Here in America, we love ‘purposed’ savings vehicles. We have IRAs for our golden years/retirement. We have health savings accounts (HSAs) for our medical needs. And when it comes to saving for higher and secondary education expenses, a 529 Plan can’t be beat. There are plenty of advantages—from tax deductions to tax-free withdrawals—when it comes to using the accounts.

But like many other specialized savings’ vehicles, 529 Plans offer some interesting benefits to investors looking beyond its intended purpose. In this case, it’s an additional vehicle for retirement savings.

While it shouldn’t be your main driver for retirement investment, a 529 Plan can serve as a complement or bonus account for your retirement efforts. As such, more investors might want to consider them.

To learn more about retirement topics, visit our Retirement Channel.

529 Basics

Created back in the mid-1990s, 529 Plans are designed to help save for higher education costs. Sponsored by various states, these plans allow parents, grandparents, guardians, and students themselves to save for college.

Any U.S. resident who is 18 years or older and has a Social Security Number or Tax ID can open a 529 Plan. The plans are tied to a certain beneficiary—or who you are saving for—which can be changed by the account. There are no income restrictions and savers can contribute up to $14,000 per beneficiary in a single year. However, the account can be front-loaded by $75,000 in one year without the money being subject to the federal gift tax. Savers can put a maximum of $500,000 per beneficiary into a 529 account.

By placing money in the plan, savers get tax advantages on a variety of levels and could possibly score the coveted trifecta of tax benefits.

For starters, depending on the plan selected, savers might be able to get an income tax deduction for their contributions on their state taxes. Secondly, taxes on gains, interest, and dividends are tax-deferred. And finally, savers can receive tax-free withdrawals on qualified education expenses.

Benefits for Retirement Too

As an education account, 529 Plans can’t be beat. But they aren’t too bad from an extra retirement account point of view either. That’s because several of their benefits can work in investors’ favor when it comes to long-term retirement savings.

Unlike an IRA, 401k or HSA, there are virtually no limits on contributions to a 529 Plan. This can provide super-savers with more headroom for their contributions.

For many high-income parents and savers, the tax benefits of deferral and potential state tax savings often outweigh taxes paid on a taxable brokerage. Part of that comes down to confusion on just what is considered taxable in a 529 Plan. Contributions made to a 529 Plan are always tax-free. Taxes and the 10% non-qualified expenses penalty are only paid on the gains. So, if you invest $100,000 and it grows to $150,000, you’ll only pay taxes on the $50,000.

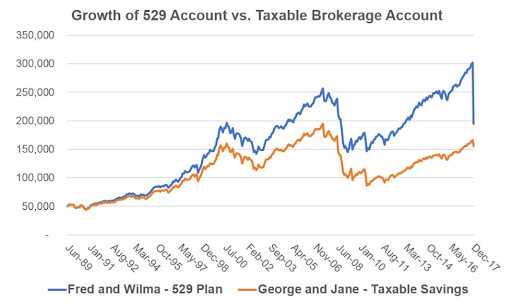

But even with the taxes on the gains, savers can often benefit and come out ahead. This example and chart from Resource Planning Group highlights two families saving $50,000 in a 529 versus regular brokerage account from 1989 to 2017. The investments are split evenly between stocks and bonds. As you can see, even after paying taxes at the end, the 529 account (blue line) comes ahead with a higher ending balance. The tax deferral makes all the difference.

Source: Resource Planning Group

Retirement savers can also benefit from 529 Plans for their own education. These days, many colleges and universities offer a wide range of classes and programs designed for retirees or furthering education. This includes study abroad opportunities and small overseas lecture trips. Students must enroll in classes for credit to use 529 Plan funds without penalty. Many universities seem hip to this fact and have designed such courses for alumni and retirees so that they do count for credit. This enables savers to tap 529 Plans for education vacations via their enrolled school. However, savers need to be critical of what costs associated with such trips would be eligible for tax-free withdrawals.

Things to Think About

Now there are some caveats when it comes to using a 529 Plan as a retirement vehicle. The tax math works the best for savers in higher-income brackets. For many low- to low-middle income investors, a taxable account—with the potential to pay 0% on dividends and capital gains—may be a better choice.

Secondly, because 529 Plans are set up by individual states, there are different rules for each plan. Some states charge so-called recapture taxes on non-qualified withdrawals, but even still, higher-income savers come out ahead in most scenarios. It’s best to check a plan’s rules. Investors might be able to skirt some of these recapture taxes by conducting a roll-over to other states’ plans a few years before withdrawal. But again, states have different rules on roll-overs.

Finally, investors need to be wary of investment choices. Often the default option is a target-date portfolio that moves into cash once a student hits college age of 18. That might be fine if you’re planning to use the funds for college, but if your timeline is 30 years from now, it makes sense to shop around a plan’s funds. Most feature low-cost index funds and stock-based investments.

Check out our Portfolio Management Channel to learn more about managing your portfolio.

The Bottom Line

529 Plans are wonderful education vehicles, but they can also be a great ‘bonus’ retirement account for many savers. While they shouldn’t be your primary driver for funding your golden years, they do make sense as another way to defer taxes and boost overall asset mix. Parents shouldn’t feel bad about ‘overfunding’ these accounts and getting every dollar they can into them.

Don’t forget to explore our recently launched model portfolios here.