The period following the 2008 financial crisis saw renewed interest in real estate investment trusts (REITs), which refer to a broad category of companies that own and operate income-producing real estate. Demand for REITs came to a head in 2016 when the S&P 500 Index added the sector to its ten existing categories.

Knowing about the different types of REITs can help investors decide if they want to invest in the S&P 500’s eleventh sector. This information can also help market participants evaluate potential players in the dozen sub-industries that comprise Wall Street’s real estate sector.

Find out about the highest-yielding REITs on our dedicated REITs page.

The Different Types of REITs

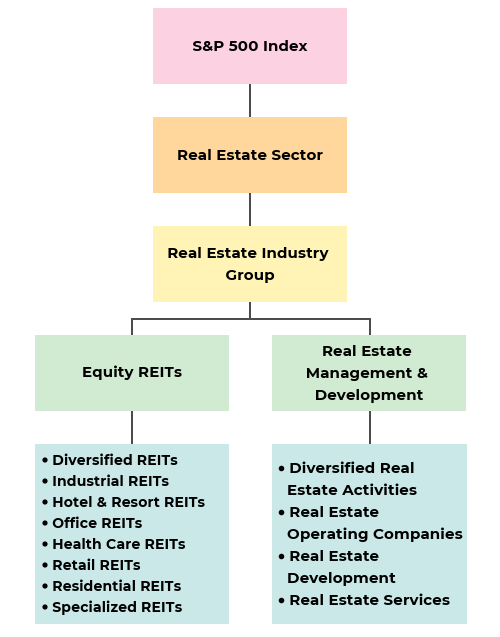

The classification of REITs was revised in 2016 as the category made its way onto the S&P 500 Index. Under the revised Global Industry Classification Standards (GICS), the broad Real Estate Sector houses the Real Estate Industry Group, which is comprised of two industries: Equity REITs Industry and Real Estate Management & Development Industry. These two industries are further broken down into two sub-industries for a four-tier classification system, which is discussed later in the article.

REITs differ from real estate development companies in tax treatment, distribution and strategy. For example, REITs do not pay corporate taxes insofar as they distribute 90% or more of their net income via dividends. Real estate management and development companies do not benefit from this special tax treatment.

As a trust, the REIT vehicle also has a larger business model and funding streams when compared with a general real estate development company. However, a REIT’s income distribution requirements often limit its ability to reinvest in the underlying business, which could hamper its growth. Real estate management and development companies, on the other hand, are usually geared toward long-term growth.

The GICS four-tier classification for real estate firms is shown below.

In spite of the 90% Rule, Why Do Some REITs Have Poor Payout Ratios? Find out here.

Equity REITs

Equity REITs are divided into eight sub-industries, which are outlined below. REITs are advantageous because they provide broad diversification benefits as well as tax savings. REITs that distribute at least 90% of their taxable income as dividends are not taxed at the corporate level. However, since the vast majority of income is paid back to investors, equity REITs are disadvantaged when it comes to growth since fewer profits are reinvested into the company.

1. Diversified REITs

For a REIT to be considered diversified, it must have operations across two or more property types, such as commercial and residential. W.P. Carey (WPC) and Vornado Realty Trust (VNO) are two such examples. The obvious advantage of this category is diversifying one’s holding across various real estate asset classes. The downside is adequate selection of quality-diversified REITs given the industry-wide shift to specialization.

2. Industrial REITs

Industrial REITs are comprised of companies involved in the acquisition, development, ownership, leasing and management of industrial properties, including industrial warehouses and distribution centers. Some of the largest industrial REITs include DCT Industrial (DCT) and Duke Realty (DRE). The major pros to industrial REITs are long-term lease terms, growing demand of e-commerce and prevalence of net lease where the tenant bears the operating expenses. The major cons include long lead times to bring industrial property to the market as well as the reliance on the broader economic climate.

