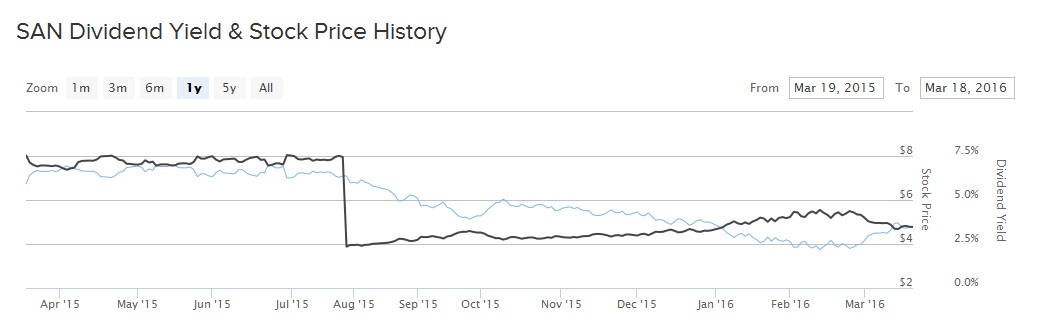

Last year was extremely difficult one for European banks. The continued sluggish performance of the European economy, resulting in very weak economic growth and rampant unemployment, has weighed on the financial sector across Europe. As the eurozone’s largest bank, Banco Santander (SAN ) was not immune from these challenges. Based on its March 21 closing price of $4.71 per share, the stock has declined 36% over the past one year.

While many developed economies such as the United States have made demonstrable progress since the financial crisis and recession of 2008, Europe has lagged behind. The region is still stuck with persistently low inflation and the threat of deflation. This has been a persistent headwind on the European banks. There is hope that the recent actions announced by the European Central Bank to continue its aggressive monetary easing policies will boost economic growth. Banco Santander and its investors will benefit from improved economic conditions in Europe. At its 2016 annual meeting, the company announced its intention to raise its dividend by 5% this year.

Banco Santander is a high yield stock with a 4.5% dividend, which is an attractive yield level. But it is also a risky stock, which means only investors comfortable with the high risk/high reward scenario should buy the stock.

Banking on Economic Recovery in Europe

Banco Santander seeks to raise its dividend to €21 ($23.54) from €20 ($22.42). This is notable not just because it is a solid dividend increase, but it was only last year that the company slashed its dividend payout by more than 60%, reflecting its difficult financial performance. Not just that, but the company also moved to a partial dividend scrip program, whereby only three out of the four quarterly dividend payments are now made in cash; the final dividend payment is issued in the form of new shares.

It is hoped that aggressive ECB action will resuscitate the banking sector in Europe. On March 10, ECB President Mario Draghi announced a wave of new stimulus measures; these actions will include lower interest rates, more bond purchases, and even a potential subsidy for lenders. First, the ECB reduced the interest rate on overnight lending by 10 basis points to -0.4%. The ECB also lowered its benchmark rate for bank-to-bank lending at zero. In addition, the ECB announced it will increase its bond-buying authorization to €80 billion (approximately $87 billion) from €60 billion (approximately $67 billion).

These measures are expected to be in place for some time, perhaps another several years. There is a good chance these actions will help restore Banco Santander to earnings growth. Banks will now be penalized for holding reserves at the central bank; instead, they will be highly incentivized to lend. Increased lending activity can help restore higher levels of economic activity and growth.

Going forward, Banco Santander intends to distribute 30%-40% of its recurring earnings as dividends, up from its previous policy of 20% distribution. In addition, the company is focused on expanding its business reach beyond Europe. For example, Banco Santander has made Brazil, an emerging market, a priority for future growth. The company now derives approximately 44% of its annual profit from outside Europe.

This helped Banco Santander grow its loyal customer base by 1.2 million, and its digitally active customer base by 2.5 million. Conditions are starting to slowly improve in Europe, and fortunately Banco Santander’s loan metrics improved as well. Credit volume rose 6% last year. Commercial revenue increased 8%, while Banco Santander’s loan-loss provision declined 4% in 2015. Underlying earnings rose 13% for the full year.

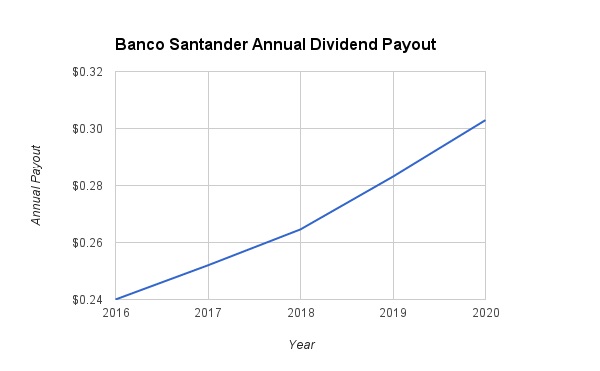

Assuming continued recovery in the European economy, driven in part by the extreme monetary easing policies employed by the ECB, Banco Santander’s future profitability should improve. Stronger economic growth will also help the company set aside fewer resources for loan loss reserves, another earnings tailwind. As a result, Dividend.com forecasts 5% dividend growth through 2018, and 7% dividend growth the next two years. That would take Banco Santander’s annual dividend rate to 30 cents per share in 2020.

The Bottom Line

In response to weak economic conditions across the eurozone, the European Central Bank has kept its foot on the monetary gas pedal. The ECB has thrown everything at the problem within its power. Banco Santander should generate enough earnings to cover its dividend this year. But investors should remember that only last year the company delivered a massive dividend cut. As a result, while Banco Santander could deliver above-average returns if everything goes according to plan, risk-averse income investors should avoid the stock.