If there has been one common theme over the last decade, it has to be the proliferation of low interest rates. With the Great Recession and now COVID-19 crisis, central banks around the world have pulled out all the stops to keep the world’s economy growing. And that’s meant keeping key benchmark interest rates at zero or near-zero levels for the better part of a decade.

For income seekers, this has been a rough road. Many traditional sources of income like bonds or CDs just aren’t cutting it. To that end, many investors have been forced to think outside the box to get needed yields.

One of the outside of the box areas could be the oft ignored closed-end funds (CEFs). One-part ETF, one-part mutual fund, these old-school hybrid securities could be exactly what an investor needs for their income portfolio.

Check out our Fixed Income Channel to learn more about different ways to generate income.

CEFs: The Basics

Mutual funds and exchange-traded funds (ETFs) are portfolio staples at this point. Pretty much everyone has some exposure to either fund type. But they aren’t the only vehicle designed to hold assets. And one actually predates both – we’re talking about the humble closed-end fund (CEF), which was founded back in the 1800s.

The origin of closed-end funds is a simple one. A few publicly traded stocks started to own various shares of other publicly traded companies and eventually dissolved their business operations so all that was left were their stock portfolios. These days issuers have launched CEFs with a specific purpose or strategy in mind.

Perhaps, the best way to think of closed-end funds is sort of like a cross between ETFs and mutual funds. They are like ETFs in the sense that they trade throughout the day on the major exchanges. However, unlike exchange-traded funds, CEFs do not have a creation and redemption mechanism and are IPO’d with a fixed number of shares. After their initial IPOs, CEFs can and often do trade for discounts to their net asset values, allowing investors to pick up stocks for pennies on the dollar. For example, if a closed-end fund is trading at a 10% discount to its net asset value (NAV), you effectively get a dollar’s worth of assets for 90 cents.

Closed-end funds are like traditional mutual funds in that they are actively managed. The kicker here is that because shares of the fund trade on the exchanges, managers of CEFs can be fully invested and own less-liquid securities. Mutual funds always have to have some cash or equivalents available to cover shareholder redemptions. This cash drag can lower mutual fund returns.

Finally, because of their structure, CEF managers can use leverage – the amount of which is regulated by the Fed – to increase their returns.

The Boost to Your Income

Given CEFs’ quirks, it’s easy to understand why they are often ignored by investors. But given the need for income, investors and financial advisors may want to get to know closed-end funds a bit better. And the potential for higher income is great. Additionally, according to the Investment Company Institute, more than 61% of CEFs are invested in bonds and fixed-income securities.

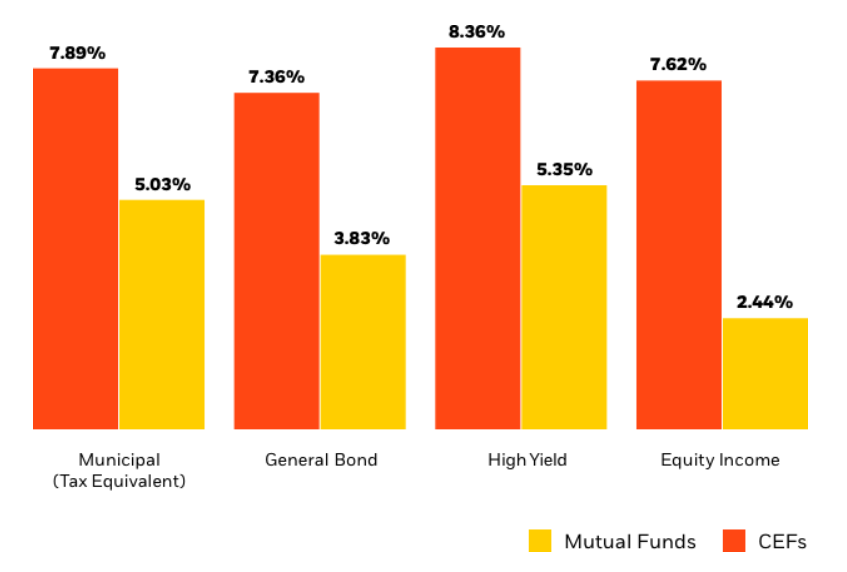

Because many CEFs do trade for discounts to their net asset values (NAVs) and engage in leverage, the vehicle provides much higher yields than comparable investments. By just how much bigger? How about 2 to 5 percentage points. You can see the difference in CEFs vs. mutual fund yields on the chart from investment manager BlackRock.

Source: BlackRock

The difference in NAV and the use of leverage can significantly boost a CEF’s ability to juice its distribution yield. And those yields may be tax-advantaged as well.

For starters, many CEFs are invested in municipal bonds, which are generally free from Federal taxes and can offer state/local tax benefits as well.

Secondly, many CEFs follow managed distribution programs. This allows them to monetize total returns today rather than later on. Because of this, not all of their distributions will come from net investment income and capital gains. Some comes back to investors as an untaxed return of capital. Return of capital reduces an investor’s cost basis in an investment, and essentially defers the tax owed until the security is sold. The added bonus is that managers of the fund are able to offset losses to offset gains, and as long as they are earning their targeted distribution, investors are able to get total returns untaxed.

Finally, esoteric asset classes benefit from being in a CEF. Rather than receive a K-1 statement, CEFs holding master limited partnerships (MLPs) hand out a standard 1099 form. Investors in gold bullion holding closed-end funds are only subject to the 20% tax on long-term capital gains, rather than the collectibles tax of 28%.

Use the Dividend Screener to find high-quality dividend stocks. This includes a wide range of closed-end funds covering a variety of asset classes!

Buying Assets for Pennies on the Dollar

Given the potential income benefits of adding a swath of some CEFs to your portfolio, investors and their advisors should consider the fund structure.

An easy and broad way could be buying an ETF that holds CEFs. Both the Invesco CEF Income Composite ETF (PCEF) the and VanEck Vectors CEF Municipal Income ETF (XMPT) offer broad exposure to CEFs trading at discounts in various fixed-income and municipal sectors, respectively. The best part is they both yield more than the bond market. For example, PCEF is now yielding close to 7%.

The great thing about CEFs is that there are plenty of funds that cover almost any strategy available in a mutual fund or ETF at a higher yield. For example, the Macquarie Global Infrastructure Total Return Fund (MGU ) currently yields about 2 percentage points more than the average infrastructure-focused mutual fund, while the BlackRock MuniYield Quality Fund (MYI) yields more than double the average national municipal bond ETF.

Running our screener can help you find CEFs that meet your income objectives. The key is making sure you’re finding funds with discounts to their NAVs and not overpaying for assets.

The bottom line is that CEFs can provide a much-needed income boost to portfolios. While a little quirky, it’s worth learning about them and adding them to your investment mix in moderation.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.