Waste Management (WM ) reported its fourth quarter results before the opening bell on Tuesday, posting slightly lower revenues and higher adjusted earnings compared to last year’s Q4.

WM's Earnings in Brief

- Waste Management reported fourth quarter revenues of $3.44 billion, which are down slightly from last year’s $3.5 billion.

- Net income for the quarter came in at $590 million, or $1.28 per share, compared to last year’s Q4 net loss of $605 million, or $1.29 per share.

- On an adjusted basis, earnings came in at $308 million, or 67 cents per share, compared to last year’s $263 million, or 56 cents per share.

- WM beat analysts’ EPS estimates of 61 cents, but revenues came in below the $3.52 billion expectation.

- Looking ahead, Waste Management sees adjusted EPS between $2.48 and $2.55, while analysts are expecting $2.48.

CEO Commentary

WM president and CEO David P. Steiner had the following comments: “We built strong momentum during the first three quarters of 2014, and that momentum continued into the fourth quarter. Our strong pricing and cost controls delivered growth in our traditional solid waste business as income from operations grew $36 million and income from operations margin rose by 130 basis points compared to the fourth quarter of 2013. In addition, operating EBITDA in the traditional solid waste business grew by $25 million and operating EBITDA margins expanded by 100 basis points.(b) For the seventh consecutive quarter, our yield was at least 2.0% and volumes improved sequentially for the fourth consecutive quarter. Our cost of operations improved by $97 million and as a percent of revenue improved 170 basis points compared to the prior year fourth quarter."

WM to Raise Dividend

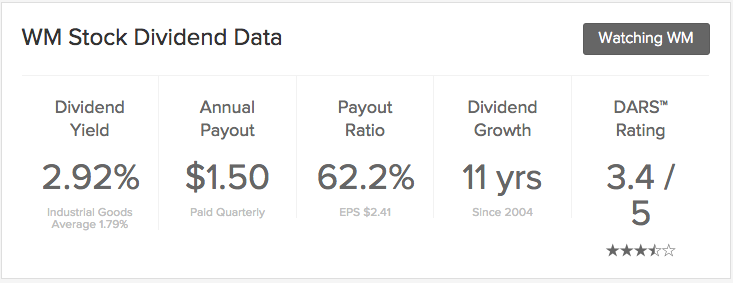

In its quarterly report, Waste Management reported that its board of directors plans on raising its annualized dividend to $1.54 from $1.50. We expect the company to declare the higher dividend in the coming weeks.

Stock Performance

Waste Management stock was up $1.72, or 3.35%, in pre-market trading. YTD, the stock is down 0.89%.

The Bottom Line

Waste Management (WM ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.