Once the largest company in the world by market capitalization, ExxonMobil Corporation (XOM ) is a household name and a clear leader in the energy industry.

With a history tracing back over 135 years, ExxonMobil is known for its ability to maximize margins and run efficiently in any market cycle, unlike many of its competitors. The company specializes in integrated oil and gas operation, including the exploration, production and sale of crude oil, natural gas and other petroleum products.

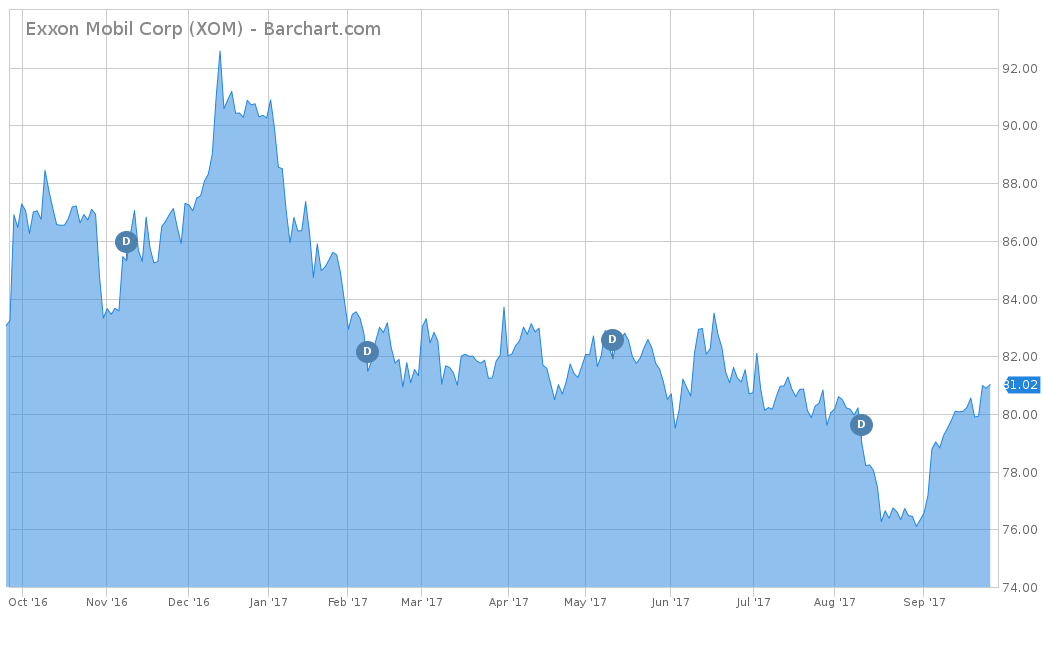

In January 2017, the company took on new leadership after Rex Tillerson stepped down after having served as CEO since 2006. The incoming CEO Darren Woods was previously president of the company and has worked in the refining and chemical segments for many years. However, the stock has not yet felt the positive effects from the change in leadership. On a year-to-date basis, XOM is down over 10%, while the S&P 500 is up over 12%. The same goes for the trailing five years, in which XOM is still down over 11% while the S&P 500 is up over 71%.

Fundamentals

From a balance sheet perspective, ExxonMobil is one of the strongest companies in the world and by far the strongest in the energy sector. However, the company’s revenues and stock have been hugely impacted by the declining price of oil over the last five years. In that same time period, Exxon has seen a negative 14.2% average in revenues. In 2012, Exxon saw revenues in excess of $482 billion, and now at the end of 2016, it has less than half at just over $226 billion. However, analysts expect 2017 year-end revenues to report at around $257 billion and in 2018 at $280 billion.

Like revenues, ExxonMobil has also seen a declining earnings per share figure for the last five years, with a negative 25.9% average. After finishing 2016 with an EPS of $1.88 per share, consensus of analysts expectations compiled by Zacks suggest that the company can rebound in 2017 with an estimated EPS of $3.46/share and $3.72/share in 2018.

One commitment that management has always stood by is the company’s dividend. Even with declining revenues, the company has managed to raise its dividend every year, with a five-year average of 10%. It also believes that going forward, much of the stock price’s growth will come from the company’s ability to continue to cover and raise those dividend payments to its shareholders.

