For investors, General Electric (GE ) is about as blue chip as they come. The manufacturing powerhouse has been a stalwart of the American economy for decades and features plenty of earnings and dividends growth. However, GE’s blue chip was more “black and blue” just a few years ago.

That’s because GE lost its way and was delving into plenty of non-manufacturing roles and business lines.

But it seems that GE is back now. Under CEO Jeffrey Immelt, GE has gotten back into the business of making things. Asset sales, spin-offs and a hefty dose of acquisitions have changed the venerable industrial’s product mix back into being about building things.

In the end, GE has the focus and tools available to regain its dividend mojo and become a stalwart once again.

A Major Shift In Focus

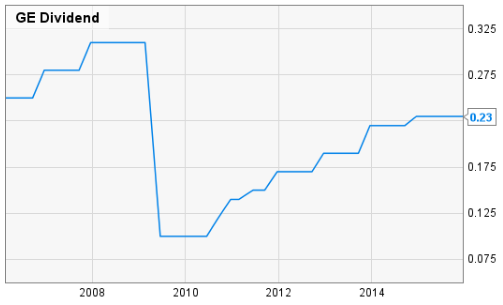

GE has a long history of being a major part of the “Bedrock of America.” That size and scope as one of the nation’s largest conglomerates allowed it to have one of the longest streaks of rising dividends in the Dow Jones Industrials, a streak that lasted nearly 71 years. (Did you know that GE actually paid a dividend for more than 100 years? Find out additional facts about Dow 30 Dividend stocks – including GE – with our Dividends in Focus: Dow 30 analysis.)

The problem is that GE couldn’t keep it going. During the height of the credit crisis and recession, the firm had to cut its payout by 68%, down to just 10 cents per share. The reason was simple – “cash is king,”

and GE didn’t have any, thanks to its focus on non-manufacturing businesses.

Former CEO Jack Welch loaded up General Electric with plenty of non-electric items. GE Capital was one of the largest lenders in the world and was bigger than some banks. GE held a monster real estate portfolio and aviation leasing loans; there was derivatives trading under its umbrella, as well as a hefty consumer loan/credit card portfolio. GE even had an asset management business tucked in there. By the time the calendar rolled over to 2007, GE Capital and its ownership of NBC Universal were the two largest divisions by total revenues at General Electric.

You could barely call the firm an industrial anymore. But the recession stopped that in its tracks.

Back To Building

As revenues fell and cash flows dwindled to the point where GE needed to cut its dividends to save $9 billion a year, newly appointed CEO Immelt decided to get back to basics. Immelt dove deep into turning GE back into General Electric. For starters, that included selling or spinning off major parts of its financial and non-industrial assets. (Take a look at Jeffrey Immelt and his tenure at GE via our Dow 30′s CEOs visual archive.)

Consumer credit and bank operations were spun off as Synchrony Financial (SYF ), while Blackstone (BX ) purchased billions of dollars’ worth of GE Real Estate’s assets. NBC Universal was sold. Various pieces of GE Capital were sold off and the business unit is once again about lending money to GE’s customers for its own products.

Reducing its financial exposure was only one piece of the pie. Boosting its manufacturing prowess in some of the largest long-term themes and trends was the next order of business. And that meant acquisitions. A whole lot of them.

A few years ago GE purchased Lufkin to boost its holdings in oil field equipment. Last year, it made a mega-buyout of French power and energy equipment supplier Alstom. That deal added critical power businesses for utilities, as well as grid infrastructure products and renewable energy businesses. Already a leader in wind turbine technology and manufacture, GE recently paid $1.65 billion for Denmark-based manufacturer and supplier of rotor blades LM Wind Power.

But getting back to building doesn’t just mean manufacturing heavy machinery. GE is going high-tech. In its acquisition spree the firm managed to snag both ShipExpress and Meridium. These software firms allow GE’s heavy industrial goods to come to life with real-time data analytics and work processes. When combined with its own Predix software suite, GE Digital is hoping to create the concept of the Brilliant Factory and bring the Internet of Things (IoT) to every facet of its industrial businesses.

Back To Dividend Growth

The real goal of GE’s transformation is to get it back on its feet. That includes boosting its dividends. Since the end of the recession, GE has increased its payout somewhat, but has kept it the same through 2015 and 2016. The reason has been the lack of cash flow boosts that GE Capital would have provided and whatever extra cash it generates has gone to these much-needed industrial buyouts.

But it won’t always be that way. Already, GE has seen its industrial cash flows grow by over 23% last year on the back of its recent moves. And its latest acquisitions haven’t even borne real fruit yet. GE is still rolling out Predix, while its LM Wind Power buyout won’t be accretive to earnings until 2018, at which point GE’s industrial operations will account for 90% of the company’s earnings and it’ll see significant increases to its cash flows.

By then GE should be able to have raised its dividend and regained much of its lost mojo.

Want to know when General Electric will pay that dividend? Check out the ex-dividend dates and dividend yields with our Dow 30 Dividend Stocks page.)

The Bottom Line

GE is transforming itself by going back to its roots – being a massive industrial manufacturer. Building things is once again the priority. That focus will ultimately work out in GE’s favor as its dominance in various industries, coupled with a new high-tech spin, will result in higher revenues. For dividend investors, this is great news, as GE will finally be able to really start moving the needle on its dividend growth. It just might take some time.

General Electric is one of 13 major conglomerates that Dividend.com tracks. Keep up-to-date with the latest conglomerate dividend yields and ex-dividend dates with our Conglomerates Dividend Stocks page.