Before the opening bell on Friday morning, General Electric (GE ) reported its fourth quarter results, posting higher earnings and revenues compared to last year’s Q4 figures.

GE's Earnings in Brief

- GE reported fourth quarter revenues of $42 billion, up from last year’s Q4 revenues of $40.38 billion.

- Operating earnings for the quarter came in at $5.63 billion, or 56 cents per share, which is up slightly compared to last year’s Q4 figures of $5.42 billion, or 53 cents per share.

- GE’s Q4 results beat analysts’ EPS estimates of 55 cents, while revenues came in slightly below the expectation of $42.2 billion.

CEO Commentary

GE chairman and CEO Jeff Immelt commented on the company’s year-end results: “GE ended the year with strong fourth-quarter industrial earnings and margin growth. The environment remains volatile, but we continue to see infrastructure growth opportunities. We are pleased with our execution in 2014: meeting our commitment to grow industrial segment profits 10%, industrial segment organic revenue growth of 7%, increasing operating margins 50 basis points, decreasing costs by $1.2 billion, reducing the size of GE Capital and returning $11 billion to shareowners.”

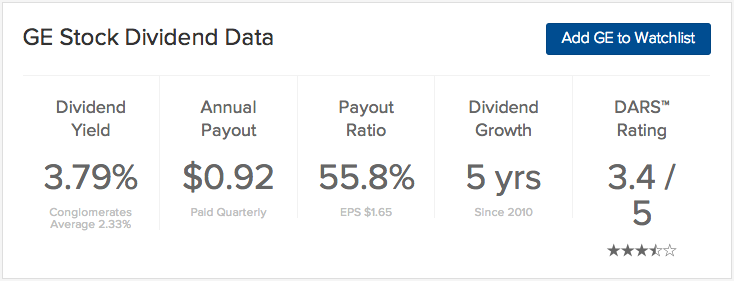

GE's Dividend

General Electric will pay its next quarterly dividend on January 26. The stock went ex-dividend on December 18.

Stock Performance

GE Stock was up 10 cents, or 0.41%, in pre-market trading.

The Bottom Line

General Electric (GE ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.