To construct more tax-efficient portfolios, investors should begin with the FDCs: Fit, Diversification and Cost.

Fit – begin with the investors’ particular risk/return needs or expectations. Diversification – invest across asset classes to reduce risk of individual securities or markets impacting returns. Cost – lower the portfolio’s holding and transaction costs to reduce drag and increase returns. This all sounds great on paper but often ignored is the largest cost to investors.

Unfortunately, investors construct their portfolios failing to address the largest cost they collectively still face: taxes 1. Indexing can help keep capital gains distributions and their associated tax costs lower thanks to its generally lower turnover. Also, a notable tax advantage may be found when indexing with Exchange Traded Funds (ETFs) given their unique creation/redemption processes which can further reduce capital gains to investors 2. But we’re not there yet.

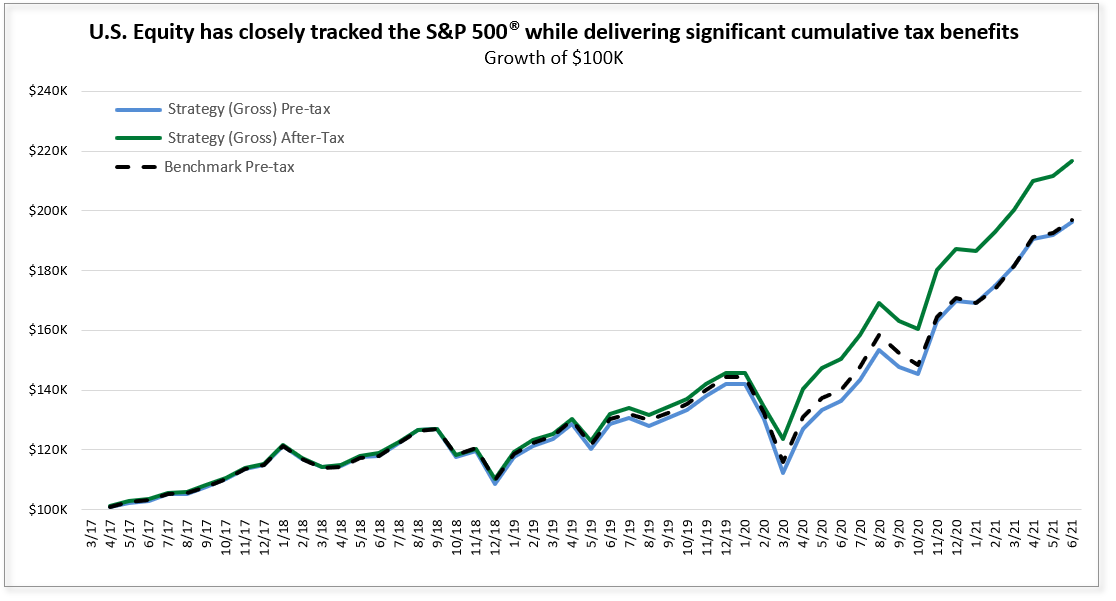

To lower tax cost further and improve after-tax performance, consider the strategy of Tax Benefit Capture (TBC), often referred to as tax loss harvesting. TBC describes the selling of a position that has declined below its cost basis in order to “lock-in” a realized loss. 3 The realized loss can then be used to offset capital gains from other parts of the portfolio such as actively managed investments, alternative assets or gains. Many studies show that the potential value add of tax management using TBC is generally estimated to be between as much as 1% and 3% return per year over many years. The chart below from Green Harvest Asset Management’s U.S. Equity Strategy illustrates how tax management using TBC can improve after-tax returns versus a benchmark.

Capturing a tax benefit via tax loss harvesting entails selling a holding when it’s at a loss for that investor. But the adroit investor can also swap – simultaneously replace that position with a similar enough substitute – to maintain the desired market exposure and thus still capture the tax benefit and be positioned for if or when asset prices rebound.

In Conclusion

Constructing a better portfolio typically involves increasing fit, increasing diversification and lowering the cost drag to the investor. For many investors, there may be room for improvement in the after-tax performance of their portfolios. After all, we all want better portfolios to meet our goals. That means not just making more but keeping more of what we make.

Disclaimer

Green Harvest Asset Management does not provide tax, legal or accounting advice. This material is for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Although Green Harvest does not provide tax, legal or accounting advice to, we stand ready to assist clients and their advisors in reviewing the relevant tax rules.

References

- 1. BlackRock, Inc. analysis of Morningstar data (as of Dec. 31, 2018)

- 2. ETF.com – Why Are ETFs So Tax Efficient? – 1/31/14