3. Hotel & Resort REITs

Companies that specialize in the acquisition, development, ownership, leasing and management of hotel and resort properties fall into this category. Some of the leading hotel REITs with high dividend yields include Apple Hospitality REIT (APLE) and Xenia Hotel & Resorts (XHR). When the economy is performing well, REITs in this category can greatly outperform the market. On the flipside, the hospitality industry is heavily exposed to disruptive business models such as Airbnb and other online lodging services.

4. Office REITs

Real estate firms with a focus on the acquisition, development, ownership, leasing and management of office locations are included in this category. Boston Properties Inc. (BXP) is one such company specializing in office space. Office REITs with anchor tenants usually benefit from longer leases compared with tenants of industrial properties. On the downside, office space is highly vulnerable to economic growth and industry consolidation. The time it takes to complete an office development can stretch over many years.

5. Health Care REITs

Hospitals, nursing homes and assisted living facilities are all examples of healthcare REITs. National Health Investors Inc. (NHI) and CareTrust REIT (CTRE) fall in this category. America’s aging population and the need for new long-term care facilities suggest there is strong demand for healthcare property. The major downside is that the healthcare industry is very prone to shifts in public policy, which is a significant source of uncertainty.

6. Retail REITs

Companies that acquire, develop, lease and manage retail locations such as shopping centers and outlet malls fall under this category. Kimco Realty (KIM) is one of North America’s largest operators of open-air shopping centers. Retail REITs benefit from favorable lease agreements compared with other forms of REITs, including triple net leases and annual rent escalations. The obvious downside to retail REITs is the significant decline in foot traffic as a result of weaker consumer spending and the growth of online shopping.

7. Residential REITs

The companies in this category are involved in the provision of multi-family homes, apartments, manufactured dwellings and student housing. AvalonBay Communities, Inc. (AVB) is a prime example. Residential REITs are highly attractive in jurisdictions benefiting from economic growth and population growth, which describes the current climate in the United States. However, this category is highly exposed to shifts in monetary policy and interest rates, which has been known to weaken demand for residential property.

8. Specialized REITs

Companies involved in real estate ventures that do not fit in the categories mentioned above or in the Real Estate Management & Development category are considered specialized REITs. This category also includes companies that do not generate a majority of their income from real estate rental or leasing operations. Some of the available specialty REITs include EPR Properties (EPR) and VICI Properties Inc. (VICI). The major benefit of specialized REITs is the ability to diversify one’s exposure to various aspects of the real estate market. However, this category requires considerably more research on the part of investors to understand what the underlying holdings represent. Asset selection in specialized REITs is also more limited when compared with other categories.

Click here to learn more about REITs.

Real Estate Management & Development Companies

The second real estate industry is further divided into four sub-industries. A breakdown of each is provided below.

One of the primary advantages of investing in real estate management companies is high dividend payouts. This category also offers direct exposure to real estate developers, which is a huge plus in an age when portfolio managers are bullish on industrial properties globally. However, companies in this category do not offer the same diversification benefits as some of the equity REITs categories mentioned above. Additionally, some of the sub-industries do not offer direct exposure to real estate.

1. Diversified Real Estate Activities

Companies involved in real estate development, management or related services but with no dominant business line are considered diversified real estate firms. Examples include Brookfield Asset Management (BAM).

2. Real Estate Operating Companies

This category refers to companies that are engaged in the operation of real estate properties for the purpose of leasing and management. RMR Group Inc. (RMR) is an example of a real estate operating company.

3. Real Estate Development

Companies that develop real estate and sell their properties post-development are included in this category. Examples include Brookfield Property Partners (BPY) and *Howard Hughes Corporation * (HHC).

4. Real Estate Services

The broader real estate ecosystem, including agents, brokers and appraisers, fall under this category. Some examples include CBRE Group (CBRE) and Jones Lang LaSalle (JLL).

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

The Bottom Line

The real estate sector offers plenty of upside for yield-seeking investors. As demand for real estate continues to grow amid the decade-long recovery, this sector could provide unique advantages without the added risk of investing in physical properties outright.

Check out what investors are currently most interested in by visiting our Most Watched Stocks Page.