Strengths

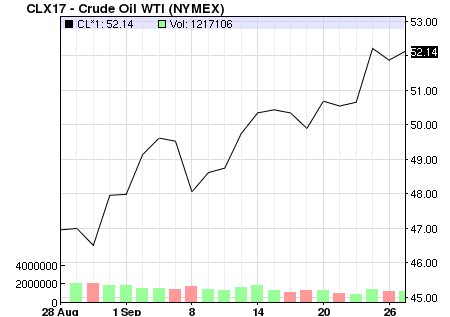

The biggest strength of ExxonMobil is its ability to generate superior returns from the integration of low-cost assets combined with a low cost of capital. When oil was trading well over $100 per barrel, ExxonMobil was pulling in revenue hand over fist. However, since the price of oil now hovers just above the $50 per barrel range, Exxon has had to tighten its belt with superior capital allocation and operation. Now that oil has stabilized since early in 2016, Exxon’s management forecasts the price of oil to remain at the same level over the long term. Exxon’s management has stated that the company can continue to cover its current dividend even if oil dips down to the low $40-per-barrel range. However, this will leave little growth in revenues and most likely prevent any dividend hikes in the future. But in 2018, Exxon is projected to be the leader in the industry with nearly 50% of total production from long-life assets. To see other major integrated oil and gas dividend stocks, click here.

Exxon has started shifting its focus from oil to other larger projects like oil sands and liquefied natural gas. According to the company’s long-term outlook on energy, natural gas will comprise 25% of the energy demand in 2040, surpassing coal. At the same time, nuclear and renewables will grow by 50% of its current levels and be close to 25% of the global demand of energy. With these two long-term focuses, Exxon has spent much of its current resources to meet upcoming demands. The company has interests in liquefaction of natural gas capacity of approximately 65 million tons per year through ventures in Qatar and Indonesia. There are also additional projects in Australia, West Africa and other areas of the Asia-Pacific region.

Growth Catalyst

There are two catalysts that could potentially cause the stock to see appreciation, which is a departure from its recent trend. The first is the company’s ability to raise its dividend. Even though revenues have decreased over the last five years, the company has still been able to raise its dividend thanks to superior cash flow management. Now that oil has stabilized and the company further diversified its portfolio, both earnings and revenues have begun to bounce back into positive territory. This would eventually lead to future dividend hikes, which should help boost the stock’s price to the investing public.

The second catalyst for Exxon is if the price of oil increases. The company currently has one of the lowest finding and development costs of $20 per barrel. If oil continues to increase well above the $50 to $60 per barrel mark, then Exxon’s margins would continue to spike. This is the case with oil, as prices have jumped from $47/barrel to over $52 in the last month alone, thanks to Hurricane Harvey causing shut downs of many Texas refineries. During this same time, Exxon has seen a spike in its stock price and is up over 6%.

Source: Nasdaq

Dividend Analysis

The clear driver of ExxonMobil’s stock price is its dividend. Thanks to its rising dividend, many investors have continued to remain with the energy giant as opposed to its competitors who have cut their dividend when oil prices dropped. ExxonMobil has a current dividend payout of $3.08 per year, or a 3.79% current yield. The company has raised its dividend 34 consecutive years in a row, since 1983.

With a dividend payout ratio of 89% and management’s commitment to dividends, investors should feel confident that Exxon will ensure stable dividends going forward.

Risks

Like the rest of the energy sector, Exxon’s greatest risk is and always will be the fluctuation of commodity prices. The company has restructured operations so that it can operate successfully with oil prices remaining above the $40/barrel mark. However, if it drops below that measure, Exxon will have a tough time with such a narrow margin. Moreover, any decline in global demand for liquefied natural gas and other energy sources could become a potential risk to Exxon’s bottom line.

If a global energy slowdown causes Exxon’s revenues to drop enough that management is forced to cut the dividend, expect the stock to tumble.

The Bottom Line

Overall, ExxonMobil’s stock price looks to have flattened out, which is mostly due to the stagnant price of oil over the last two years. Now that both revenues and earnings are on the rebound, management is looking to raise the stock’s dividend for the 35th year in a row. This, along with increasing oil prices, should cause XOM to see a large uptick.

Check out our Best Dividend Stocks page by going Premium for free.