The famed Dow Jones Industrial Average is comprised of well-known “blue chip” stocks that have proven their ability to withstand economic downturns while asserting their status as “industry bellwethers” over the long-haul.

One of the driving forces behind these companies that receives little attention, however, is their social capital; specifically, the management team that is responsible for growing EPS, and even more so, the chief executive officer who is in charge of “steering the vessel” as a whole.

In an effort to shed more light on the executives behind some of the biggest firms on Wall Street, below we take a visual tour of the Dow 30′s CEOs, covering everything from their history at the firm to their compensation.

For more information, be sure to check out: Dividends in Focus: The Dow 30.

Procter & Gamble {% dividend pg %}

- CEO: Alan George “A.G.” Lafley

- Total Compensation: $19,504,353

- Base Salary: $2,000,000

A.G. Lafley’s total compensation can buy over 1,625,362 original scent Tide Laundry detergents, which are sold for about $12 per unit. Going off his base salary, Lafley can purchase just over 166,666 bottles of detergent.

Microsoft {% dividend msft %}

- CEO: Satya Nadella

- Total Compensation: $84,308,755

- Base Salary: $918,917

Satya Nadella’s total compensation can buy more than 702,572 Windows 8.1 Software, which are priced at roughly $120. Nadella an also purchase over 7,650 Windows 8.1 software with his base salary.

Wal-Mart {% dividend wmt %}

- CEO: C. Douglas McMillon

- Total Compensation: $25,592,938

- Base Salary: $954,408

C. Douglas McMillon’s total compensation can buy more than 6.4 million jars of Wal-Mart brand Great Value peanut butter, which are priced at roughly $3.98 per jar. With his base salary, McMillon could purchase 239,800 peanut butter jars.

Johnson & Johnson {% dividend jnj %}

- CEO: Alex Gorsky

- Total Compensation: $16,910,960

- Base Salary: $1,453,846

Alex Gorsky’s total compensation can buy just over 1,127,397 bottles of Extra Strength Tylenol, which costs about $14.99 per bottle. Gorsky’s base salary could buy just over 96,000 bottles.

Home Depot {% dividend hd %}

- CEO: Craig Menear

- Total Compensation: $5,200,000

- Base Salary: $1,300,000

Craig Menear’s total compensation can buy more than 1,969,696 pieces of 8 foot 2×4s, which are priced around $2.64. With his base salary, Blake could buy more than 492,424 2×4s.

Goldman Sachs {% dividend gs %}

- CEO: Lloyd Blankfein

- Total Compensation: $19,928,813

- Base Salary: $2,000,000

Lloyd Blankfein’s total compensation could pay for about 132 people to enroll in GS’s Fundamental Equity Management services, which costs each individual a hefty minimum annual fee of $150,000. Blankfein’s base salary could pay these private wealth management fees for 13 people.

McDonald’s {% dividend mcd %}

- CEO: Don Thompson

- Total Compensation: $9,496,664

- Base Salary: $1,225,000

Don Thompson’s total compensation could buy 2,055,554 Big Macs, which cost around $4.62 per sandwich. With his base salary, Thompson could purchase over 265,000 Big Macs.

UnitedHealth Group {% dividend unh %}

- CEO: Stephen J. Hemsley

- Total Compensation: $12,073,284

- Base Salary: $1,300,000

Stephen Hemsely’s total compensation could cover the monthly premiums of 80,488 couples with a SmartGuard Health Plan, which averages about $150 per month for couples aged between 25-35. Hemsely’s base salary could cover about 8,666 couples’ monthly premiums.

Verizon {% dividend vz %}

- CEO: Lowell McAdam

- Total Compensation: $15,826,606

- Base Salary: $1,480,769

Lowell McAdam’s total compensation can pay for a month of Verizon’s Family Plan for more than 98,916 families; the Family Plan costs $160 per month per family. With his base salary, McAdam could pay for 9,254 families’ monthly plans.

3M {% dividend mmm %}

- CEO: Inge G. Thulin

- Total Compensation: $16,368,708

- Base Salary: $1,339,000

Inge G. Thulin’s total compensation can buy over 10,294,784 rolls of Scotch Magic Tape, which cost about $1.59 per roll. Thulin’s base salary can purchase over 842,138 rolls.

