If there is a poster child for the active ETF movement over the last year or so, it would have to be Cathie Wood and her Ark Invest funds. Focusing on tech, innovation and healthcare, the six Ark ETFs – including her flagship ARK Innovation (ARKK) – have gathered billions in assets and amassed staggering returns. And in that, Ark may be the reason why fund sponsors have started to embrace active ETFs in the first place. Active ETFs have shown that they can be viable vehicles for active management.

But, lately, ARKK’s magic has been fading.

With poor returns and the ETFs continuing to crash, ARK Invest looks like it’s in serious trouble. For investors, it highlights an important factor with active ETFs and management – don’t put all your eggs in one basket!

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Big Returns, Then a Big Crash

One hundred and fifty-two percent. That’s a staggering return, and it’s just what ARKK managed to pull off during 2020, following a nearly 35% return in 2019. With those hedge fund-like returns, Cathie Woods and the team at Ark Invest seem to have some real hits on their hands.

The reason for that success may come down to Ark’s active approach. The fund and its five sisters are all actively managed, and so they don’t not track underlying indices.. As such, Woods and her team have been able to take big bets on whatever they deemed worthy at the time. Moreover, Ark has benefited from its concentrated effect. When investors make big bets on just a few different stocks, returns can be magnified. So, with stocks like Tesla (TSLA), Roku (ROKU) and Teladoc (TDOC) leading the way in Woods’ portfolio, shares of ARKK surged – as did her other funds.

But, lately, Woods and Ark Invest have been drowning.

With the Federal Reserve cutting off the flow of cheap money and raising rates, investors have started to dial back risk. Technology, healthcare and “innovation” are taking a backseat to industrials and value investments. With that, ARKK and its sister ETFs – like the ARK Next Generation Internet ETF (ARKW) , have plunged.

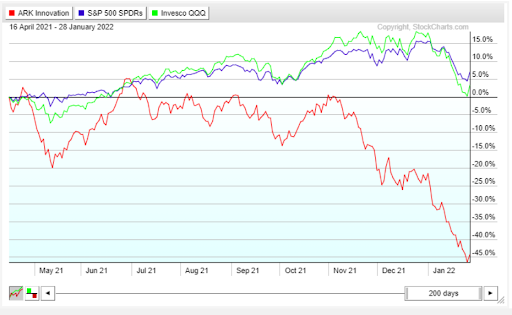

Five of Ark’s six active ETFs managed to return double-digit losses in 2021. At the same time, the NASDAQ and S&P 500 recorded double-digit returns for the year. So far, this year hasn’t been any better. With all stocks accelerating lower, ARKK has continued to suffer in a big way. You can see by this chart how bad the bleeding has been versus the NASDAQ and S&P 500.

Source: Stockcharts.com

The Big Lesson for Active Management

There is a lesson to be learned here from the return performance of ARKK. It isn’t that Woods is a bad money manager or that her thesis is completely wrong; it’s just that even top managers have bad years, and sometimes external forces have an effect on the market. In this case, it’s a combination of the Fed, rising interest rates and an abandonment of high-tech stocks.

So, what does this ultimately mean when it comes to adding active management and ETFs to a portfolio? Be diversified. Just like you wouldn’t invest 100% in stocks – unless you were very young; you shouldn’t be 100% tied to a single manager or active ETF. In the case of ARKK, unfortunately, some investors did just that.

The benefit of active management is that a fund can look nothing like an index and that’s where they can gain additional alpha. Clearly, Cathie Woods was “correct” in her choices since the funds launched in 2017, with positive returns each of those years. The reverse can also be true, however. Not looking at an index can get you into trouble when the markets turn or economic/environmental factors shift.

Rather than throw active management out the window, investors need to use it more like spice for their portfolios. Using active plus passive together can lead to better results over the long haul. You’d still be ahead quite nicely had you invested in ARKK and some of Woods’ ETFs early on.

Secondly, being diversified among active managers may be prudent. People aren’t infallible and can make mistakes or time themes incorrectly. Right now, tech is not the place to be. But it could be for a value- or dividend-focused manager. By pairing several active managers and their ETFs together, investors can do better over a full market cycle.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

The Bottom Line

While Cathie Woods and Ark Invests’ recent performance hasn’t been great, we can learn a lesson from its downturns: Be diversified even when it comes to active management. Having multiple managers and strategies in your portfolio provide a better chance at long-term success. Betting solely on what’s hot in the moment has never been a recipe for success. Thinking broadly is a better way to go.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.