When it comes to dividends, we all know that boring can be beautiful – and there is nothing exciting about selling bottled water and pretzels. But, for PepsiCo, Inc. (PEP ), that boring business of selling snack foods and beverages continues to drive its top- and bottom-line growth. And it has done so for decades now.

Perhaps more importantly, it drives its juicy dividend. PEP continues to be a dividend stalwart for many investors.

But don’t take that history for complacency. There’s still plenty of carbonation left in Pepsi’s tank. In the end, the consumer staples giant has all the right moves to be a core dividend stock for your portfolio.

Find out which popular brands Pepsi owns here.

Iconic Brands Driving Sales

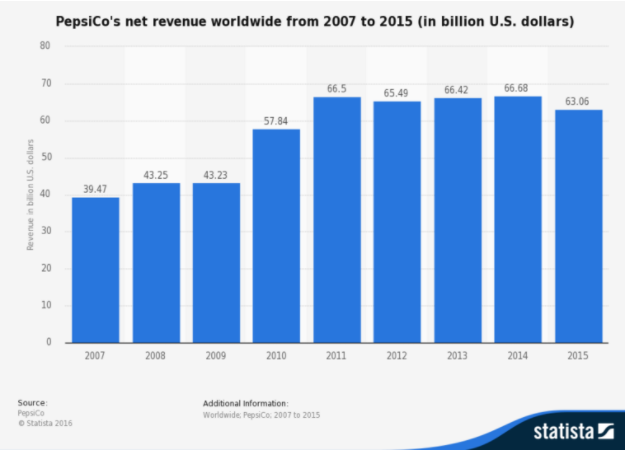

Pepsi doesn’t necessarily need an introduction. Its namesake soda has been refreshing consumers since 1919. However, today, PEP is more than just one brand. It’s a global snack-and-beverage powerhouse that clips about $63 billion in sales annually. The secret to that large revenue figure has been its enormous brand equity that it has taken decades to build. Lay’s Potato Chips, Quaker Oats, Tropicana and Mountain Dew are just some of the firm’s 22 brands that generate over $1 billion in annual sales.

And increasingly, it’s generating more of those sales from overseas sources.

About 56% of its total revenue is derived from the United States. The rest comes from 199 different countries in the developed and emerging world. More importantly, those sales overseas continue to grow as Pepsi and its cadre of brands have become the standard bearer of snack foods. Rising incomes in various emerging markets have allowed citizens to indulge in small luxuries like soda. Meanwhile, here in the developed world, potato chips have become part of our typical shopping routines. In the end, it’s managed to grow its average annual sales by 13.79% over the past five years. The chart from Statista below shows just how large and stable its base is.

All of this brand equity has allowed PEP to defeat rival Coca-Cola (KO) in a big way. In four out of five primary markets in which Pepsi operates, it holds the number one spot regarding market share. Rising sales of Pepsi products are also the main driver of increasing retail sales in these markets, as shown in the chart below. Only in Mexico does Coke take the lead spot.

We have a dedicated page for Consumer Goods where we track all consumer goods stocks and the industries within consumer goods. You can find the average dividend yields of these industries and the sector on this page.

Driving Dividends at PEP

This huge base of sales has continued to fuel Pepsi’s cash flows. With relatively high margins, PEP has been very successful in turning those revenues into profits. Continuous cost improvements and productivity gains have also helped to increase margins on its products.

The substantial free cash flows have then translated into some big-time dividends and share buybacks.

2016 represents the 44th consecutive year that PEP has paid an increasing dividend. The beauty is that the streak occurred through both recessions and economic booms, which just highlights the appeal of PEP’s consumer staples nature and the ease at which consumers – both wealthy and poor – can afford to buy its products. Moreover, its wide range of nations where you can buy Pepsi adds another level of diversification to its revenues.

What’s really impressive is that its payout ratio, or the number of profits handed back to investors as dividends, has been between 50% and 58% over the last few years. This low payout ratio means PEP has plenty of room – about 45 cents worth – to raise its dividend without doing anything.

Get the full payout history of Pepsi and see how much the dividend has increased over the past 44 years.

Driving Future Growth

This base of earnings is great for Pepsi, but it also has plenty of opportunity to grow its earnings over the long term.

As we said before, emerging markets represent a huge untapped base of customers to begin eating its chips and beverages. Only about 31% of its revenues come from these areas. Pepsi can make incremental jumps in local market shares through its already-aggressive marketing efforts.

Here in the U.S., the key for future growth comes from targeting a different kind of customer. Soft drink sales have started to slip as people have become more health-conscious. Pepsi has taken this challenge head on by adding more natural products to its brand umbrella. This includes natural and organic offshoots of established brands and hyping its water efforts, as well as engaging in buyouts of smaller organic/health-food companies. Already, these moves seem to have slowed the tide of its lower-sugar soda/snack sales in the U.S., while boosting its organic/natural product sales.

Use our Dividend Screener and screen high-quality consumer goods stocks similar to Pepsi.

Buying PEP Stock

Given Pepsi’s history as a dividend stalwart and its continued growth in new markets with new products, the stock makes a great core addition to any dividend portfolio. Even better is that investors can buy shares for cheaper than the industry average.

The flight to consumer staples stocks and their dividends has caused the overall sector to trade at roughly 3.5x sales. For Pepsi and its growing revenue base, you buy it at only 2.4×. Meanwhile, shares trade for a P/E of 22 and a yield of 2.87%. Neither of those metrics is particularly expensive when considering PEP’s growth prospects and dominant position.

In the end, PEP has all the hallmarks of a great core dividend stock: a large and growing dividend yield, a stable base of revenues and the ability to grow those sales further over the long term. Investors could certainly do worse than buy PEP stock.

The bottom line is that Pepsi should be part of your portfolio.

Dividend.com has over 100,000 subscribers. Go premium for free and get access to the daily dividend newsletter where we deliver daily dividend-specific news straight to your inbox.