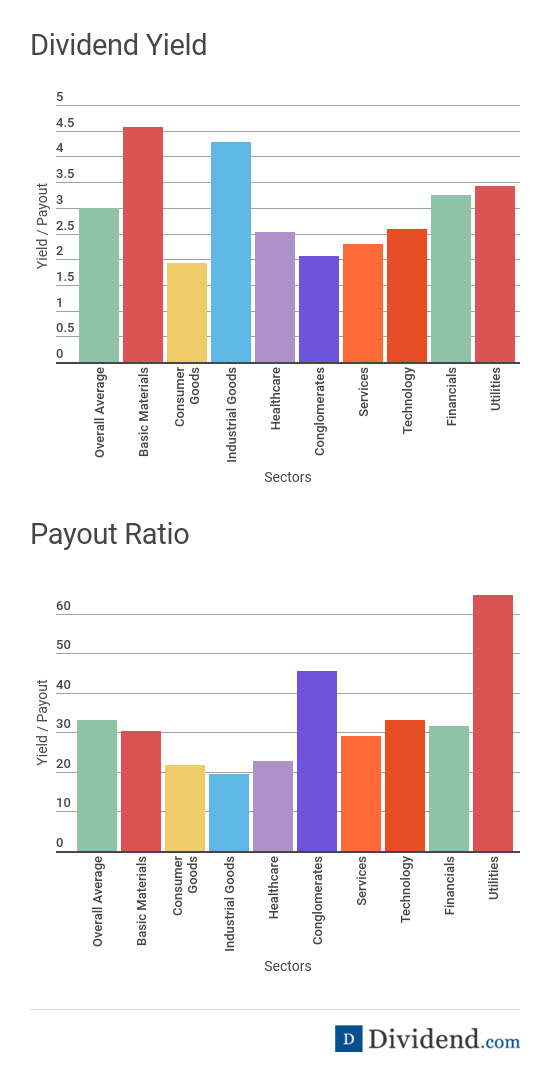

Consumer Goods stocks, on average, yield the lowest of all the sectors Dividend.com tracks. The following chart illustrates that Basic Materials are showing the highest dividend yield while Consumer Goods are showing the lowest yield. This is not because the sector is performing well, which pushes the yields down, and more to do with the fact that Consumer Goods as a sector is currently distributing the lowest amount of money to investors in the form of dividends and reflected in the payout ratios, which is also shown below.

Below, we look at 5 Consumer Goods stocks which are near their 52 week highs and also have healthy yields and modest earnings growth estimates for next year.

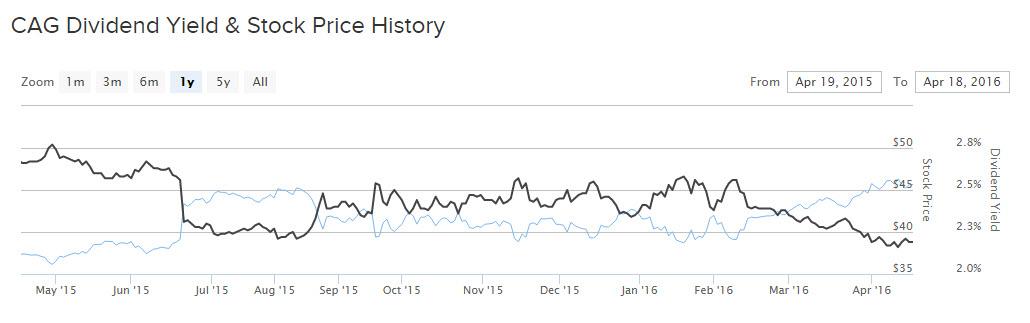

ConAgra Foods

ConAgra Foods (CAG ) with a market cap of $20 billion is currently yielding 2.17% with a payout ratio of 42% and a PE of 19.72 on an estimated 2016 EPS of $2.34. The company is only 3.6% off its 52 week high. Next year’s EPS is estimated to be only 3.42% high based upon analyst expectations at $2.42. CAG currently has an annualized dividend of $1 per share.

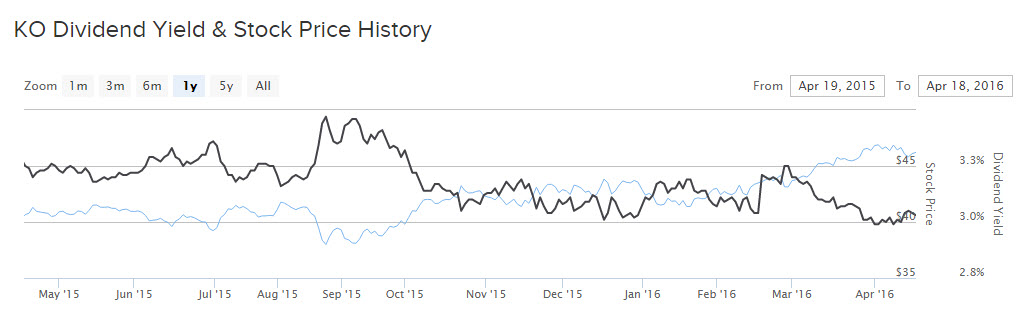

The Coca-Cola Company

Warren Buffett’s favourite stock, where he has more than $15 billion in position, is up 9.3% YTD. Coca-Cola Co. (KO ) currently trades at $46.48 and is very near its 52 week high of $47.13. Yielding a solid 3% on the back of a 72% payout ratio, the company pays $1.40 in annual dividends. The stock is not cheap, as it trades at 24.20 PE based on 2016 EPS of $1.93. The beverage company is expected to grow its earnings in 2017 to $2.03, which is a 5.18% growth in the bottom line.

