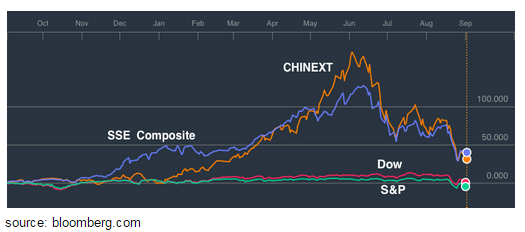

Any foreign investor looking for exposure in the Chinese stock market (ADRs or otherwise) does it for two primary reasons: growth and diversification. The dominant reason of course is growth. While so much has happened in the past year in China, markets have remained fairly flat in the U.S. Even despite the heavy pounding in the last few months, CHINEXT and the SSE Composite have seen respectable 30% + returns in the last 12 months; that’s higher than the returns of all other important indexes in the Asia Pac region (including Japan, India, and Hong Kong).

In the last ten years (which includes the hopefully-once-in-a-lifetime crash), the Dow Jones Index has returned a little more than 50%, compared to the Shanghai Composite Index, which has managed to return close to 200%. While the growth numbers are impressive, they are certainly not one-sided. If you are caught on the wrong side of the storm, it wouldn’t take any time at all for your portfolio to sink like a lead ball (or a Zeppelin for you Keith Moon/Jimmy Page geeks).

As the markets in general — and especially Chinese ADRs — have sharply corrected in the last few months, the obvious question on everyone’s mind reads: is it the right time to buy? And if so, what exactly? Let’s tackle both questions one at a time (with the obvious disclaimer of using your own discretion, since no one can predict the future).

1. Is it the Right Time to Buy Chinese ADRs?

To answer that we need to spend a little time on what is really happening with China and why. It’s not that anyone needs a lesson in macroeconomics, but think back to your 101 lectures as it’s important to determine whether or not the recent meltdown is cyclical or structural. If it is cyclical, then it’s only a matter of timing your buy decision. If, however, there is a structural problem, it’s better to stay away.

Remember “China-nomics”? The economic policy room debates about how China is not ruled by “traditional economics” and how it can and has beaten global economics for three decades? Well, the last few years have told a different story. It’s not so much about 14% vs. 7% growth, but the fact that recently China has been on a downward trend while the world economy seems to be recovering. That is noteworthy and is spooking many economists.

Let us see if there are any major structural issues with China:

Debt: The total debt-to-GDP ratio for China is now more than 280%. Opinions on how bad that exactly is are, unfortunately, split. Given that the U.S. has managed fine with a 332% debt load, and the fact that China’s government debt is fairly manageable (giving the government more room to maneuver), it is probably not yet time to panic. If we do go into a global recession it will be due to China’s inability to correct its recent trend—which is the worst-case scenario.

GDP Growth: Has GDP growth slowed down despite the usual China methods? Short answer: no. It has been a different China under Xi Jinping since 2013. They have been reluctant to roll out broad monetary stimulus and have come to accept a “new normal” playing field.

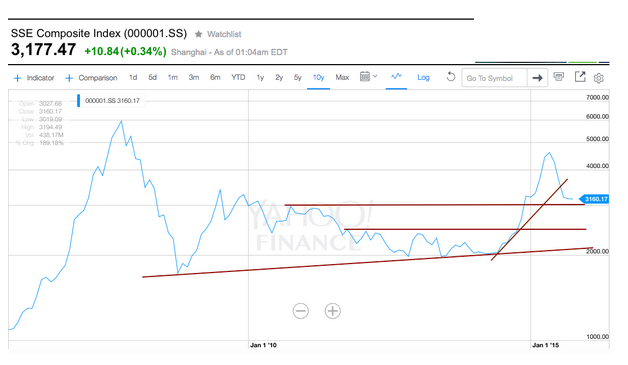

Stock Market Meltdown: Is the recent meltdown letting out steam or is it a long-term sell-off? This is a tough one. The SSE Composite has broken past the recent uptick trend that started last year in July. It’s now nearing previous resistance levels of 3,050-3,129. If those levels are broken, we can expect a decline of a further 8%-10% to the mid 2,400s. On the other hand, if the markets bounce off those levels a couple of times, that could be good sign to buy.

Another important factor to note is that the sharp rise and decline is nothing new for China. The sharp rise in Chinese stock markets from June 2014 was not seen anywhere in any other major market. So a sharp fall is more than warranted.

