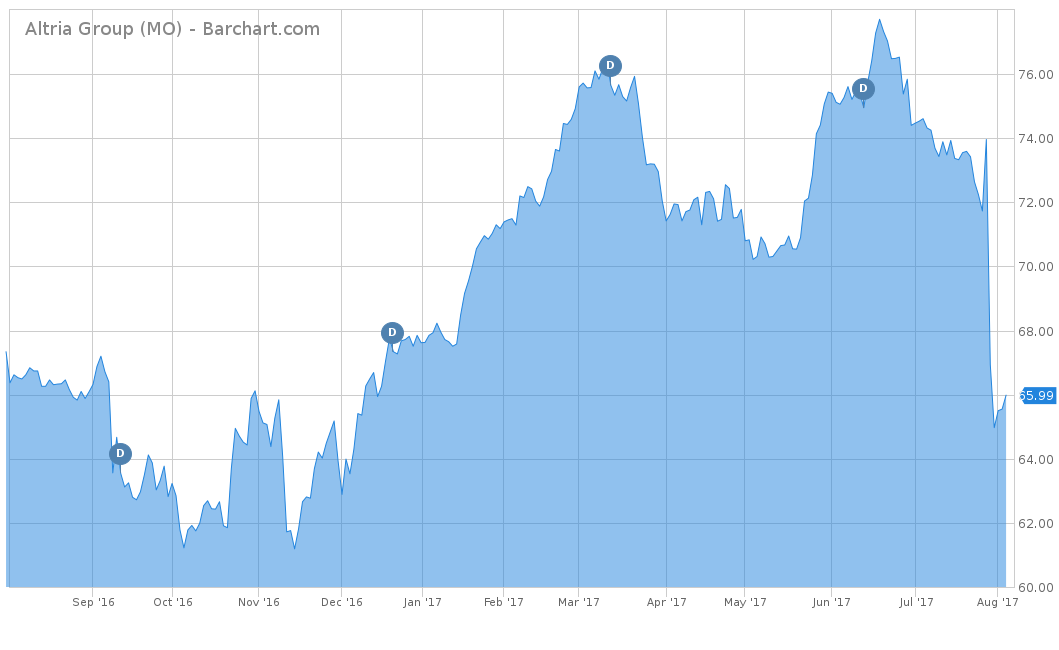

Altria Stock Dips as FDA Plans to Reduce Nicotine Levels

The maker of cigarette brands Marlboro and Parliament, Altria Group (MO ), was this week’s top trending topic with a 169% increase in viewership. The Food and Drug Administration announced last Friday a new comprehensive regulatory plan that will reduce tobacco-related deaths over the next several years. This plan seeks to lower the nicotine levels in cigarettes to non-addictive levels. Upon news of this breaking, shares of Altria Group, as well as other tobacco companies like British American Tobacco PLC (BTI ) and Philip Morris International (PM ), saw major declines for the day.

Since the news broke on Friday, the stock has declined over 10% for the week. Altria was much more impacted than its competitors BTI and PM, which were only down 6.3% and 2.4%, respectively, for the same time period. Altria has also underperformed on a year-to-date basis. Prior to Friday’s open, the stock was up 9.38%. However, since the recent decline, the YTD returns for the stock are down 2.62%. The stock has also underperformed over the trailing one-year and is down 0.78%. However, the stock has only underperformed in the short term; over the trailing five years, the stock is up over 83%. One of the draws to MO is its history of raising its dividend, which it has for eight years in a row. The stock is paying an annual dividend of $2.44 per share, yielding 3.70%.

To view a list of the top cigarette dividend stocks, click here.

