Income investors should look more closely at real estate investment trusts, which are commonly referred to as REITs. The reason is because the REIT asset class has a lot of positive qualities that make these stocks attractive investment candidates for investors who desire income. First, REITs are required to distribute 90% of their earnings to investors in order to retain their tax advantaged status. This means they naturally carry above-average dividend yields. For example, HCP Inc. (HCP) is a REIT operating in the health care industry. It recently increased its dividend.

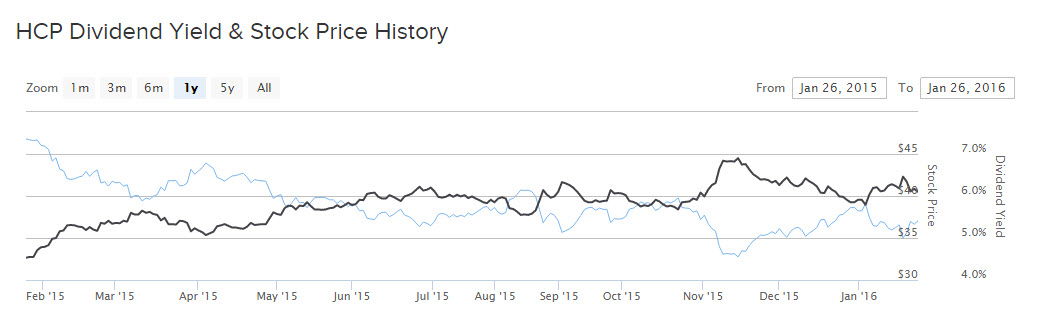

HCP is a unique company. It has now raised its dividend for 31 years in a row. This qualifies HCP as a “Dividend Aristocrat”, which is unusual because it is the only REIT on the list. Despite its steady dividends, HCP stock has declined 31% in the past one year, including a 24% decline just since the beginning of 2016. Still, despite the pervasive bearishness, income investors should continue to view HCP stock favorably.

A Profound Demographic Advantage

HCP is a unique hidden gem in the REIT asset class, due mostly to its advantaged business model. It operates a number of health care-related properties including senior housing, medical facilities and hospitals. Because of this, HCP should capitalize on a massive demographic shift in the United States. In a survey published earlier this year, Gallup reported that Baby Boomers—people born roughly between 1946-1964—are the single largest generation in the U.S. Baby Boomers alone constitute about one-third of the U.S. adult population. There are millions of people entering retirement every year, and as the general population ages, it will result in enormous demand for health care.

The aging population should provide the health care industry a strong long-term tailwind, which is why investors can reasonably expect HCP to experience steady growth for many years. According to the U.S. Census Bureau, between 2012 and 2050 the 65-and-older population will double to more than 83 million. This means demand for laboratory services, hospitals and nursing homes will rise significantly over time.

Biggest Risks Going Forward

The two main risks HCP investors need to keep in mind moving forward are rising interest rates and the situation surrounding HCP’s major tenant ManorCare. First, REITs operate highly debt-heavy capital structures, and when rates go up, interest expense goes up. But the U.S. Federal Reserve has reiterated that the pace of interest rates will be slow and gradual. HCP will have plenty of time to restructure its balance sheet, which it has done. Last year, the company raised $3 billion from financing and capital recycling activities, including $2.3 billion of debt at a blended rate of just 3.5%.

In addition, investors are concerned about HCR ManorCare. Last year, ManorCare was charged with submitting false Medicare claims for services that, according to the Department of Justice, should not have been reimbursed because they were either not covered by the skilled nursing benefit or were not medically necessary. This has weighed on HCP’s stock, but the company has taken quick and aggressive action to prepare for any financial penalties as well as reduce its dependency on ManorCare. Last year, HCP sold 50 HCR ManorCare non-strategic assets with expected proceeds of $350 million. HCP also entered into an $847 million acquisition of private-pay senior housing to reduce its reliance on ManorCare. However, these risks are offset by HCP’s strong tenant portfolio.

High-Quality Tenant Portfolio Fuels Dividend Growth

HCP has a high-quality portfolio that should profit from this major trend. ManorCare is a concern, but HCP has adequately prepared for any forthcoming financial penalties. And, it holds a diversified portfolio. HCP derives 40% of its portfolio from senior housing, 27% from skilled nursing facilities, 14% from life science buildings and 14% from medical office buildings.

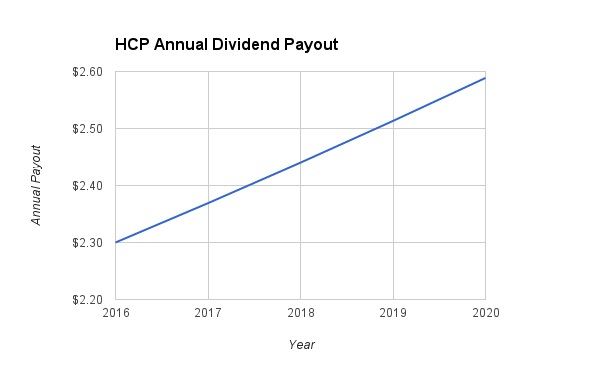

As a REIT, HCP reports earnings as funds from operation, or FFO, instead of traditional EPS. In 2015, HCP grew its adjusted FFO by 4% to $3.16 per share. Growth was driven by accretive property acquisitions and higher rents. This more than covers HCP’s new dividend. Reflecting its strong tenant portfolio, HCP’s new quarterly dividend of $0.575 per share on its common stock is a 1.7% increase from the $0.565 per share in the previous quarter. On an annualized basis, the new payout is $2.30 per share. This represents an 8% yield based on HCP’s February 9 closing price.

HCP’s trailing payout ratio is 73% of FFO. That is higher than many companies, but for REITs which are required to distribute the vast majority of earnings, it is manageable and in-line with management’s expectations. Going forward, the company should at least be able to increase its dividend at rates that mimic inflation. Through 2020, I model 3% annualized dividend growth. That would take HCP’s dividend to $2.59 per share by 2020.

The Bottom Line

The business model for health care REITs is to raise capital, invest in health care properties, and then collect rents which allow them to invest in additional properties. This creates something of a “snowball effect” that produces steady growth like clockwork. It is how HCP has managed to raise its dividend each year for more than three decades.

HCP faces significant risk from rising interest rates and the fallout from the investigation of ManorCare. But the company has set aside enough funds by selling non-critical assets that the impact on its future earnings and dividends should be contained. With an 8% dividend, HCP remains a top REIT stock pick for income investors.

Disclosure: The author is long HCP