Recommendation:

It is probably best to wait and watch if more support levels are broken at this point. If, however, you are convinced that the worst is either over or not far, you could start buying in small pieces and average out your costs as time goes by.

2. Which Chinese ADRs Are Worth Buying?

If you do choose to buy at a certain time in the near future, the following list of dividend-paying Chinese ADRs might come in handy.

- Sector: Education Services

There are three companies to consider in this sector: China Distance Education Hldgs Ltd. (DL ), Xueda Education Group (XUE), and TAL Education Group (XRS). Out of the three, DL and XUE are investment options worth considering from a dividend yield perspective. From a valuation and future capital growth point of view, DL seems to be a better option.

DL is a good dividend-paying stock, with a yield of 7.67%, and has been paying dividends regularly for the last three years. The company has good cash reserves to dip into and has a PEG ratio of 0.89 (well below the industry average). The stock is currently trading at more than 60% below its all-time high and is trading at around the level it was two years back (September 2013).

- Sector: Oil & Gas

There are three companies to consider in this sector: PetroChina Co. Ltd. (PTR ), CNOOC Ltd. (CEO ), and China Petroleum & Chemical Corp. (SNP ). Out of the three, CEO has the highest dividend yield at 5.04%. From a valuation point of view PTR seems to be the best choice.

Keep in mind a few important things to note about this sector: all the ADRs mentioned above are at/close to five- to seven-year lows. The fall has been one of the sharpest in this sector. China’s growth is slowing down and oil prices are at a ten-year low (almost back to where they were during the peak of the recession in 2009). There is no sign that oil prices will return to their previous levels any time soon. Hence, this probably isn’t the best time to invest in this sector.

Even if you decide to invest, the decision is a complex one. PTR might be the cheapest at this point, but it also has the highest debt on its book. CEO might not be as cheap (relatively speaking) as the other two, but it has the most cash reserves, least debt, and is more than 50% below its high. However, CEO has broken through some historic support levels and doesn’t have any strong support levels close to its current market price.

- Sector: Telecom

Three companies to consider in this sector are China Telecom Corp. Ltd. (CHA ), China Unicom Limited (CHU ), and China Mobile Limited (CHL ). CHL has the highest dividend yield (3.04%) but not by a huge margin.

CHL also is the biggest company in the group, with the most cash and the least debt. Even though its P/E is not unreasonable (relatively speaking), it is only 23% below the all-time highs. This doesn’t necessarily mean that the stock is due for a big fall in the near future (not all stocks are created equal), but it does show that CHL has not fallen as sharply as some of its competitors.

My recommendation would be a buy on CHL, but one must watch out for the $56.70 support level. If the stock falls below that level, it can slide down a further 5%-6%. It would be wise to buy in smaller pieces to average out the prices.

- Sector: Real Estate

Stocks to consider in this sector are E-House China Holdings (EJ), Leju Holdings Ltd. (LEJU), and Xinyuan Real Estate Co., Ltd. (XIN). It’s tough to choose which stock to buy in this sector.

LEJU has the highest dividend yield out of the three at 16.2%. EJ and LEJU are in real estate services (listings, etc.) and have low-capital, scalable models, while XIN is a property developer (growth will probably be fueled by debt). LEJU seems to have a lot of trader interest given that it has risen/fallen 20% within a week in recent times. Unless your risk appetite allows you to buy a stock like that, you should stay away from it. It is currently close to 60% below it is recent peak.

XIN is the next best choice and seems to have bottomed out in January of this year. It has tried to break free a few times, but this year it looks poised to finally do so. The company is in the construction business, though, which has been slowing down for the last three years.

Note: 30% of Chinese GDP comes from construction, which industry has not been doing well in the last three years. That is perhaps one of the bigger reasons why commodities and GDP growth have suffered alongside each other. The good news, however, is that home sales seem to have picked up in the last year.

The Bottom Line

With no way to truly tell if the stall is cyclical or structural, it is hard to get a read on the immediate future of the markets. While other markets are slowly trudging upwards — albeit painfully — the Chinese markets seem to be letting off a little more steam than anyone truly expected. September and October have historically not been kind months to investors, so if your appetite for risk is minimal, it is smart to sit in cash a little longer, or ball in small chunks so as to even out your average purchase price.