Nike {% dividend nke %}

- CEO: Mark Parker

- Total Compensation: $14,678,349

- Base Salary: $1,550,000

Mark Parker’s total compensation can buy 104,845 pairs of men’s Nike Free Running Shoes, which cost about $140 a pair. With his base salary, Parker can purchase about 11,000 pairs of running shoes.

Merck {% dividend mrk %}

- CEO: Kenneth Frazier

- Total Compensation: $13,375,935

- Base Salary: $1,500,000

Kenneth Frazier’s total compensation can buy over 1,762,310 bottles of Coppertone Sun Tan Lotion, which cost roughly $7.59 per bottle. Frazier’s base salary can buy over 197,000 bottles of sun tan lotion.

DuPont {% dividend dd %}

- CEO: Ellen J. Kullman

- Total Compensation: $14,152,638

- Base Salary: $1,435,000

Ellen J. Kullman’s total compensation can purchase 404,361 Teflon non-stick frying pans, which cost about $34.99 per pan. With her base salary, Kullman can buy about 41,000 Teflon pans.

Travelers {% dividend trv %}

- CEO: Jay S. Fishman

- Total Compensation: $17,087,994

- Base Salary: $1,000,000

Jay S. Fishman’s total compensation could cover the annual auto insurance premium for 13,114 policies; the average annual premium for a Travelers auto insurance policy in Illinois is roughly $1,300. Fishman’s base salary could cover the annual premiums for 769 policies.

Intel {% dividend intc %}

- CEO: Brian Krzanich

- Total Compensation: $9,553,600

- Base Salary: $887,500

Brian Krzanich’s total compensation can buy 28,518 Intel Core Processors; the cost of an Intel Core i7-3770K Processor is around $334.99. With his base salary, Krzanich could purchase over 2,600 processors.

International Business Machines {% dividend ibm %}

- CEO: Ginni Rometty

- Total Compensation: $16,184,727

- Base Salary: $1,500,000

Ginni Rometty’s total compensation can purchase 5,440 IBM Server Towers, which cost roughly $2,975 per tower. Rometty’s base salary could purchase 504 server towers.

JP Morgan Chase {% dividend jpm %}

- CEO: James Dimon

- Total Compensation: $11,791,833

- Base Salary: $1,500,000

Jamie Dimon’s total compensation could cover the annual fees for 124,124 Chase Sapphire credit card holders; Chase Sapphire credit cards charge an annual fee of $95. With his base salary, Dimon could cover the annual fees for nearly 16,000 Chase Sapphire holders.

Cisco Systems {% dividend csco %}

- CEO: John Chambers

- Total Compensation: $16,488,184

- Base Salary: $1,100,000

John Chambers’s total compensation can buy 242,473 Cisco wireless routers, which cost roughly $67.99. With his base salary, Chambers could purchase just over 16,176 wireless routers.

AT&T {% dividend t %}

- CEO: Randall L. Stephenson

- Total Compensation: $23,247,167

- Base Salary: $1,633,333

Randall L. Stephenson’s total compensation could cover the monthly costs for 276,751 U-Verse Internet and Premium TV Bundle customers; the bundle costs about $84 per month. Stephenson’s base salary would cover the monthly bundle costs for about 19,000 customers.

Caterpillar {% dividend cat %}

- CEO: Douglas R. Oberhelman

- Total Compensation: $14,989,569

- Base Salary: $1,600,000

Douglas R. Oberhelma’s total compensation can buy 165 large excavators; a 2012 model can cost approximately $90,000. With his base salary, Oberhelman could purchase 17 excavators.

Visa {% dividend v %}

- CEO: Charles Scharf

- Total Compensation: $7,692,113

- Base Salary: $950,037

Charles Scharf’s total compensation could cover the Acquirer Processing Fees for 394,467,333 Visa credit card transactions; Visa charges an acquirer processing fee of $0.0195. Scharf’s base salary could cover the fees for 48,719,846 transactions.

Pfizer {% dividend pfe %}

- CEO: Ian Read

- Total Compensation: $18,947,747

- Base Salary: $1,776,250

Ian Read’s total compensation can buy 1,457,519 bottles of Advil Pain Reliever Caplets, which cost about $12.99 per bottle. With his base salary, Read could purchase 136,000 bottles of Advil.

General Electric {% dividend ge %}

- CEO: Jeffrey R. Immelt

- Total Compensation: $19,776,716

- Base Salary: $3,446,667

Jeffrey R. Immelt’s total compensation can purchase 8,793 GE Profile refrigerators; the top freezer model goes for about $2,249. Immelt’s base salary could buy 1,532 refrigerators.

