Retirement isn’t what it used to be. A combination of factors – such as the lack of pensions, low interest rates and overall higher living costs – has made the act of retirement harder for many Americans. Even with proper planning, it can be a daunting task to get every piece right. And according to new research, the task is facing a precipice.

Soon, more Americans will turn 65 than in any other point in history.

Dubbed Peak 65, the milestone has widespread implications for a number of social programs and, potentially, market implications. In the end, it pushes more stress and pressure on individuals as some of the frameworks we have for retirement will possibly change.

For pre-retirees, the concept of Peak 65 is a major looming concern. But it’s one that can be dealt with by implementing careful planning.

To learn more about retirement topics, visit our Retirement Channel.

What is Peak 65?

Historically, 65 years of age is a major milestone for workers. It’s the age when many people can qualify for full Social Security benefits and Medicare. That date was set in stone back during the Great Depression and the original Social Security Act of 1935. Since then, many workers have used the date as the start of their golden years.

The issue is that perhaps too many people are marching into their golden years at the same time. That’s the gist of a new study from the Alliance for Lifetime Income. The non-profit consumer education organization recently unveiled its framework for the so-called Peak 65 problem.

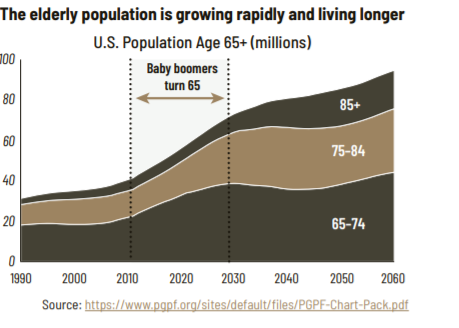

Born between 1946 to 1964, the Baby Boomer Generation numbers roughly 73 million. The problem is that the generation is hitting the tipping point when it comes to retirement. We’ve all seen the stat that roughly 10,000 Boomers turn 65 every day. According to the Alliance for Lifetime Income, that number is now closer to around 12,000 per day, ramping up the number of older individuals to unprecedented levels. According to the group’s study, by 2024, we will have more people aged 65 or older than at any other time in the nation’s history. By 2030, all of the Baby Boomer Generation will have turned 65. You can see by this chart below how the breakdowns in age brackets will look.

Source: Alliance for Lifetime Income

The issue is that at that time the number of those aged 65 and older will be larger than the number of children in the United States. Nearly one-fifth of the entire estimated U.S. population will be at retirement age.

Wide-Sweeping Issues

According to the Alliance For Lifetime Income, this has some dramatic effects on how we view and save for retirement. The so-called three-legged stool of retirement planning – employer pensions, personal savings and Social Security – is becoming obsolete.

With employer pensions now unavailable for the vast bulk of workers, more retirees are being forced to rely on Social Security for the bulk of their income. Originally, Social Security was designed to replace about 40% of a worker’s income, with pensions picking up much of the slack. However, these days, the social program is being used for more than 50% of pre-retirement income in married couples and nearly 70% in those who are unmarried.

This is dangerous because of the financial shortfalls facing the Social Security trust. Without intervention, the trust will be depleted by 2035, only 11 years after Peak 65. The issue is that by this time there will only be 2.2 workers paying taxes to support the program. That’s the lowest amount in history, and the number continues to drop as Millennials and Gen Z adults forgo having children.

The second piece is that low interest rates have caused many retirees to lean on the market or take undue risks to their portfolios to generate enough income. You used to be able to buy a CD yielding 4% or more and live off the interest. These days, you need to buy some pretty exotic fare to get a high yield.

Overall, the Alliance For Income predicts that retirement security will drop significantly once Peak 65 happens due to these combinations of forces. And that includes middle-to-upper-middle income earners.

Potential Solutions

So, what can retirees do about this? Aside from saving every extra dollar they can ahead of time? Finding a replacement for the lost pension income is key. Alliance For Income suggests that personal annuities can make the difference in finding inflation-protected income that won’t outlast a retiree’s lifespan. In exchange for a lump sum payment at retirement, an investor can turn their portfolios into a steady monthly payment for life. As such, immediate or fixed annuities could form the core of a retirement savings and spending plan going forward.

But annuities aren’t perfect either. Their payment rates are tied to prevailing interest rates and they can be very expensive. And any riders – such as inflation protection – can cost you more. But they are a good starting point for investors. Turning a portfolio of savings to cover basic necessities will go a long way in reducing the need for social security and retirement scarcity risks.

Dividend stocks remain a top draw as well. Earning 2 to 4% in cash can go a long way to helping boost income both during and before retirement. Moreover, dividend payers tend to be less volatile than the overall market.

Dividends do have drawbacks as well. For one thing, they aren’t guaranteed, and firms cut them for various reasons. And, again, investors are still exposed to overall market risk – dividends or not.

Our Best Dividend Stocks List has 20 of the highest-rated stocks by our proprietary Dividend.com Rating system. Go Premium to find out the entire list.

The Bottom Line

Peak 65 is a major issue for those heading into retirement. With it comes some major challenges and potentially big changes to how we generate future income in our golden years. The real lesson is that we may not be able to rely on Social Security as much as we did in the past.

Keep track of the latest news in our News section, where we regularly publish the latest around dividend investing.