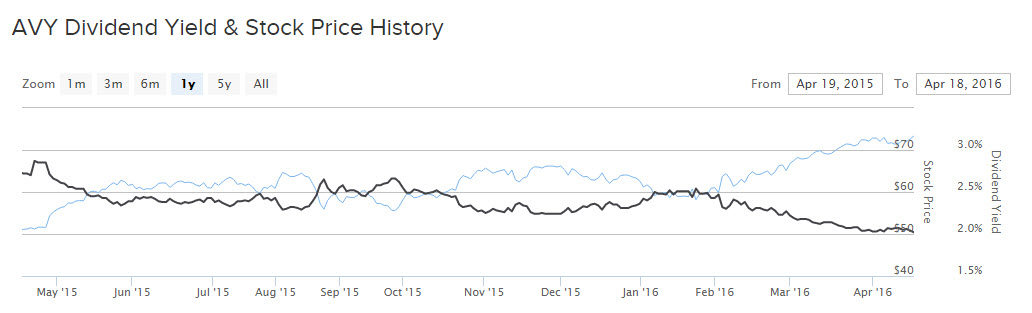

Avery Dennison Corp

Avery Dennison Corporation (AVY ) is engaged in the production of pressure-sensitive materials and a variety of tickets, tags, labels and other products. The stock has had a spectacular 2016, as it is up 15% so far. Its 52 week high is $74.33. It is trading only 1.2% off of its high at $73.42. The company has a yield of 2.06% on an annualized dividend of $1.48. With more than 50% of its earnings being retained, the company is expected to clock a double digit earnings growth in 2017 at $4.19 compared to its 2016 earnings of $3.76, based upon analysts’ expectations. The company has a dividend history since 1994 and has consecutively grown its dividend for the last 5 years. Investors have discounted that, as they give it a valuation of 19.42 PE, which is well above the industry average.

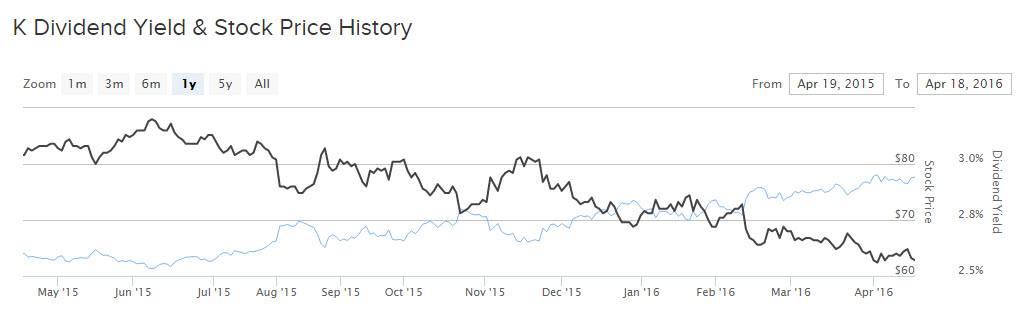

Kellogg Company

The cereal company, Kellogg Co. (K ), is currently trading just 0.5% off of its 52 week high at $77.68. Though revenue and income has plateaued since 2013, the stock hasn’t reflected that. Analysts expect the company to grow its 2017 EPS by 7.32% at $3.96 compared to $3.69. The stock trades at a PE of 20.93 on 2016 EPS estimates. The company pays a $2 annualized dividend and has a payout ratio of 54%.

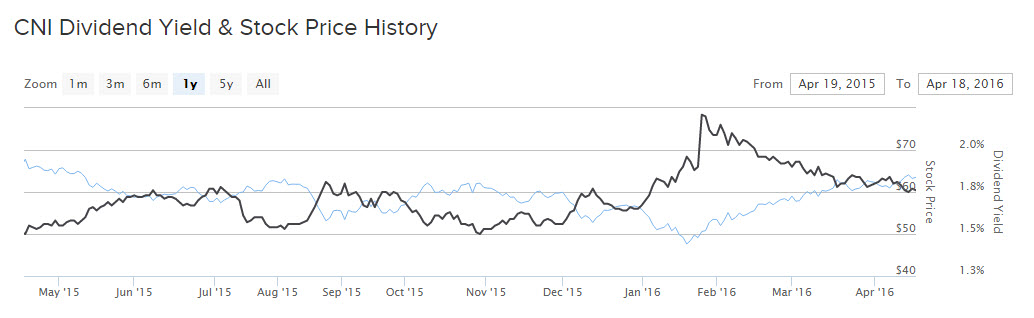

Canadian National Railway Company

As spring approaches, rail traffic picks up. Canadian National Railway (CNI ) stock has been chugging along nicely in 2016, as it’s up more than 11%. Its current market price is $64.19, as of writing this analysis. Its 52 week high is $68.15, implying it’s 5.8% off from its high. The current payout ratio of the stock is 43% based on 2016 EPS estimate of $3.41. According to analyst estimates the company is expected to record a 10% jump in earnings for 2017, as its EPS is estimated to come in at $3.75 for 2017.

The Bottom Line

The 5 stocks mentioned above stand out in terms of earnings growth expectations, healthy payout ratios and solid yields, which is reflected in their stock price performance. Also, check out 5 Technology stocks near their 52 week high, 4 Healthcare stocks near their 52 week high and 4 REITs near their 52 week highs.