Casual restaurants have enjoyed improved business conditions over the past year. The steady recovery in the U.S. economy since the recession, marked by low unemployment and rising wages, has created a tailwind for casual restaurants. In addition, U.S. consumers have more disposable income as a result of low gas prices. These are all positive indicators for casual restaurants, which depend on buoyant consumer spending and a strong economy.

Cracker Barrel Old Country Store (CBRL ) is a prime example of a company that has benefited from these tailwinds. Cracker Barrel is a family-friendly restaurant in a niche market. It caters to smaller cities, primarily in rural areas of the country, and offers a familiar comfort-food style menu. The company operates 636 company-owned restaurants spanning 42 states. The company has seen a great deal of success with its American-heritage-focused offerings. Along with its restaurants, the company also operates in-restaurant retail shops where guests can buy gifts and other memorabilia.

Cracker Barrel is a highly profitable company that generates significant cash flow, thanks to its streamlined cost structure and excellent sales growth over the past year. The company has a shareholder-friendly management that is committed to providing investors with cash returns – and recently passed along a huge dividend increase.

Crackel Barrel Serves Up Growth and Dividends

On June 1, Cracker Barrel gave investors two servings of dividends: a special dividend and an increase to the company’s regular dividend. First, Cracker Barrel declared a $3.25 per-share special dividend. The special dividend will be payable July 29 to shareholders of record on July 15.

Get all the latest on special dividends in our special dividend tool linked here.

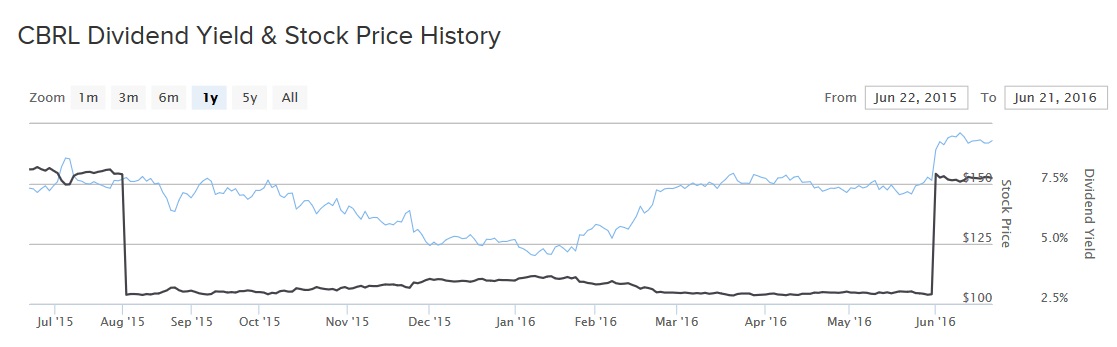

In addition, Cracker Barrel raised its quarterly dividend rate by 4.5%, from $1.10 per share to $1.15 per share. This regular quarterly dividend is payable Aug. 5 to shareholders of record on July 15. The new annualized dividend rate increased to $4.60 per share. Taken together, the special dividend and annual regular dividend represent a total payout of $7.85 per share for 2016, which represents a 4.67% total cash return this year.

These cash returns are possible because the company has performed very well over the past year. Restaurant comparable sales – a very important statistic for restaurants that measures sales at locations open at least one year – rose 1.8% over the first three quarters of fiscal 2016. The retail business has done even better, up 2.5%. The restaurant has performed much better than many of Cracker Barrel’s closest competitors. For example, Bob Evans Farms (BOBE), which operates a very similar restaurant business, saw comparable restaurant sales decline 2.5% in its most recent fiscal year.

Cracker Barrel has successfully taken market share from its competitors. Comparable restaurant sales are projected to increase 2-2.5% for the full fiscal year. At the same time, Cracker Barrel has successfully cut costs to boost profit margin. The company cut general and administrative costs by 3% over the first three fiscal quarters. More recently, there has also been improvement in cost of goods sold, which boosted operating profit margin to 9.6% last quarter, up from 8.1% in the same quarter last year. Another factor helping to reduce costs is the decline in agricultural commodities. Cracker Barrel expects flat food cost inflation this year. The company has a proven ability to generate significant earnings growth over time due to its strategic focus on sales growth and cost cuts.

