[Updated November 15, 2017] General Electric (GE ), the industrial conglomerate that operates in energy, renewables, aviation and healthcare, is an original Dow Jones Industrial Average component and a long-standing cornerstone of the United States economy. Income investors have long put their faith in the stock’s historically rock-solid dividend, but that faith was shaken when the company trimmed its quarterly dividend by two-thirds during the financial crisis.

Nearly a decade later, GE is still working some of the excess of its ill-fated financial services unit off the books. Should investors be targeting GE stock and its dividend once again?

Update: General Electric stock is down 13% from Friday’s close after the restructuring plan announced by CEO John Flannery at the company’s investor day on Monday failed to inspire confidence. The plan included a strategic refocus on the healthcare, power and aviation segments, and away from ancillary businesses, such as media, chemicals and banking. Most notable was the announcement that the company would be cutting the dividend in half, the second such cut in the past decade. In addition to the dividend cut, GE plans to cut overhead costs by $2 billion in the next year and divest itself of at least $20 billion in assets.

Check out our dedicated page for Top Dividend Paying Stocks in the Industrials Sector.

Business Summary

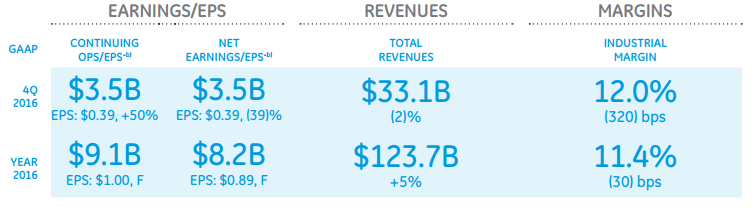

General Electric was founded in 1892 and is one of the world’s largest companies by sales, having generated more than $123 billion in revenue in 2016. Of that sales number, GE delivered EBITDA (earnings before interest, taxes, depreciation and amortization) of over $19 billion.

Cash flow has become a bit of an issue for GE over the last couple of years. Part of the reason for the company’s volatility in quarter-to-quarter cash flows is due to differences in timing between customer billing and revenue recognition. Overall, however, GE’s cash flows continue to be impacted by several factors – its balance sheet transformation to a purer industrial company, a weak energy environment and large capital commitments to shareholders via dividends and share buybacks.

Update: GE’s cash flow problem is about to get worse. Flannery announced that GE is cutting its earlier 2018 estimate of $12 billion in free cash flow all the way down to $6-7 billion. For comparison, GE generated around $15 billion in free cash flow as recently as 2015. The SEC’s new revenue recognition rules would also reduce revenue by about $1.4 billion and operating profit by $2.1 billion. The dividend cut is expected to save around $4 billion in cash annually. Interestingly, the company committed to a $3 billion share repurchase program.

The stock now trades at around $18 per share, down nearly 43% year-to-date. Based on the new 2018 earnings estimates of $1.00 to $1.07 per share, the stock trades at a P/E ratio of around 17-18.

Dividend Policy

GE’s current dividend yield of 3.39% compares favorably to the 1.9% yield of the S&P 500. The stock’s payout ratio of 59% is reasonable, but other financial figures paint a more mixed picture.

Click here to research the dividend history of GE.

GE’s cash flow picture continues to hang over the company as it navigates through its restructuring process. GE pays about $9 billion annually to shareholders in the form of dividends. Over the last three years, the company has generated somewhere between $10 billion and $30 billion in free cash flow, a measure of how much cash a business has left over after paying all the bills and investing in growth. In other words, GE has generated more than enough cash to support the dividend.

Since its dividend cut in 2009, GE has lifted the quarterly dividend from $0.10 per share to $0.24. The dividend, however, has only grown marginally since the end of 2013, suggesting that the company is being conservative in its dividend payouts. GE has been actively buying back its stocks, having reduced its outstanding float by nearly 2 billion shares over the past few years at a total cost of nearly $40 billion.

Update: A payout ratio of 60% is reasonable, but that was based on $2 per-share-earnings estimates. Since then, both the dividend and EPS estimates were cut in half, putting the new payout ratio at just under 50%. The new dividend is also around 65-70% of free cash flow estimates, so it should be in good shape if earnings and cash flow estimates are accurate. The new dividend yield will drop to around 2.7%. That’s still well above the 1.9% yield of the S&P 500, but dividend growth expectations for GE should be very low for the foreseeable future.

For dividend-oriented investment concepts, visit our Dividend Investing Ideas Center.

