The markets were caught off guard in June when online retail giant Amazon (AMZN) unexpectedly announced it was buying high-end grocery chain Whole Foods (WFM) for $13.7 billion in an all-cash deal.

The deal is expected to close sometime in the second half of 2017. While it remains to be seen what Amazon has planned for its new acquisition, the company’s history of trying to dominate every market it operates in suggests that it wants to become a major player in the grocery space. In this article, we’ll examine how this merger may affect the rest of the grocery store industry.

Amazon’s acquisition of Whole Foods was the biggest trending news last month. Read more about it here.

Why the Boring Grocery Business Just Got Interesting

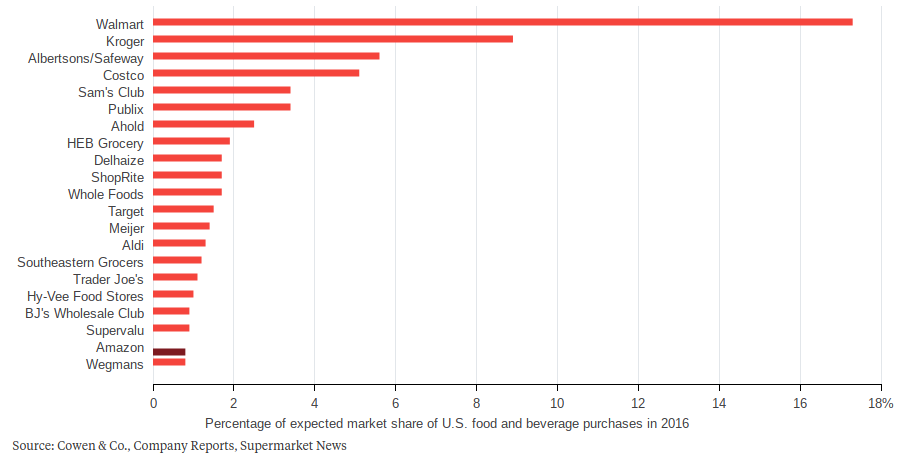

The food and beverages market is a $675 billion industry, but it’s highly fragmented. Walmart (WMT ) is the biggest player in the space and generated more than 50% of its sales in 2016 through its grocery business.

Amazon owns less than 1% of total food and beverage purchases in 2016. With so many companies maintaining modest market shares and the grocery business accounting for around 30% of total personal spending, according to Morgan Stanley, Amazon sees the opportunity to make a big move into the industry by acquiring Whole Foods.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold.

Why Would Amazon Want to Buy Whole Foods?

To this point, Amazon hasn’t been able to gain much traction in the grocery space. Its AmazonFresh grocery delivery service is available in a handful of larger markets and recently debuted its checkout-less Amazon Go store in Seattle. Outside of that, Amazon doesn’t have much of a presence in the grocery arena.

Most of the retail sector has been impacted by the emergence of e-commerce, but grocery is still largely a brick-and-mortar business. Peapod, perhaps the most notable online grocery business, is actually older than Amazon but still only operates in a few U.S. states plus the District of Columbia. Amazon has the opportunity to use its size and scale to capture a segment of the market that remains largely unclaimed.

Point to note here is that Whole Foods is unique in the grocery space in that it targets more affluent customers, thus commanding premium prices. The company reported year-over-year declines in same store sales and gross margins in the most recent quarter as consumers showed preference to lower price rivals. In addition, competition is rising not only from domestic players, but also from established European competitors such as Lidl and Aldi – companies looking to expand their presence in the United States.

How does the Whole Foods acquisition help Amazon? It gives the company a couple of strategic options. Amazon could consider plowing its considerable resources into Whole Foods and expanding its presence as a niche player in the space geared towards more affluent customers. It also has the possibility of using Whole Foods as a launching point to become the overall discount leader in the grocery industry. The latter looks more feasible. There are already speculations over Amazon’s intent of getting rid of Whole Foods’ premium price reputation and making it more consistent with Amazon’s low-cost, high-automation business model.

What Does This Mean for the Food Retail Industry in the Long Run?

Amazon has a long history of operating at a loss in order to capture market share. It’s reasonable to assume that this is Jeff Bezos’ plan here, as well as trimming margins down to the point where it becomes the low-cost leader and forces rivals to drop their prices in order to compete. Amazon’s focus on cutting-edge technology and large-scale distribution to deliver products to customers cheaper and faster should put it in a position of competitive advantage.

The pilot Amazon Go store could be a peek into where the industry is heading – a highly efficient brick-and-mortar business that limits labor costs, improves the customer experience and gets shoppers in and out of the store more quickly. Competitors will likely need to make improvements to their supply chain management system and identify areas where expenses can be trimmed. Those that fail to keep pace on speed and cost run the risk of falling behind.

Click here to find the top dividend-paying grocery companies.

Amazon vs. Competitors

While Whole Foods stock surged nearly 30% when the acquisition was announced, the rest of the retail sector got rocked. Kroger (KR ) dropped nearly 10% on the day, while Walmart and Target (TGT ) both dropped 5%. Costco (COST ) fell more than 7%. The market clearly feels that Amazon’s leap into the grocery space is going to be bad news for any company that derives a large percentage of its sales from food and beverages. The company has historically been a disruptor in most industries in which it operates. It tends to drive down prices and create new ways of enhancing the customer experience, both factors which could negatively impact the revenue and market share of its rivals.

The longer-term performance of the major retail stocks underscores the difficulty that the brick-and-mortar shops are having. Amazon continues to fly higher, up more than 31% in the past 12 months, on the strength of North American sales growth and Amazon Web Services revenue. Walmart and Costco have posted modest gains, up 3% and 2%, respectively. Kroger is down more than 35% with much of that loss recorded since the Amazon-Whole Foods deal. Target is down 25% as it struggles with in-store sales growth.

Take a look at why Target may be a good turnaround stock.

The Bottom Line

Amazon has spent little effort targeting the grocery space, but that looks like it’s about to change in a major way. The Amazon Go store in Seattle looks like a test run for how its newly expanded footprint could look in the future. The company has a history of going all-in when looking to enter a new market, so expect to see some significant changes to how the industry operates very soon.

Amazon is a formidable competitor in an already challenging retail environment. Competitors may be forced to make significant changes to both their supply chains and their cost structures quickly in order to stay on pace with the looming threat ahead.

Check out our Best Dividend Stocks page by going Premium for free.