Before the opening bell on Tuesday morning, Johnson & Johnson (JNJ ) reported its fourth quarter results, posting lower sales and higher earnings compared to last year’s Q4 results.

JNJ's Earnings in Brief

- Johnson & Johnson reported fourth quarter sales of $18.25 billion, down 0.6% from last year’s Q4 sales of $18.36 billion.

- GAAP net earnings for the quarter came in at $2.52 billion, or 89 cents per diluted share, down from $3.52 billion, or $1.23 per diluted share.

- On an adjusted basis, earnings came in at $3.6 billion, or $1.27 per share, up from $3.56 billion, or $1.24 per share, reported last year.

- JNJ beat analysts’ EPS estimates of $1.26, but revenue came in below the $18.59 billion expectation.

- Looking ahead, JNJ sees FY2015 EPS in the range of $6.12-$6.27, compared to analysts’ estimates of $6.13.

CEO Commentary

JNJ chairman and CEO Alex Gorsky had the following comments: “2014 was a strong year for Johnson & Johnson, as we delivered solid financial results while continuing to make investments to accelerate growth for the long term. We have built significant momentum in our Pharmaceutical business, are realizing the benefits of innovation, scale and breadth in our Medical Devices business and are continuing our market leadership with iconic brands in our Consumer business. I am proud of our exceptional Johnson & Johnson colleagues who make our success possible with their commitment to advancing health and well-being for patients and consumers around the world.”

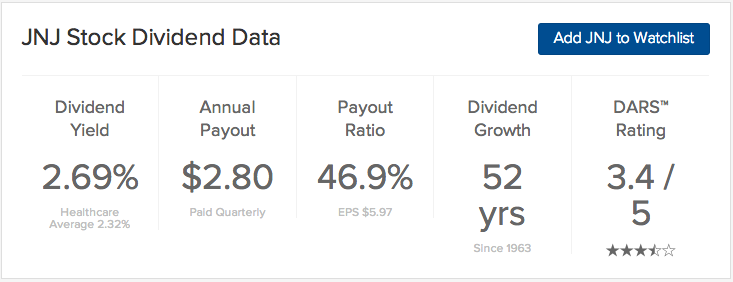

JNJ's Dividend

Johnson & Johnson will pay its next quarterly dividend of 70 cents on March 10. The stock goes ex-dividend on February 20.

Stock Performance

JNJ stock was down 94 cents, or 0.9%, in pre-market trading.

The Bottom Line

Johnson & Johnson (JNJ ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.