Boeing {% dividend ba %}

- CEO: James McNerney

- Total Compensation: $23,263,562

- Base Salary: $1,930,000

James McNerney’s total compensation could only pay for 0.06% of a Boeing 747, which cost about $356,900,000. His base salary would only pay for 0.01% of the aircraft.

United Technologies

- CEO: Gregory Hayes

- Total Compensation: $7,631,073

- Base Salary: $870,000

Gregory Hayes’ total compensation can buy 331,000 Kiddie Carbon Monoxide & Smoke Alarm sets, which cost about $22.97. With his base salary, Chênevert could purchase 37,826 CO & smoke alarm sets.

American Express {% dividend axp %}

- CEO: Kenneth Chenault

- Total Compensation: $21,837,420

- Base Salary: $2,000,000

Kenneth Chenault’s total compensation can cover the annual American Express Platinum Card fees for 48,527 card holders; the annual fee is $450. Chenault’s base salary would cover 4,444 annual fees.

Coca-Cola Co {% dividend ko %}

- CEO: Muhtar A. Kent

- Total Compensation: $20,380,660

- Base Salary: $1,600,000

Muhtar A. Kent’s total compensation can buy 20,380,660 cans of Coca-Cola, which are usually sold for around $1.00. His base salary could purchase 1,600,000 cans.

Chevron {% dividend cvx %}

- CEO: John S. Watson

- Total Compensation: $24,017,303

- Base Salary: $1,770,833

John S. Watson’s total compensation can buy 8,577,608 gallons of gasoline; a gallon of gas in a Los Angelos Chevron station costs roughly $2.80. With his base salary, Watson could purchase 632,440 gallons.

The Walt Disney Company {% dividend dis %}

- CEO: Bob Iger

- Total Compensation: $34,321,055

- Base Salary: $2,500,000

Bob Iger’s total compensation can purchase 116,739 adult 5-day passes to Disney World, which cost $294. With his base salary, Iger could purchase 8,503 5-day Disney World passes.

ExxonMobil {% dividend xom %}

- CEO: Rex W. Tillerson

- Total Compensation: $28,138,329

- Base Salary: $2,717,000

Rex W. Tillerson’s total compensation can buy 5,956,582 gallons of gas; the price of a gallon of gas at a Chicago Mobil Station is about $2.60. Tillerson’s base salary could buy 1,045,000 gallons of gas.

Gender Balance

Gender inequality is still very much prevalent, although there have been major strides forward in the last few years that have helped combat discrimination and other injustices in the workplace [see also The Top 27 Dividend-Paying Companies to Work For in 2014].

