Dividend.com analyzed the search patterns of visitors to our site during the past week ending January 24, 2016. Below, we give an analysis of how intelligently readers used Dividend.com to help them in their investment decision-making process by providing a breakdown of what was searched the most on Dividend.com ranked by volume spike to ticker pages.

1. O Realty Income

- 236 tenants in 47 industries.

- A market cap of approximately $17 billion.

- A 98.3% occupancy rate.

- Average remaining lease term of 10 years, with a 1.3% same-store rent increase YTD, with no tenant representing more than 7% of revenue.

If it’s too good to be true, it probably is. No wonder O Realty receives a valuation that’s on the expensive side, with approximately 66% institutional investors.

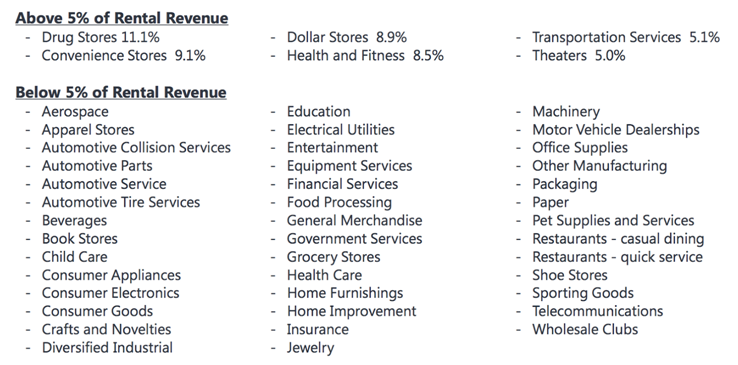

One of the most diversified REITs, only 6 of the 47 industries to which it leases properties contribute more than 5% to rental revenue, which means the company sees virtually no concentration risk.

Here are some dividend facts about O Realty:

- It’s increased its dividend 82 times and counting.

- It’s paid out 543 consecutive monthly dividends.

- Its 2016 FFO per share estimate of $2.82 to $2.89 indicates that dividends will continue in 2016

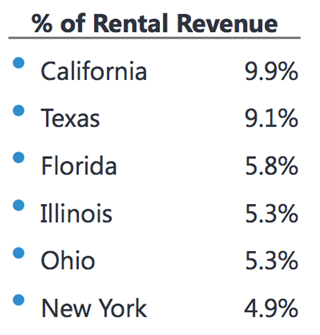

O Realty’s portfolio includes 4,473 properties in 49 U.S. states, with California contributing most to rental revenue, as indicated below.

O’s YTD return is 4.57%, while the Dow gave a negative return of approximately -6%, as of January 22, 2016.

In the current rising interest rate scenario, owning a property can become expensive. This sends more Americans towards renting than ever before, which is a boon for REITs. Having some O in your portfolio at this time wouldn’t be a bad choice for income/dividend investors. With a yield of 4.4% and a monthly payout of 20 cents per share, this could be your monthly dividend company.

2. Utilities Stocks

Our Utilities Sector Stocks page saw a 30% spike in search queries last week.

Utility stocks have been outperforming in the recent market carnage, which prompted us to push a utilities stock to Best Dividend Stock status.

The following is a list of 18 utility stocks ranging from water to gas to diversified, which Dividend.com studied before making its most recent upgrade.

A very stable business model in the form of providing electricity, water or gas meant that these stocks acquired “defensive” status as the market collapsed. Every uptick in the market is followed by these stocks, while every downtick is ignored. The utilities outlined below are top dividend stocks that have excellent analyst estimates for earnings in 2016 and a long record of paying dividends.

| Ticker | Company Name | Market Cap in billions of $ | Subsector |

|---|---|---|---|

| (MGEE ) | MGE Energy Inc. | 1.6 | Diversified Utilities |

| (AWK ) | American Waterworks Co. | 10.8 | Water Utilities |

| (CWT ) | California Water Service Group | 1.11 | Water Utilities |

| (CTWS ) | Connecticut Water Services | 0.44 | Water Utilities |

| (EE ) | El Paso Electric Co. | 1.5 | Electric Utilities |

| (POR ) | Portland General Electric Co. | 3.24 | Electric Utilities |

| (CPK ) | Chesapeake Utilities Corporation | 0.88 | Gas Utilities |

| (NGG ) | National Grid Plc | 49.29 | Gas Utilities |

| (PNM ) | PNM Resources | 2.33 | Diversified Utilities |

| (WTR ) | Aqua America | 5.1 | Water Utilities |

| (PCG ) | PG&E Corporation | 25.24 | Diversified Utilities |

| (AWR ) | American States Water Co. | 1.49 | Water Utilities |

| (UGI ) | UGI Corp. | 5.52 | Diversified Utilities |

| (SWX ) | Southwest Gas Corporation | 2.63 | Gas Utilities |

| (SRE ) | Sempra Energy | 22.59 | Gas Utilities |

| (LG) | Laclede Group | 2.52 | Gas Utilities |

| (WGL) | WGL Holdings Inc. | 3.09 | Gas Utilities |

| (CNL) | Cleco Corporation | 3.18 | Electric Utilities |

Dividend.com is particularly bullish on water as it is a fragmented business, and companies like American Waterworks and Aqua America are acquiring their way to growth.

The U.S. Environmental Protection Agency (EPA) has estimated that an investment of $335 billion for water infrastructure and $298 billion for wastewater infrastructure is needed for required improvements in the next 20 years. There are more stringent regulations from federal and state environmental regulators as well. The capital needed to meet such standards on the part of many system owners, and the monetization of public assets to support the financial condition of municipalities, are among the factors that might drive consolidation.

Read our analysis of the most recent upgrade here.

3. Chevron and Exxon Mobil

Chevron (CVX ) rose 3% on January 22 on talks of a potential stake sale in South Africa. The company has been struggling with cash flows, so asset sales are a part of their strategy to support earnings. It also has an integrated structure, which provides protection from falling commodity prices. The point of an integrated company is to have significant upstream and downstream assets that can reduce volatility in earnings in case there are problems with either line of business.

With low oil prices, the upstream business of Chevron remains weak, however, its refining margins, the downstream portion of the business, grew 59% last quarter.

Exxon Mobil (XOM ), the largest publicly traded integrated oil and gas company, is flat in 2016. We are long on XOM, with a price target of $82 as mentioned in our Trades for 2016 article. Exxon has shown a higher divergence than Chevron this year, partly due to the fact that it’s one of only three companies that garners the prestigious S&P AAA rating. The rating reflects many positives traits, such as a great balance sheet (it was the only integrated oil and gas company to raise its dividend last year) and a large upstream production that’s expected to begin in 2016, which includes the Kearl Oilsands project. At full capacity, the project is expected to produce 500,000 barrels per day of diluted bitumen.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Each week, we’ll share search patterns from the previous week in order to assist you in making insightful decisions for your portfolio.