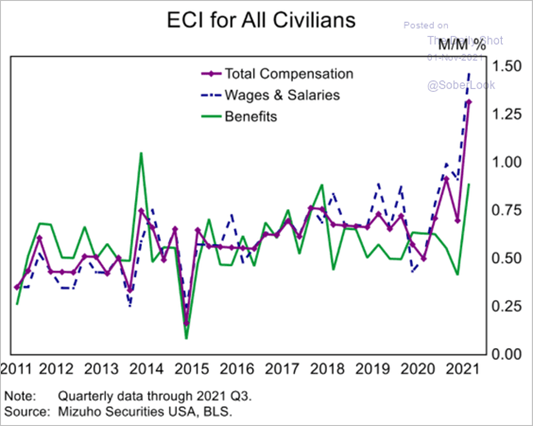

Good help is growing hard to find—and afford—in the U.S. The Employment Cost Index (ECI) posted its largest gain on record last quarter, driven primarily by wage increases on the lower end of the pay scale.

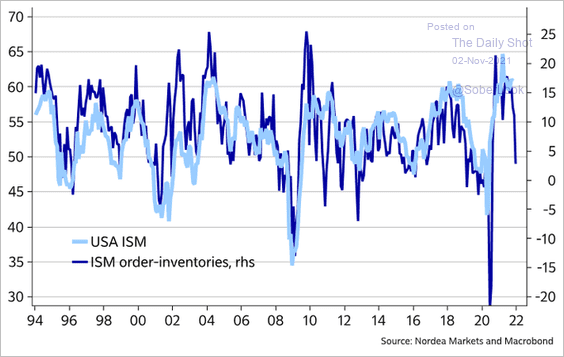

It’s yet to be seen exactly how much of the increases will be passed through to customers, but it’s unlikely to be subtle as businesses scramble to preserve their margins. Regional manufacturing reports surprised to the upside in October while the national ISM data was roughly in line with expectations, both demonstrating continued strength from the manufacturing sector. As we mentioned though, margin pressures persist, and customers are growing frustrated by supply-chain-induced inventory shortages and delays. It’s also having an effect on consumer confidence, which has been deteriorating—particularly amongst non-investors—despite the acceleration in personal incomes. Investors meanwhile have been enjoying indices yet again climbing to new record highs, but the speed of the ascent is giving us pause. Will the return to earth be just as dramatic? Finally, is stagflation taking root in Europe? And if so, what are the implications for the U.S.?

1. The employment cost index had its highest quarterly increase ever in Q3:

Source: Mizuho Securities USA, from 11/1/21

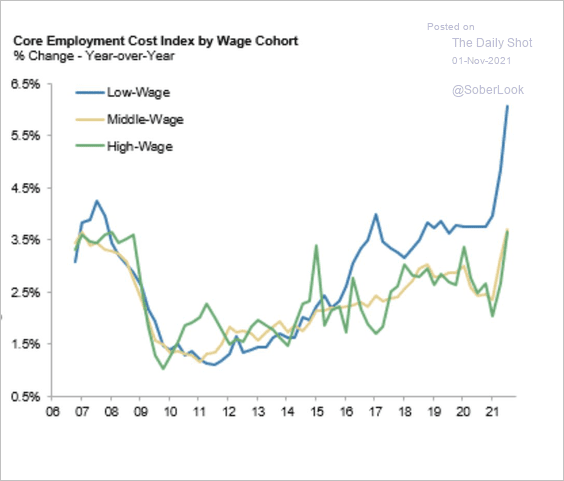

2. After 3 decades of flat wage growth and negative real wage growth, the lower end of the pay scale is demanding and receiving higher wages:

