After the closing bell on Monday, Alcoa (AA ) unofficially kicked off the first earnings season of 2015, announced higher fourth quarter sales and earnings compared to last year’s Q4 results.

Alcoa's Earnings in Brief

- Alcoa reported fourth quarter sales of $6.4 billion, up from last year’s Q4’s sales of $5.6 billion.

- The company reported a net income of $159 million, or 11 cents per diluted share, compared to last year’s Q4 net loss of $2.4 billion, or $2.19 per diluted share.

- On an adjusted basis, Alcoa’s earnings came in at $432 million, or 33 cents per share.

- Alcoa easily beat analysts’ estimates of 25 cents EPS on revenues of $5.99 billion.

CEO Commentary

Alcoa chairman and CEO Klaus Kleinfeld had the following comments: “Our strong fourth quarter capped a pivotal year as we significantly accelerated Alcoa’s transformation. As we built out our value-add businesses, we gained profitable share across exciting downstream growth markets and captured aerospace and automotive growth in the midstream. On the commodity side, our hard work reshaping the portfolio continues to pay off with improved performance for the 13th quarter in a row. In 2014 we delivered Alcoa’s strongest operating results since 2008; we enter 2015 on solid footing, poised to continue transforming and growing.”

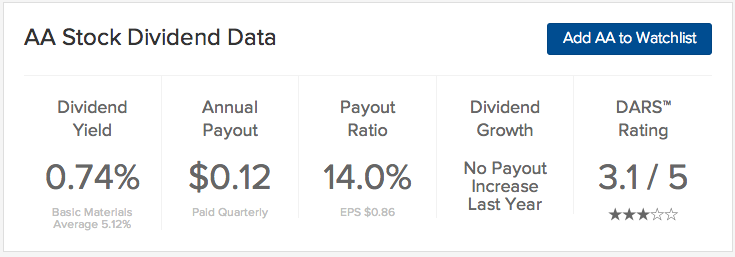

AA's Dividend

Alcoa paid its most recent 3 cent quarterly dividend on November 25. We expect the company to declare its next dividend in the coming days.

Stock Performance

Alcoa stock was up 16 cents, or 0.99%, in after hours trading. The stock ended the day mostly flat.

The Bottom Line

Alcoa (AA ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.1 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.