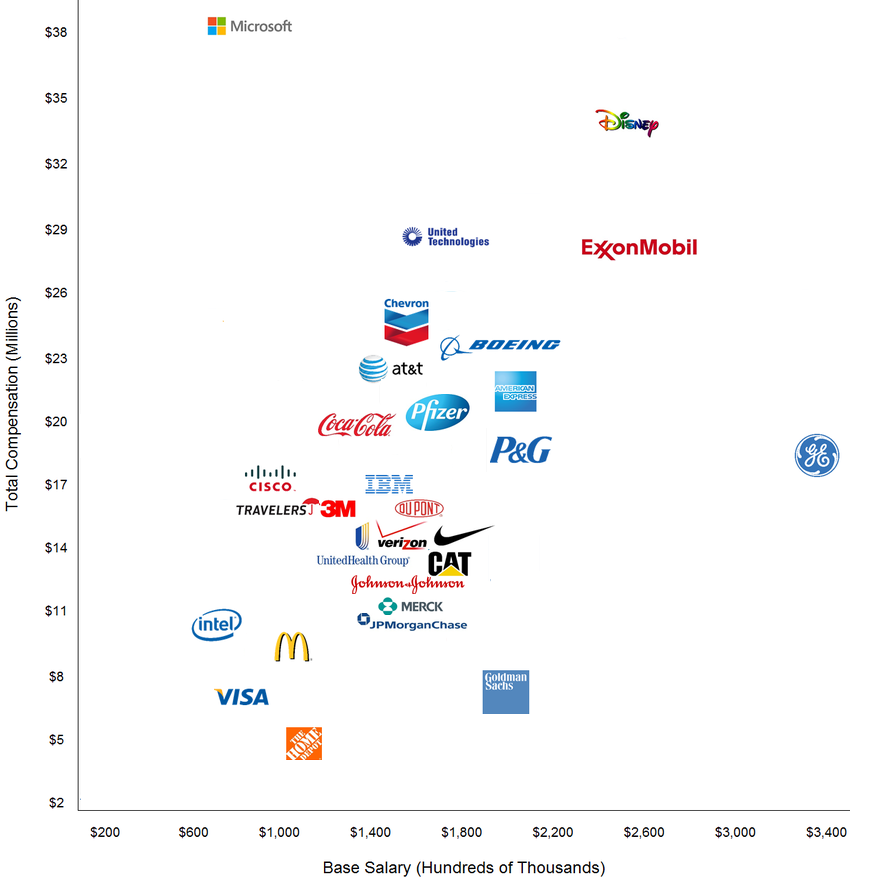

Which Dow 30 CEO Makes the Most?

The most obvious question that pops into mind when talking about who’s running what is, “how much are they getting paid for it?”

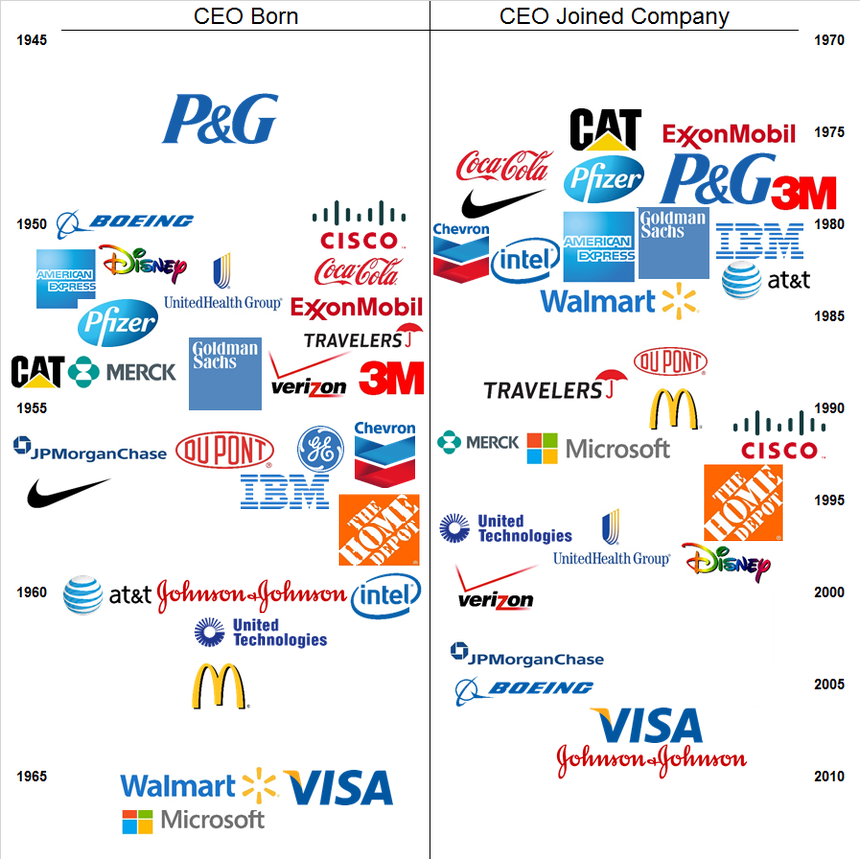

CEO Age vs. Work History

When digging through the Dow 30 CEOs’ work histories, a certain theme becomes apparent; most of the current CEOs have been working at their respective company for quite a while, more than two decades, in fact, on average.

Dow CEOs by the Numbers

The table below offers an in-depth look at how all the Dow 30 CEOs stack up against one another when it comes to age, compensation, and their history at the company:

| CEO Name | Birth Year | Base Salary | Total Compensation | Value of Shares | Tenure at Company | Start Date as CEO |

|---|---|---|---|---|---|---|

| Alan George “A.G.” Lafley (PG) | 1947 | $2,000,000 | $19,504,353 | $47,256,019 | 1977 | 5/23/2013 |

| Alex Gorsky (JNJ) | 1960 | $1,453,846 | $16,910,960 | $8,112,540 | 2008 | 4/26/2012 |

