Bank of Montreal (BMO ) reported its first quarter results before the bell on Tuesday morning, posting lower net income and adjusted earnings than last year’s Q1.

BMO's Earnings in Brief (in CAD)

- Bank of Montreal reported first quarter revenue of $5.06 billion, which is up from last year’s Q1 revenue of $4.48 billion.

- Net income for the quarter came in at $1 billion, or $1.46 per share, which is down from last year’s $1.06 billion, or $1.58 per share.

- On an adjusted basis, EPS came in at $1.53, compared to last year’s adjusted figure of $1.61.

- Analysts were expecting $1.62 EPS on revenues of $4.46 billion.

CEO Commentary

BMO CEO Bill Downe, had the following comments: “BMO’s first quarter results reflect the impact of an unsettled environment in which we saw significant movements in oil prices, long-term interest rates and the Canadian dollar. Against this backdrop, underlying business performance was solid, with combined Personal and Commercial Banking adjusted earnings of $708 million, up 6% year over year, reflecting the benefits of our diversified and growing customer base. We also had good results in our Traditional Wealth businesses, with adjusted earnings up 28% from last year.”

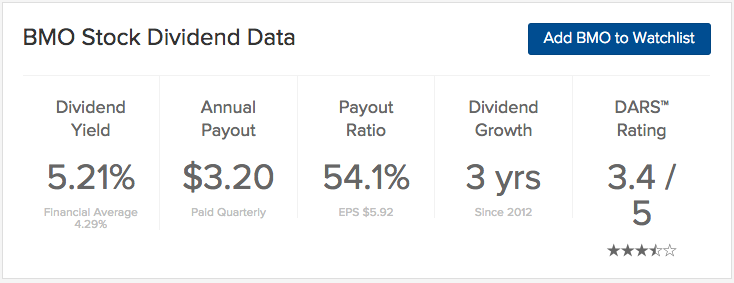

BMO's Dividend

BMO declared a second quarter dividend of 80 cents.

Stock Performance

BMO stock was inactive in pre-market trading. YTD, the stock is down 3.09%.

The Bottom Line

Bank of Montreal (BMO ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.