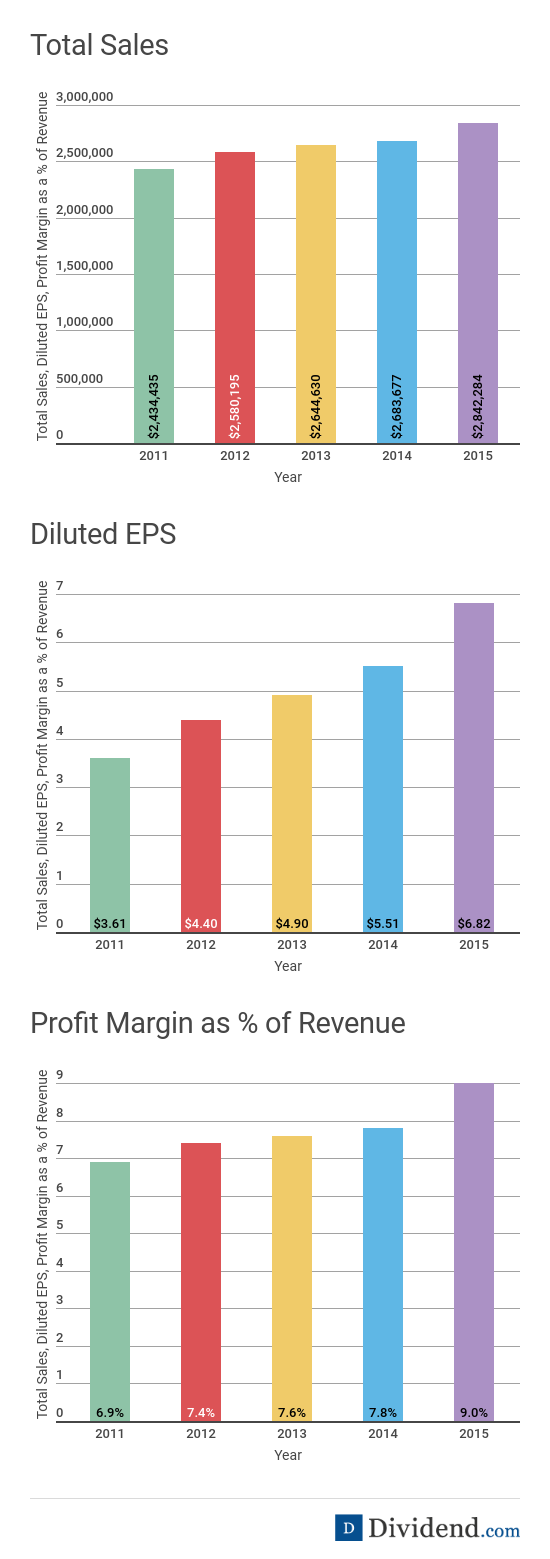

From 2011-2015, Cracker Barrel increased total revenue 16% and earnings per share by 88%, thanks to its cost savings and margin expansion.

Business conditions are expected to remain strong over the course of the year. For fiscal 2016, Cracker Barrel now expects $7.45-$7.55 of earnings per share, up from the previous forecast of $7.40-$7.50 per share. Analysts widely support this view. Analysts expect $7.52 of earnings per share this year. Moreover, fiscal 2017 is expected to be another year of growth. Analysts expect the company to grow earnings per share by 9% next year. Continued growth will support future dividend increases, especially since Cracker Barrel has a modest payout ratio. As a percentage of expected 2016 earnings per share, Cracker Barrel’s payout ratio is 61%.

Cracker Barrel stock performed extremely well to start 2016. As of its June 21 closing price, shares of Cracker Barrel have gained 32% year-to-date based on its Dec. 31, 2015 closing price of $126.83 per share. The stock has exhibited excellent strength, as it is only 1.5% off its 52-week high.

The Bottom Line

Cracker Barrel stock has outperformed the S&P 500 by a huge margin this year, yet the stock is still reasonably valued at 22 times earnings. In addition, the stock offers an above-average regular dividend yield of 2.7% and has also declared large special dividends in each of the past two years. Cracker Barrel is a suitable choice for growth and dividends.