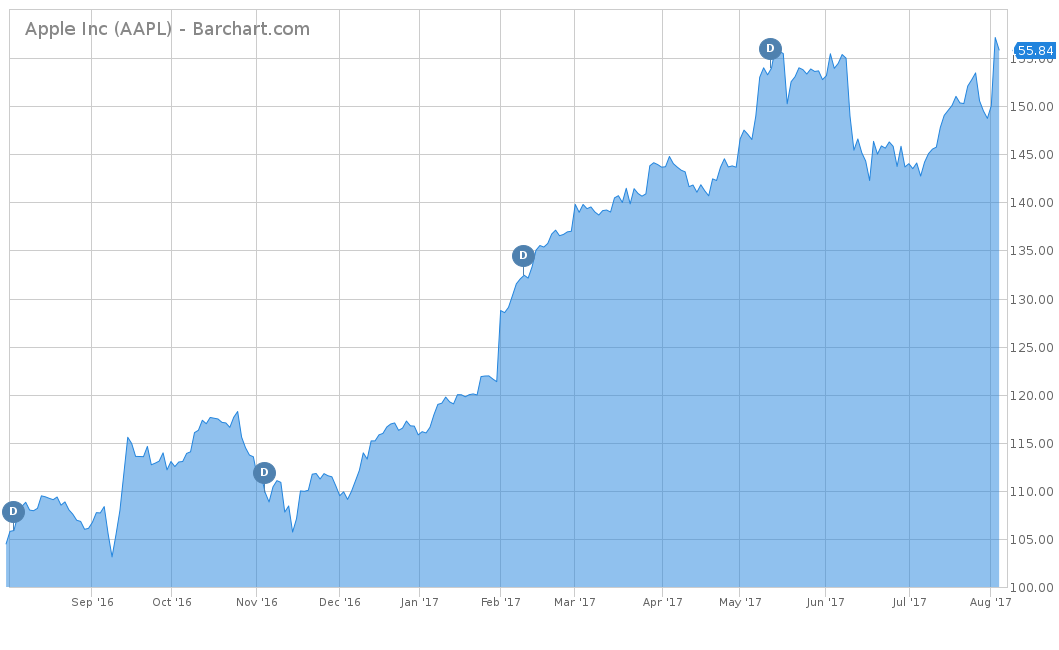

Apple Hits New High After Beating Earnings

Apple Inc. (AAPL ) led the stock market to new highs on Wednesday after the company announced earnings on Tuesday night. This caused the largest company in the world by market capitalization to be the week’s second-most trending topic, up 74%. The company announced that its earnings had climbed 12% to $8.7 billion in the second-quarter, due to rising demand in the iPhone and iPad. Revenue also increased in the company 7% from the same time last year by $45.4 billion. With this positive news, Apple raised its revenue forecast for the third-quarter to a range of $49 billion to $52 billion. This announcement has analysts hopeful about the news of potential delays with the new upcoming lineup, like the upgraded iPhone 7 and the highly anticipated iPhone 8.

After the earnings release on Tuesday night, Apple saw a gain of 4.73% on Wednesday. The company has performed very well on a year-to-date basis and is up nearly 40%. Over the trailing one-year, the stock has greatly outperformed the broad market and is up nearly 47%. What makes the stock more attractive than other technology companies, like Amazon Inc. (AMZN) or Alphabet Inc. (GOOG), is that it pays a dividend. The stock began issuing a dividend in 2013 and has raised it every year since then. It currently pays 1.62% or $0.63 per share every quarter for an annual dividend payout of $2.52.

To view other technology stocks that pay a dividend, click here.