| Bob Iger (DIS) | 1951 | $2,500,000 | $34,321,055 | $118,574,095 | 1999 | 10/1/2005 |

| Brian Krzanich (INTC) | 1960 | $887,500 | $9,553,600 | $10,640,082 | 1982 | 5/16/2013 |

| C. Douglas McMillon (WMT) | 1966 | $954,408 | $25,592,938 | $48,649,656 | 1984 | 2/1/2014 |

| Charles Scharf (V) | 1966 | $950,037 | $7,692,113 | $18,760,147 | 2007 | 10/1/2012 |

| Don Thompson (MCD) | 1963 | $1,225,000 | $9,496,664 | $1,147,637 | 1990 | 7/1/2012 |

| Douglas R. Oberhelman (CAT) | 1953 | $1,600,000 | $14,989,569 | $21,042,197 | 1975 | 7/1/2010 |

| Ellen J. Kullman (DD) | 1956 | $1,435,000 | $14,152,638 | $32,834,841 | 1988 | 1/1/2009 |

| Craig Menear (HD) | 1959 | $1,300,000 | $5,200,000 | $10,017,811 | 1997 | 11/1/2014 |

| Ginni Rometty (IBM) | 1958 | $1,500,000 | $16,184,727 | $115,014 | 1981 | 1/1/2012 |

| Ian Read (PFE) | 1953 | $1,776,250 | $18,947,747 | $42,328,551 | 1978 | 12/7/2010 |

| Inge G. Thulin (MMM) | 1953 | $1,339,000 | $16,368,708 | $10,171,900 | 1979 | 2/24/2012 |

| James Dimon (JPM) | 1956 | $1,500,000 | $11,791,833 | $153,005,766 | 2004 | 1/1/2006 |

| James McNerney (BA) | 1949 | $1,930,000 | $23,263,562 | $60,653,195 | 2005 | 6/30/2005 |

| Jay S. Fishman (TRV) | 1952 | $1,000,000 | $17,087,994 | $48,909,703 | 1988 | 4/1/2004 |

| Jeffrey R. Immelt (GE) | 1956 | $3,446,667 | $19,776,716 | $49,594,320 | 1982 | 9/1/2001 |

| John Chambers (CSCO) | 1949 | $1,100,000 | $16,488,184 | $53,250,009 | 1991 | 1/1/1995 |

| John S. Watson (CVX) | 1956 | $1,770,833 | $24,017,303 | $8,614,750 | 1980 | 1/1/2010 |

| Kenneth Chenault (AXP) | 1951 | $2,000,000 | $21,837,420 | $68,269,960 | 1981 | 1/1/2001 |

| Kenneth Frazier (MRK) | 1954 | $1,500,000 | $13,375,935 | $19,731,575 | 1992 | 1/1/2011 |

| Lloyd Blankfein (GS) | 1954 | $2,000,000 | $19,928,813 | $359,640,129 | 1981 | 5/31/2006 |

| Gregory Hayes (UTX) | 1960 | $2,484,939 | $6,916,038 | $6,948,185 | 1999 | 11/24/2014 |

| Lowell McAdam (VZ) | 1954 | $1,480,769 | $15,826,606 | $12,337,149 | 2000 | 7/1/2011 |

| Mark Parker (NKE) | 1955 | $1,550,000 | $14,678,349 | $74,203,377 | 1979 | 1/1/2006 |

| Muhtar A. Kent (KO) | 1952 | $1,600,000 | $20,380,660 | $11,066,621 | 2005 | 1/1/2008 |

| Randall L. Stephenson (T) | 1960 | $1,633,333 | $23,247,167 | $3,293,701 | 1982 | 5/9/2007 |

| Rex W. Tillerson (XOM) | 1952 | $2,717,000 | $28,138,329 | $211,606,401 | 1975 | 1/1/2006 |

| Satya Nadella (MSFT) | 1967 | $918,917 | $84,308,755 | $60,418,676 | 1992 | 2/4/2014 |

| Stephen J. Hemsley (UNH) | 1952 | $1,300,000 | $12,073,284 | $303,947,801 | 1997 | 1/1/2006 |

Before we highlight the biggest shareholders of the Dow 30, it’s important to understand a number of definitions that relate to stock ownership; please note that the term definitions below should serve as a reference for what the column headings in the table represent:

- % Free Float: This is the percentage of shares that are in the public’s hands and can be freely traded without restrictions. The higher the number, the greater the percentage of outstanding shares that are available for trading by the public and vice versa. Learn more about the free-float case of Wal-Mart (WMT) here.

