Before the opening bell on Monday morning, D.R. Horton (DHI ) reported its first quarter results, posting higher revenues and earnings compared to last year’s Q1.

DHI's Earnings in Brief

- D.R. Horton reported first quarter revenues of $2.24 billion, up substantially from last year’s Q1 revenues of $1.63 billion.

- Net income for the quarter came in at $142.5 million, or 39 cents per share, compared to last year’s Q1 figures of $123.2 million, or 38 cents per share.

- DHI beat analysts’ estimates of 35 cents EPS on revenues of $2.18 billion.

CEO Commentary

DHI’s chairman of the board Donald R. Horton had the following comments: “Our fiscal 2015 is off to a great start, highlighted by $220.7 million of pre-tax income, on $2.3 billion of revenues. Our position as the largest and most geographically diverse homebuilder provides a strong platform for us to compete for new home sales, evidenced by year-over-year increases in the value of our net sales orders, home sales revenue and sales order backlog of 40%, 37% and 29%, respectively."

DHI Declares Dividend

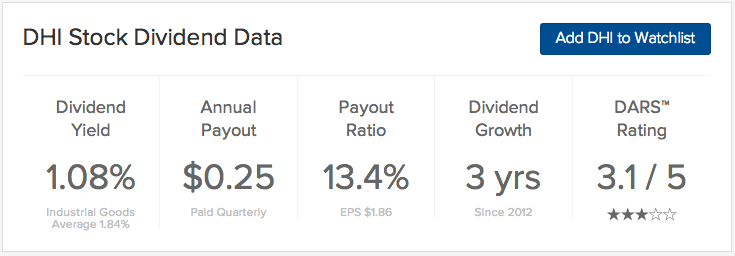

D.R. Horton declared a quarterly dividend of 6.25 cents, which is payable on February 17 to all shareholders on record as of February 6.

Stock Performance

DHI stock was up $1.33, or 5.77%, in pre-market trading.

The Bottom Line

D.R. Horton (DHI ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.1 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.