GE Continues to Play to Its Strengths

Despite some short-term pressures, GE’s core business and its outlook remain a strengths. Some of those strengths include:

- Diversified business – According to its first-quarter financial presentation, GE operates seven unique industrial sector segments. Every one of those segments was profitable in the first quarter, helping to insulate the company from weakness in any one area.

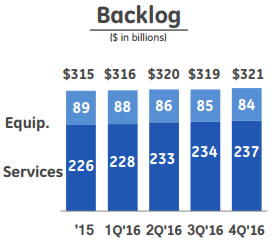

- Increasing backlog – GE’s backlog has steadily continued to grow over the last several quarters, including stronger backlog growth in the higher-margin services segment.

- High switching costs – One of GE’s competitive advantages is its ability to cast a wide moat around its products and services. The costs associated with switching away from GE makes it more likely that customers will stick.

- A truly global structure – More than 50% of the company’s revenues are generated overseas, which helps insulate GE from some of the domestic economic and political uncertainty.

- Focus on infrastructure – President Trump’s desire to make significant investments in America’s infrastructure should increase the demand for GE’s products and services.

Update: The diversified business plan turned out to be more of a hinderance as evidenced by the new consolidated business plan. The former business plan, initiated by Jack Welch and furthered by Jeff Immelt, was to broaden the company’s scope in order to diversify risk. That proved troublesome during the financial crisis when GE’s risky financial services portfolio went bust and led to the last dividend cut. Flannery’s plan is much more conservative and should focus on GE’s core competencies, although it will take some time to realize results.

Want to learn more about GE’s various business lines? Click here.

Future Avenues for Growth

Industrial companies, particularly those of the size of GE, aren’t typically known for their growth potential, but the company has set itself up nicely in a few different areas.

- Focus on the industrial sector – The GE Capital division was a big money maker for several years, but it subsequently became very costly and wasn’t part of the company’s core business. Much of the exit from GE Capital is now complete, with the last major sale agreement having been sealed in March 2017. The remaining GE Capital assets will be merged with the GE’s legacy structure, serving its industrial business – a move that will make GE more stable financially.

- Foray into big data and analytics – The company is advancing into the Internet of Things by collecting and evaluating data on everything from jet engines to household appliances.

- Improving services business – According to the first-quarter presentation, GE has a 30 basis point margin on equipment, but gets 140 basis points on services. Look for the company to keep growing this area of the business.

- Cost cutting – The broad move towards an industrial focus includes cutting costs and making the entire business more efficient.

Update: The focus on the three core segments mentioned above will continue. The entry into big data and analytics appears to be tabled for the time being, maybe indefinitely. Meanwhile, the cost-cutting efforts become less of an opportunity for future growth and more as being necessary to refocus the business.

Current Business Risks

As GE continues to execute on its business, there are a few headwinds that investors should consider.

- New CEO – On June 12, John Flannery was announced as the company’s new chief executive officer, replacing Jeff Immelt, who is stepping down after 16 years at the helm. Flannery’s appointment could help ease concerns over the impact of Immelt’s rocky tenure.

- Winding down GE Capital – While much of the exit from GE Capital has been completed, the company still has some potential negative earnings exposure as it closes out its position, although much of the risk is already behind it.

- Weakness in energy – The energy sector is still weak as oil prices struggle to increase. This is a low-margin business for the company and poses further risk.

- Uncertain regulations – The regulatory environment is changing rapidly, but the impacts of these changes are still unclear.

Update: Flannery certainly plans a more conservative operation than Immelt. His new vision for GE is an about-face from Immelt’s approach, and could take a lot of time to bear fruit. Weakness in energy prices is still a concern, although oil prices are now at their highest level since mid-2015.

The Bottom Line

General Electric is a business in transition. The framework for its transformation back into an industrial giant has largely been laid, but now the company needs to execute. While risks persist, the company is getting back to the business it knows best, which should be a long-term positive. The company has long been committed to rewarding shareholders through increased dividends, and that can be expected to continue.

The company likely still has some pain ahead in the short term as its restructuring progresses, but long-term investors may find value in the stock.

Update: GE is very much a business in transition now, as the company’s new transformation plan could take years to complete. GE should no longer be considered a dividend-growth stock until the financial results indicate that the turnaround is working. At this point, GE stock is a risky play with a dividend that shouldn’t necessarily be considered secure.

Check out our Best Dividend Stocks page by going Premium for free.