Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on the mass destruction of Hurricane Harvey that left many parts of Texas and Louisiana heavily damaged. Exxon Mobil (XOM ) was one of many oil companies that had to shut down its refineries in Texas. Weyerhaeuser (WY ) and other lumber companies saw movement due to the U.S. delaying Canadian lumber duties. Royal Bank of Canada (RY ) beat earnings and raised its dividend again this year. Finally, Hurricane Harvey hit the headquarters of Main Street Capital Corporation (MAIN ).

You can view our previous trends article here, which centered on the global tensions of nuclear war between the United States and North Korea.

Hurricane Harvey Causes Texas Oil Refineries to Shut Down

Harvey, a category 4 hurricane, hit both Texas and later Louisiana this week, causing major destruction in the form of high winds and massive flooding. Due to the rising water, many areas of Texas have seen thousands of homes and businesses badly damaged. This has also negatively affected the oil industry, as many of the country’s largest refineries are located in the flooded areas.

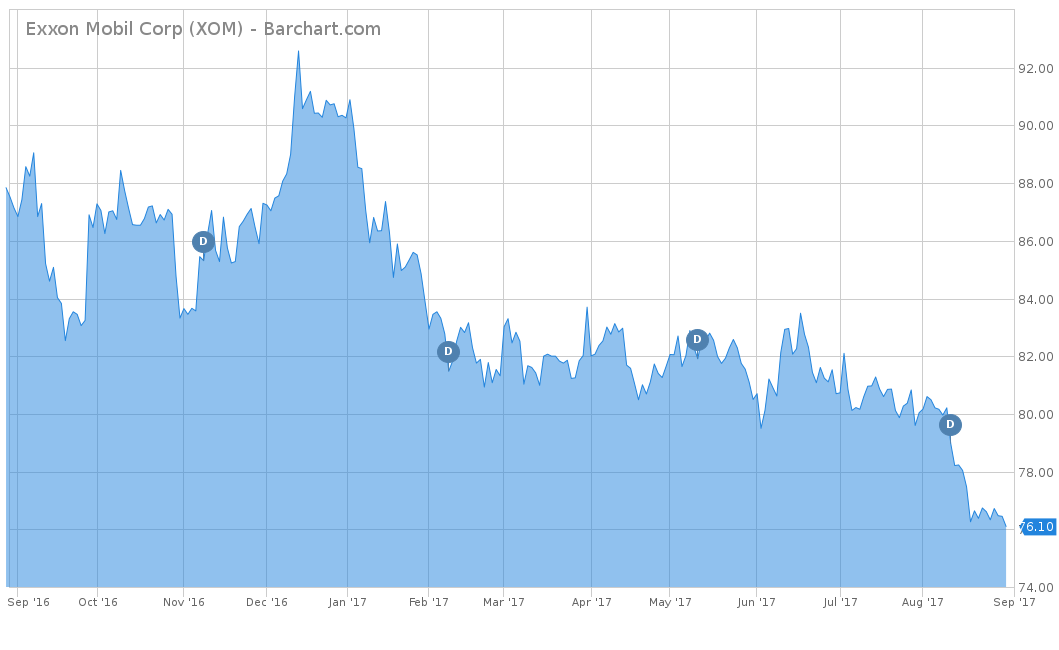

For instance, the country’s largest refinery is the Saudi-owned Motiva, which was closed on Wednesday. Exxon Mobil Corporation (XOM ) had two large Texas refineries in Baytown and Beaumont close that currently produced over 560,000 and 362,000 barrels a day, respectively. The flooding has caused the closing of thirteen different refineries in the area, which make up about 22% of the nation’s refining capacity. With all the destruction to the area and its effects on the oil and gas industry, this topic was the most trending subject this week, up 362%.

Since the storm hit over the weekend, Exxon Mobil has seen a slight pullback in price (around -0.85%) since the market opened on Monday. However, expectations are that the full effects of the refinery closures have not yet been reflected in the stock price. On a year-to-date basis, Exxon has performed like most of the other companies in the energy sector and is down 15.68%. The energy sector, as a whole, is down slightly more, as shown by a negative 16.80% YTD return on the Energy Select Sector SPDR (XLE). Both XOM and XLE are closely tied to the price of oil, which is down 19.28% year-to-date. However, Exxon Mobil looks attractive given its higher-than-average dividend. The stock pays an annual dividend of $3.08, which is equal to a 4.04% yield. What is more impressive about the company is that it has maintained dividend growth for 34 years, despite an oil price volatility and the occurrence of the financial crisis.

To view a list of the top oil and gas dividend stocks, click here.