Source: The Daily Shot, from 11/1/21

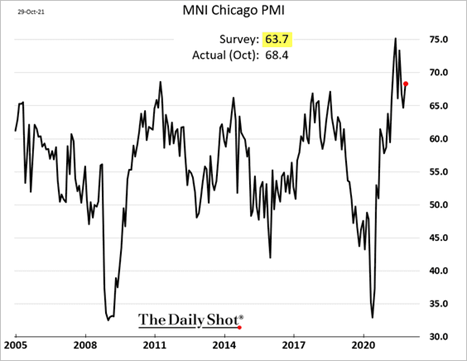

3. Both the Kansas City and Chicago Fed reports showed increased business activity last month:

Source: The Daily Shot, from 11/1/21

4. Overall, U.S. manufacturing continued at a nice pace last month. Will it start to moderate as other data suggest?

Source: The Daily Shot, from 11/1/21

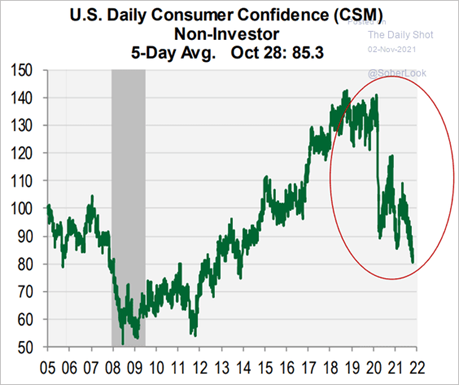

5. The Covid “hangover“, including inflation worries, continues hinder Americans’ confidence in the economy:

Source: Cornerstone Macro, from 11/2/21

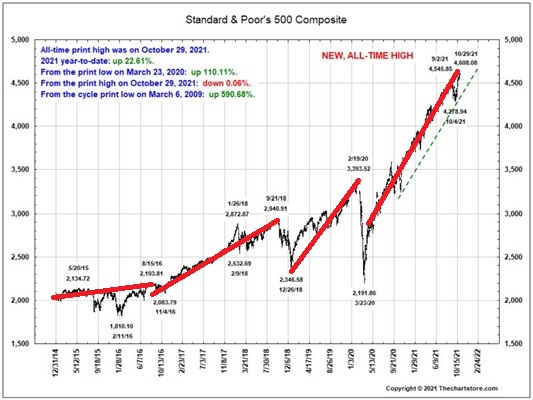

6. Halloween may be over, but this is still scary; Does anyone notice that the slopes are getting steeper? When the inevitable correction comes, will the downside be as fast as the upside?

Source: The Chart Store, from 10/31/21

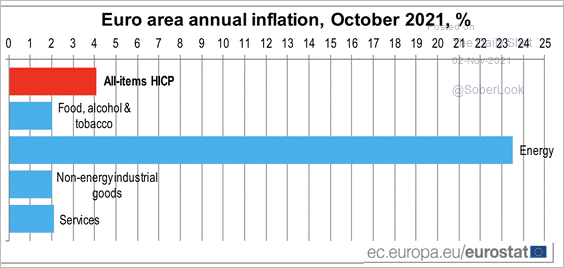

7. Energy inflation will work its way into most segments of the economy unless you don’t want to eat, travel or heat your home…

Source: Eurostat, from 11/2/21

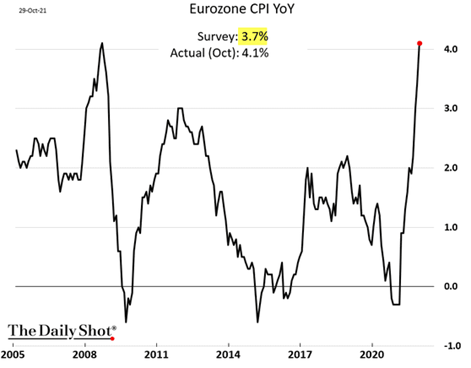

8. European inflation surprised to the upside:

Source: The Daily Shot, from 11/1/21

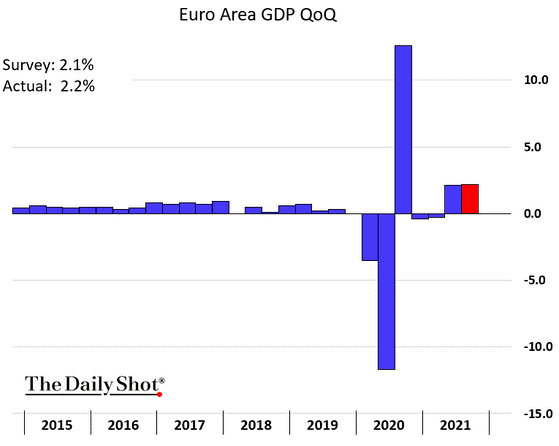

9. Yet Europe has returned to a low-growth mode. Higher inflation + low growth + relatively high unemployment = stagflation!

Source: The Daily Shot, from 11/1/21

Disclosure:

The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

David M. Haviland a Managing Partner of the firm and Lead Portfolio Manager of Beaumont Capital Management (BCM). Check out his full bio here.