- Insider Ownership: This refers to the percentage of shares held by company insiders, meaning people who are employed by the company. In theory, a higher number implies that the insiders have a larger stake in the success of the company, although this is difficult to quantify in practice.

- Individual: This refers to the largest direct individual shareholder of the company according to SEC filings; note that this individual is not necessarily a company insider, although they may be.

- ETF: This refers to the ETF that holds the highest stake of a particular company; note that the ETF ticker listed is not the only one that holds a particular stock, instead it’s the fund that boasts the greatest allocation to that security in comparison to all the other funds that also hold that stock.

The table below showcases the ownership breakdown of the Dow 30 stocks:

| Company | % Free Float | Insider Ownership | Individual | ETF |

|---|---|---|---|---|

| 3M Co. (MMM) | 99.95% | 0.03% | Inge Thulin | DIA |

| American Express Company (AXP) | 99.83% | 0.16% | Kenneth Chenault | IYG |

| AT&T, Inc. (T) | 99.93% | 0.01% | Rafael de la Vega | FCOM |

| Boeing Co. (BA) | 99.90% | 0.17% | James McNerney | ITA |

| Caterpillar Inc. (CAT) | 99.76% | 0.24% | Peter Magowan | DIA |

| Chevron Corporation (CVX) | 99.98% | 0.02% | Carl Ware | XLE |

| Cisco Systems, Inc. (CSCO) | 99.34% | 0.11% | John Chambers | IGN |

| DuPont (DD) | 99.92% | 0.16% | Ellen Kullman | XLB |

| Exxon Mobil Corporation (XOM) | 99.88% | 0.14% | Rex Tillerson | IYE |

| General Electric Company (GE) | 99.59% | 0.03% | Jeffrey Immelt | FIDU |

| Intel Corporation (INTC) | 99.93% | 0.02% | Paul Otellini | SMH |

| International Business Machines Corp. (IBM) | 99.93% | 0.03% | Samuel Palmisano | TDIV |

| Johnson & Johnson (JNJ) | 99.97% | 0.02% | William Weldon | IHE |

| JPMorgan Chase & Co. (JPM) | 99.45% | 0.12% | James Dimon | IYG |

| McDonald’s Corp. (MCD) | 99.95% | 0.03% | John Rogers | XLY |

| Merck & Co. Inc. (MRK) | 99.70% | 0.01% | Kenneth Frazier | IHE |

| Microsoft Corporation (MSFT) | 92.00% | 3.42% | Bill Gates | IYW |

| Nike Inc. (NKE) | 79.26% | 0.25% | Mark Parker | PWB |

| Pfizer Inc. (PFE) | 99.95% | 0.04% | Ian Read | IHE |

| Procter & Gamble Co. (PG) | 99.95% | 0.04% | Alan Lafley | XLP |

| The Coca-Cola Company (KO) | 99.43% | 0.33% | Herbert A. Allen | XLP |

| The Goldman Sachs Group, Inc. (GS) | 98.38% | 1.53% | Lloyd Blankfein | KBWC |

| The Home Depot, Inc. (HD) | 99.81% | 0.16% | Francis Blake | RTH |

| The Travelers Companies, Inc. (TRV) | 99.67% | 0.42% | Jay Fishman | KBWI |

| United Technologies Corp. (UTX) | 99.85% | 0.01% | Gregory J. Hayes | ITA |

| Unitedhealth Group, Inc. (UNH) | 98.45% | 0.75% | Stephen Hemsley | IHF |

| Verizon Communications Inc. (VZ) | 99.99% | 0.01% | Lowell McAdam | VOX |

| Visa, Inc. (V) | 79.35% | 0.05% | William Sheedy | DIA |

| Wal-Mart Stores Inc. (WMT) | 48.64% | 0.53% | Jim Walton | RTH |

| Walt Disney Co. (DIS) | 92.29% | 0.10% | Robert Iger | XLY |

The Bottom Line

The CEOs of the Dow 30 are among the most well-known and powerful CEOs in the world. It is a common debate whether these CEOs are compensated too much based on their salaries and total compensation. Looking at a CEO’s history with the company, how much of their company’s products they can buy, and seeing how much of their company’s stock they own are just a couple of ways to investigate their compensation.