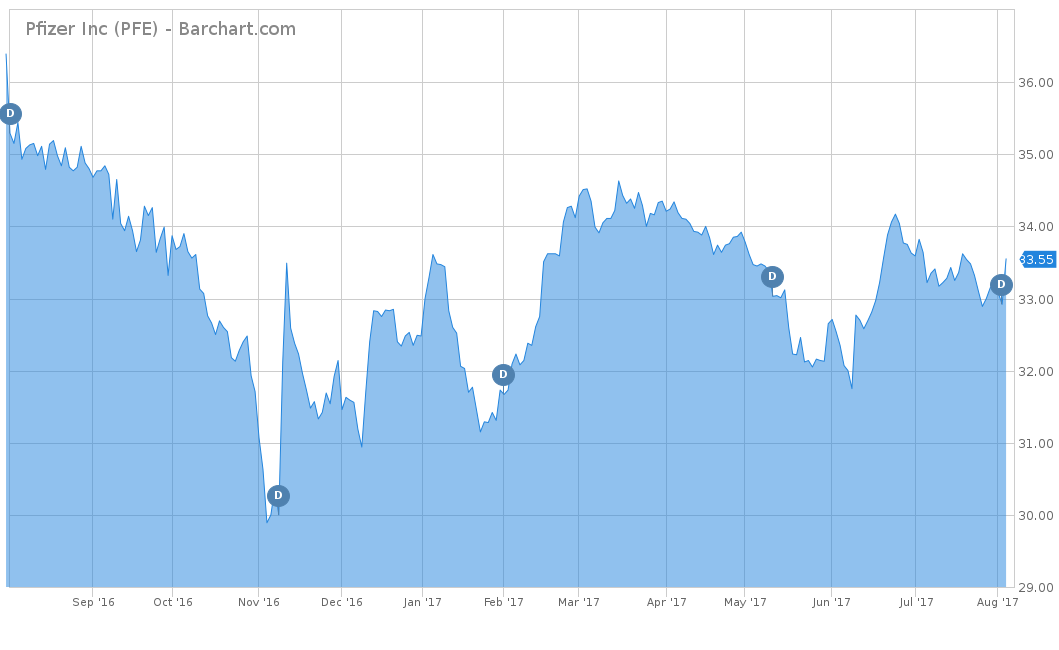

Pfizer Misses Revenue Expectations

The third-most trending topic this week revolves around Pfizer Company (PFE ), which saw an increase in viewership of 43%. The company reported earnings Tuesday and missed Wall Street expectations. Revenue fell 2% to $12.9 billion, which was below analyst expectations of $13.08 billion. This fall in revenue was caused largely by a 19.5% decline in sales of Enbrel, the company’s treatment for rheumatoid arthritis, plaque psoriasis and other chronic ailments. Sales of Prevna, the company’s vaccine for pneumococcal disease, saw sales decline 8.2% to $1.15 billion. However, the company did increase its net income and beat earnings on a per share basis. Pfizer narrowed its earnings 2017 forecast to $2.54 to $2.60 per share from $2.50 to $2.60 per share.

Since the announcement, the stock is up marginally at 0.86%, indicating that even though the company missed revenue estimates, investors are not panicking. The stock has underperformed on a year-to-date basis and is up only 2.97%, lower than the returns of competitors like Eli Lilly and Co. (LLY ), which is up 11.41% for the same time. However, one advantage that Pfizer has over most of the pharmaceutical sector is its higher-than-average dividend yield of 3.83%. The stock currently has an annualized payout of $1.28 per share and has raised its dividend every year since 2010.

AstraZeneca Rebounds With 2 FDA Drug Approvals

AstraZeneca PLC (AZN ) had a turbulent week and was the fourth-most trending topic of the week with a 40% increase. Last Thursday, the stock dropped nearly 16% after news of its lung cancer drugs going through its MYSTIC trails were shown to be ineffective. However, the stock had a slight recovery thanks to the U.S. FDA’s approval of the breakthrough blood cancer drug Acalabrutinib, which treats patients with a rare blood cancer called mantle cell lymphoma. The FDA also approved the drug Imfinzi the day before, which treats non-metastatic lung cancer.

For the last week, the stock has bounced back considerably since last Thursday and is up 5.06%. On a year-to-date basis, the stock is up just over 11% but down over 11% for the trailing one-year. Although performing relatively well in the shorter term, the stock has underperformed for the trailing five years and is up only 25.89%. By comparison, the largest pharmaceutical ETF, the PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP ), is up 84.48% for the same time period. However, this ETF does not pay a dividend like AstraZeneca, which is currently yielding 2.90%.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this article was based around the release of second-quarter earnings and the healthcare sector. Altria stock fell dramatically after the FDA announced plans to reduce nicotine amounts in cigarettes. Apple beat expectations, which gives hope to investors about the upcoming iPhones later this year. Pfizer had its revenues drop but net income and EPS improved. AstraZeneca had a turbulent week after having one drug failed and two new FDA drug approvals.

For more Dividend.com news and analysis, subscribe to our free newsletter.