4G Rollout, Partnership with Apple Fuel Growth

The U.S. telecommunications sector is rife with large companies that pay significant dividends to shareholders, led by AT&T (T ) and Verizon Communications (VZ ). Income investors have flocked to the telecoms because these stocks typically sport dividend yields twice as much as the average yield in the S&P 500, or more. But the trade-off is that U.S. telecoms do not offer much dividend growth. They typically lift their dividends by just 2-3% per year.

This is where international telecoms may be a better place to look for high levels of dividend growth. Foreign telecoms can offer higher growth potential than their U.S. peers. An example is China Mobile (CHL ), the largest wireless carrier in the world, with 826 million subscribers. China Mobile is positioned in China, a premier emerging market. The Chinese economy is expected to grow by 6-7% this year. The country has a population of 1 billion and a rising middle class. This provides China Mobile with a much longer runway of growth potential ahead than many other telecom stocks. And it was only two years ago that China Mobile launched its landmark partnership with* Apple, Inc.* (AAPL ), which has accelerated its growth.

Capital Spending for Growth

For China Mobile, its primary growth objective is expanding coverage across China. China is a very large nation; not only does it have many large cities, but it also has a very large rural population. Such a broad expanse is difficult to cover for a telecom company, which is why China Mobile has spent significant resources in building out its 4G network coverage. The good news is that the company has made significant progress. In the first half of 2016, China Mobile added over 200,000 4G base stations, and now has 1.32 million 4G base stations. This has resulted in significant conversion of 2G and 3G customers to the faster network. China Mobile has averaged 19 million 4G additions per month in the first six months of 2016, and has reached 51.2% 4G penetration.

China Mobile’s partnership with Apple, agreed to in 2014, is another major growth catalyst. Prior to the agreement, Apple devices were not sold in China. Bringing together the world’s largest smartphone company with the world’s largest telecom is a natural partnership, and it is why Apple CEO Tim Cook called the partnership a “watershed moment” for the company. This has led to significant revenue growth in the past few years.

China Mobile has increased operating revenue by 24% over the past five years. Although its EBITDA has declined in that period, this is due largely to its elevated capital investment spending. As a growth company, this is to be expected – with the presumption that the company will be able to reduce capital expenditures once its 4G and other expansion plans are complete.

Growth Catalysts

A major growth catalyst for China Mobile is data. As 4G coverage expands, connectivity and downloading speeds improve, and that means customers will be using much more data. In the first half of the year, handset data traffic increased by 134%. In the same period, wireless data traffic revenue soared 40%, and now represents 43% of total telecommunications services revenue for the company.

Longer-term, additional growth catalysts China Mobile has its eyes on are big data, cloud computing and the Internet of Things(IoT). These areas are being highly pursued by U.S. telecoms, and China Mobile is not far behind. China Mobile had over 80 million connections to the IoT over the first half of 2016.

These initiatives have all resulted in strong growth for the company so far this year. China Mobile reported 7% revenue growth through the first six months of 2016, in Chinese currency terms. Earnings before interest, taxes, depreciation and amortization (EBITDA) grew 2% in the period, and net profit rose 6%.

Dividends

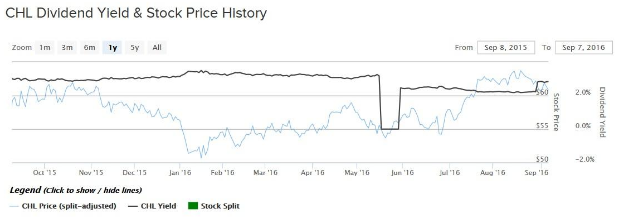

Reflecting its strong growth, China Mobile has grown its dividend at a rapid pace. The company pays its dividend semi-annually. It recently declared its second dividend of the year in the amount of $0.959864 per share. This is a 24% increase from the previous semi-annual dividend payout. The second dividend installment for 2016 is payable Oct. 11.

China Mobile’s two semi-annual dividend payments cumulatively add up to $1.73 per share. Based on the stock’s Sep. 8 closing price of $61.93 per share, China Mobile’s annualized dividend represents a 2.8% dividend yield. This is about 70 basis points above the S&P 500 average dividend yield of 2.1%.

The Bottom Line

China Mobile offers a different investment thesis than the major U.S. telecoms. While AT&T and Verizon offer high dividend yields of 4-5%, China Mobile has a much lower dividend yield. However, what China Mobile lacks in current yield, it makes up for in terms of growth. AT&T and Verizon offer such high yields because they distribute the vast majority of their earnings. There is not much growth potential in the U.S., as the domestic market is highly saturated.

By contrast, China is a growing market. China Mobile is aggressively investing in opening up its network across the country, and is also spending heavily to bring 4G technology nationwide. China is an emerging market, which offers much higher economic growth potential. As a result, China Mobile is a better fit for dividend growth investors.