Wells Fargo (WFC ) is a core holding for legendary investor Warren Buffett, chairman of Berkshire Hathaway (BRK-A). As of December 31, Berkshire Hathaway was Wells Fargo’s largest shareholder. It owned slightly more than 479 million shares of Wells Fargo, a stake that is worth approximately $23.6 billion based on Wells Fargo’s May 11 closing price.

The reason Buffett is such a huge investor in the company is because Wells Fargo has a strong business model and what Buffett would refer to as a wide economic moat. Wells Fargo is the nation’s biggest mortgage originator and the third-largest bank by assets. It has a very strong brand name, and is an industry leader. This provides the company with high profitability and a competitive advantage.

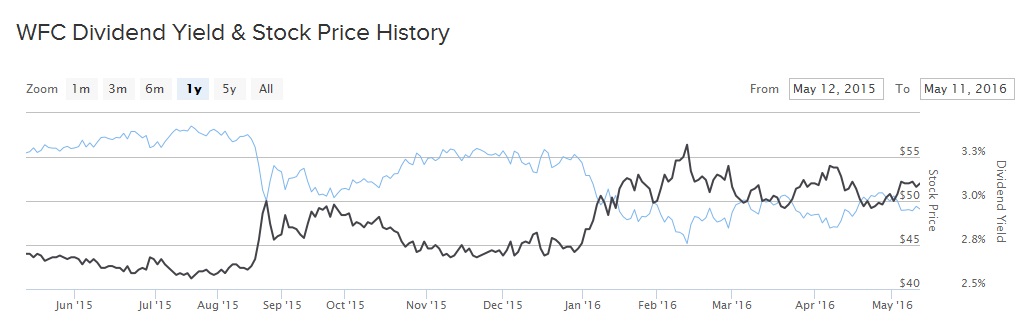

With its steady profits, Wells Fargo rewards shareholders with compelling dividend payments. On April 26, Wells Fargo declared a quarterly dividend of 38 cents per share. This is a 1% increase from the dividend last quarter. On an annualized basis, Wells Fargo’s new dividend payout will be $1.52 per share, which offers a 3.1% dividend yield as of its current share price.

Wells Fargo has an above-average dividend yield, strong profitability, and forward growth catalysts. As a result it is an attractive dividend stock.

Strong Fundamentals in a Challenging Climate

There are two key headwinds weighing on bank stocks right now: low interest rates and declines in loans made to the energy sector. This is what caused Wells Fargo’s disappointing stock price performance. First, while the U.S. economy has improved since the Great Recession, interest rates remain stuck near historic lows. The Federal Reserve raised the Fed funds rate this year for the first time in nearly a decade, but the 10-year U.S. Treasury bond yield is still just 1.75%.

This has negatively impacted big banks like Wells Fargo, but the company is navigating the tough environment well. Last quarter, Wells Fargo managed 4% revenue growth from the year-ago period, while earnings per share declined 4% year over year. The company managed to beat analyst expectations on both revenue and earnings per share for the quarter, which is a rarity among bank stocks so far this year. The reason for Wells Fargo’s relative outperformance is that it relies more on mortgage originations and less on fixed-income trading and investment banking. The U.S. housing market continues to strengthen as home prices have risen in several markets over the past year. This has benefited Wells Fargo, which exhibited 7% loan growth and 4% deposit growth last quarter, year over year.

Another factor weighing on the banking sector is exposure to oil and gas loans. With commodity prices plunging, banks stand to lose money on loans made to energy firms, which are now in deep distress. Fortunately, Wells Fargo is not as highly exposed to the energy sector as some other banks in its peer group. Net charge-offs were $886 million last quarter, up $178 million year over year. Its provision for credit losses exceeded net charge-offs by $200 million last quarter. While Wells Fargo is hurting from the fallout in the energy market, it has effectively managed its credit portfolio and has kept its exposure modest.

This relatively conservative approach to lending and managing its business has allowed Wells Fargo to be steadily profitable, even though the stock has not performed well over the past year. Last year, Wells Fargo generated $86 billion of revenue and $23 billion of profit. Revenue and earnings per share increased 2% and 1%, respectively, from the prior year. Its return on assets was 1.32% while return on equity was 12.68%. The major contributors to Wells Fargo’s strong earnings were a strict focus on cost controls, as well as an improving loan and deposit portfolio. In the fourth quarter, Wells Fargo had a solid 10.7% Tier 1 ratio.

Focusing on the past year and beyond, it is clear that Wells Fargo continues to benefit from the recovery in the U.S. economy. Consumers are in better shape thanks to the gradual growth in the labor and real estate markets. The increased activity for both deposits and loans signals the U.S. consumer is still in relatively good financial shape, which bodes well for Wells Fargo over the long term.

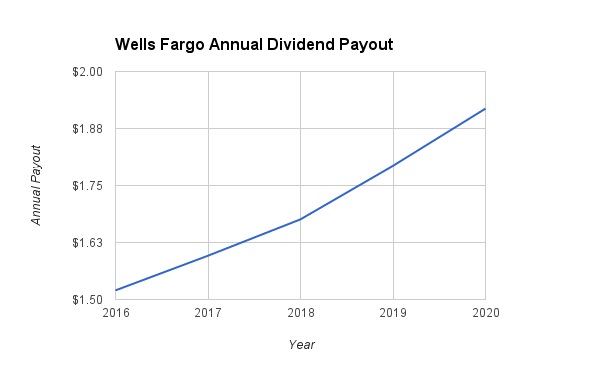

Going forward, investors can expect Wells Fargo’s dividend to increase further as the company’s profitability improves. Wells Fargo’s earnings growth should accelerate in future years, if interest rates rise, and along with the gradual improvement in the U.S. economy, specifically the housing market. Based on these expectations, we are modeling 5% dividend growth over the next two years followed by 7% dividend growth thereafter. Under this assumption, Wells Fargo’s annual dividend will reach $1.92 per share in 2020.

The Bottom Line

Wells Fargo has had a difficult year due to persistently low interest rates. Earnings per share have not grown much over the past year. This has led to a slowdown in dividend growth as well, as dividends are a function of underlying profitability. But going forward, Wells Fargo will be a major beneficiary of rising interest rates, and its oil and gas loan portfolio should improve as commodity prices recover. It has a 3.1% dividend yield, which is significantly above the S&P 500 average yield. As a result, income investors should still view Wells Fargo stock positively.