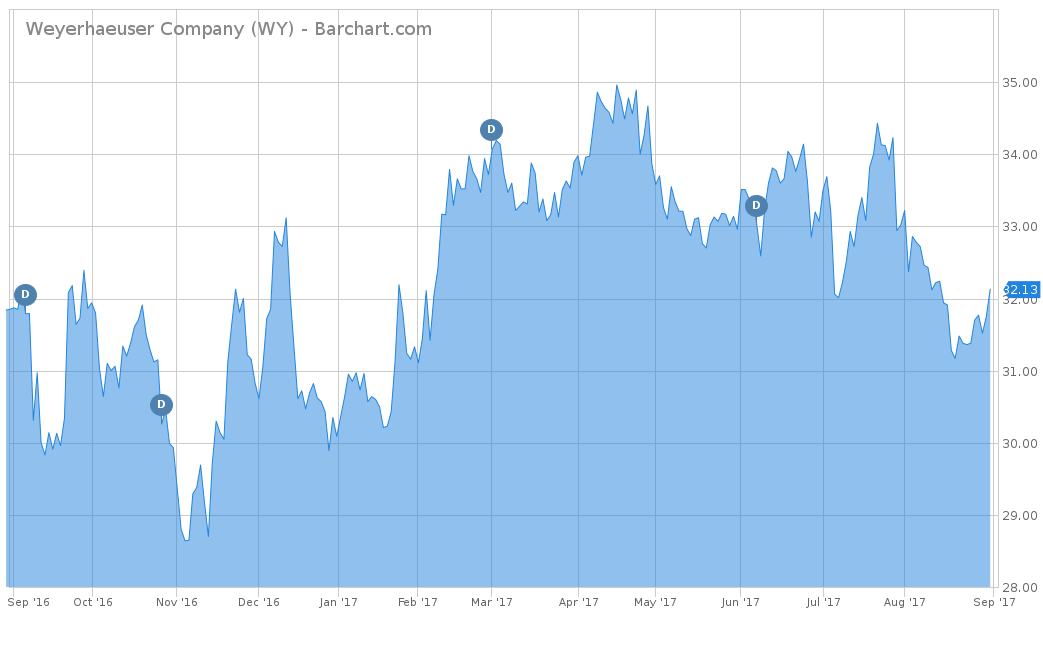

Lumber Industry in Focus After U.S. Delays Ruling on Duties

The lumber industry was the second-most trending topic of the week, up 265% after the U.S. delayed its ruling on Canadian lumber. U.S. Commerce Secretary Wilbur Ross on Monday announced a two-and-a-half month delay in determining final anti-dumping and anti-subsidy duties on Canadian softwood lumber, to buy more time to negotiate a settlement of the trade dispute. The dispute between Canada and the U.S. has escalated this past April when the Trump administration imposed preliminary countervailing duties of up to 24% on Canadian imports. This has caused lumber futures to gain as much as 15% on a year-to-date basis, as the supply of lumber has substantially decreased.

The largest lumber manufacturer in the United States is Weyerhaeuser Company (WY ), which has seen a 2.42% increase over the last week. On a year-to-date basis, the company has fared relatively well and is up 6.81%, but it has underperformed when compared to the S&P 500. Weyerhaeuser has also seen minimal gains over the last five years, with a total cumulative return of 27.16%. However, the stock does provide a fairly high dividend of 3.91%, which is higher than most of its competitors. Although the company has not necessarily provided investors with index-beating appreciation in its stock price, it has raised its dividend for the last five years in a row.

To see the list of other lumber-related companies that pay a dividend, click here.

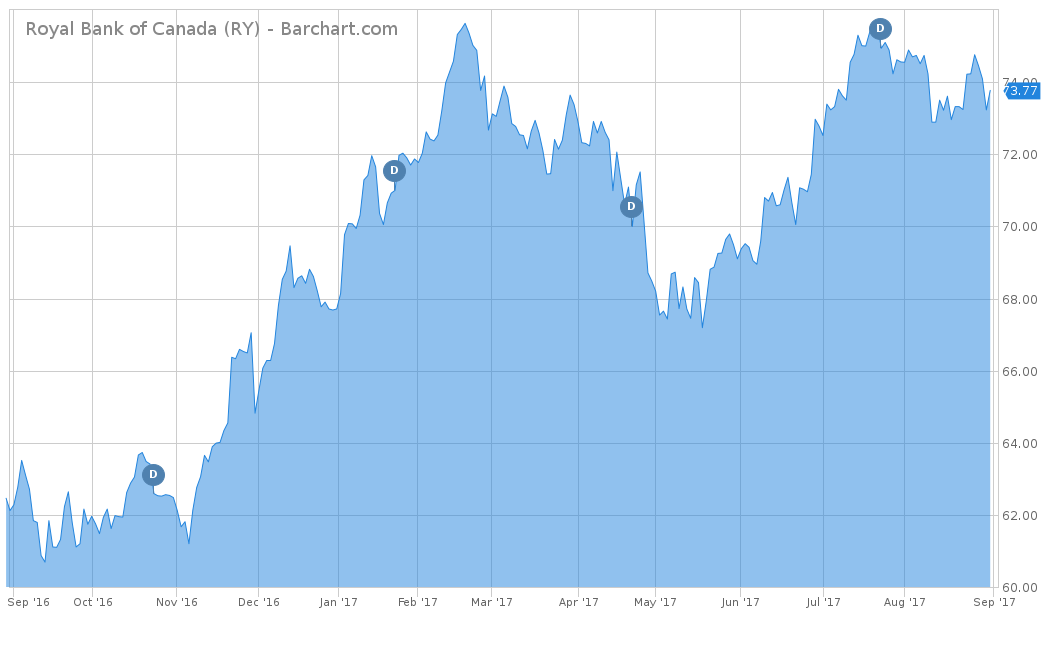

RBC Trends After Second Dividend Hike

Royal Bank of Canada (RY ), which is the largest bank in Canada, released third-quarter earnings this week, beating expectations, and is the third-most trending topic, up 71%.

Total net income came in at $2.8 billion, which beat last year’s figures by 5%. Earnings per share came in at $1.89 and beat analysts’ expectations of $1.87 and last year’s figure of $1.72. As a result of the positive earnings, RBC has decided to raise its quarterly dividend by 5% to $0.91 per share. This is the second dividend increase of the year as analysts expect the big bank to continue to grow its earnings for the remainder of the year.

Over the last week, RBC stock has seen a moderate uptick of 0.54%. On a year-to-date basis, the stock has underperformed compared to the U.S. banking industry and is up only 1.16%. However, it is outperforming its Canadian banking peers, as evidenced by the iShares S&P TSX Capped Financials Index Fund (XFN), which is up only 0.79% at the same time. Over the last rolling five years, RBC is up a cumulative amount of 65.06%, also beating XFN’s 60.74% total return. One benefit that RBC has over most of its peers is a large dividend yield of 4.97%, which is significantly higher than the XFN yield of 2.86%.

To view other banking stocks that pay a dividend, click here.

Hurricane Affects Main Street Capital Corp.

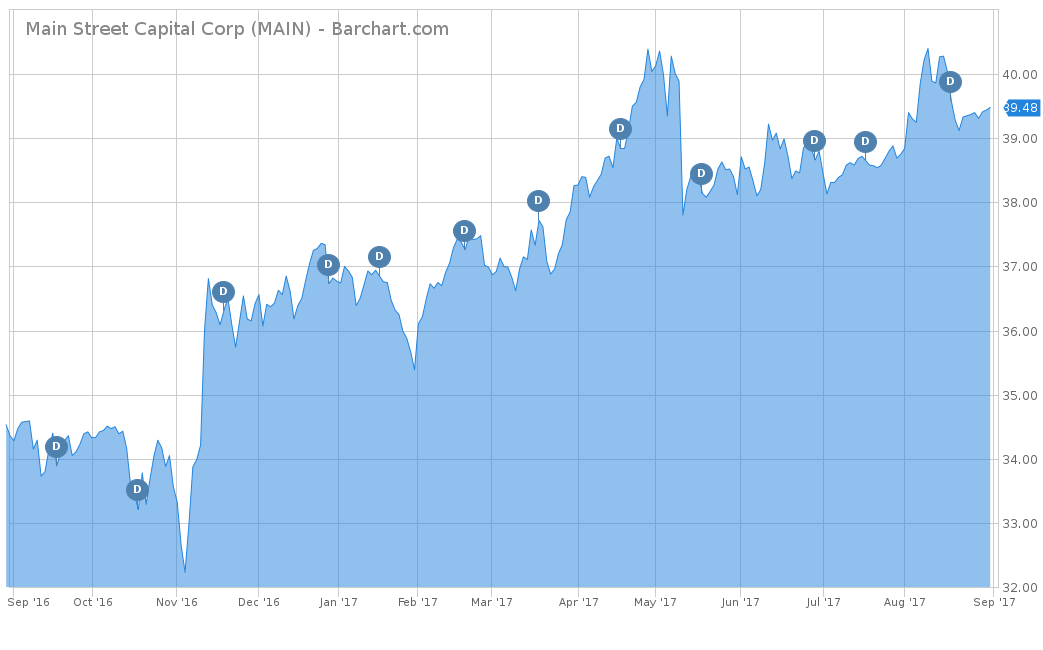

The fourth-most trending topic this week revolves around Main Street Capital Corporation (MAIN ), up 35%. The company has its headquarters located in Houston, Texas, and many of its portfolio companies are in the surrounding areas. These areas have been affected by the aftermath flooding and damage of Hurricane Harvey. Outside of the company’s headquarters, it has over $88 million of its investments in the area, with the largest being in the PPL RVs Company, which totals nearly $30 million. Although this may be a small portion of the company’s overall portfolio that totals greater than $3.6 billion, it could cause a negative effect on the company’s total operations going forward.

However, over the last five days, the stock has seen little movement and is up 0.48%. For a year-to-date basis, MAIN is up 7.34%, and for the last five years, it is up a cumulative amount of 48.33%. The stock remains attractive for investors due to the high dividend yield of 5.76% to a total annual amount of $2.28 per share. Income investors love this stock because MAIN has raised its dividend for the last six years and pays its dividend on a monthly basis.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this article was based around Texas and the destruction caused by Hurricane Harvey. A large portion of the oil refiners in the U.S. were shut down due to flooding. The lumber industry has been in focus because of the U.S./Canadian duties being delayed. Royal Bank of Canada raised its dividend for the second time this year based on strong earnings. Finally, Hurricane Harvey could negatively affect the operations of the Houston, Texas-based Main Street Capital Corp.

For more Dividend.com news and analysis, subscribe to our free newsletter.