The Social Security Act was signed into law by President Franklin D. Roosevelt in 1935, creating a federal safety net for elderly, unemployed and disadvantaged Americans.

Since its inception, tens of millions of Americans have received financial assistance through the program. In 1960, the program was expanded with the addition of Medicare to allow Social Security benefits for disabled workers and their dependents.

Let’s take a look at the benefits that Social Security provides and tips on maximizing your benefits.

Use the Dividend Screener to find the security that meet your investment criteria.

Getting a Holistic View of Social Security Benefits

Most Americans are familiar with the basic tenets of Social Security: You pay into the Social Security program through a payroll tax during working years and collect a monthly stipend between the ages of 62 and 70. Aside from the obvious retirement payments, the Social Security program provides a wide range of other benefits to different groups of people.

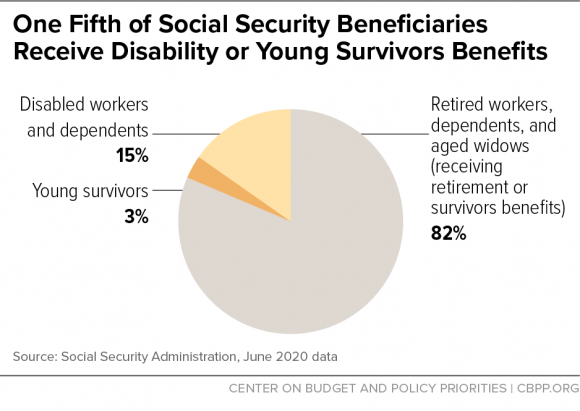

Retired workers account for just 82% of benefits. Source: CBPP

Some of the lesser-known benefits include:

- It’s more than a pension: Social Security provides life insurance and disability insurance. In fact, around 90% of individuals have earned life insurance protection and a similar percentage are insured in the case of severe disability.

- A larger risk pool with lower costs: Social Security provides a higher annual payout than private retirement annuities per dollar contributed because its risk pool isn’t limited to those who expect to live a long time.

- Millions of children benefit: Social Security lifts 1.5 million children out of poverty and about 2.8 million children received their own benefits as dependents of retired, disabled or decreased workers in 2019.

- Beneficial to the disadvantaged: Social Security has a disproportionately positive impact on people of color, who experience greater levels of poverty per capita, as well as women, who tend to earn less than men during their careers.

While some sustainability concerns have arisen, these reports are largely overblown and misunderstood. The depletion of the Social Security reserve fund could result in a permanent 25% reduction in all benefits beginning in 2035 (not an elimination of all benefits), but a modest increase in payroll taxation can make it sustainable. However, that is a different topic of discussion altogether.

Be sure to check out Retirement Channel to learn more about retirement planning strategies.

How to Maximize Your Benefit

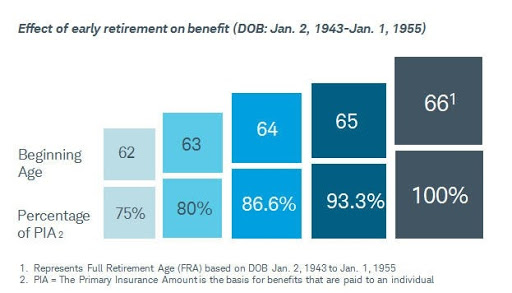

More than a third of insured workers claim Social Security benefits as soon as they become eligible at age 62; however, claiming early benefits results in a permanent 0.5% reduction in benefits for each month before full retirement age. On the other hand, delaying benefits until age 70 lets you collect credits that vary from 5.5% to 8% depending on your birth year.

Example of how early retirement can affect benefits. Source: Schwab / SSA

There are a few things to consider when deciding when to take benefits:

- Income Requirements: You should delay Social Security benefits if you have enough retirement savings from other sources in order to maximize your benefit. If you have the ability to do so, postponing retirement is a good way to avoid taking benefits and pay down debts to reduce cash requirements in retirement.

- Breakeven Age: Life expectancy plays an important role in the decision of when to take benefits. By comparing your life expectancy with your breakeven age (typically 77 or 78 years old), you can determine if it makes sense to take early Social Security benefits or delay them to ensure you have enough.

- Spouse and Children: Your spouse’s age and health are important since they may qualify for a survivor benefit. If you’re a high earner, you may want to delay your Social Security benefit to provide your spouse with a higher survivor benefit. These same considerations may apply for children that may be eligible for benefits.

If you have already taken early Social Security and changed your mind, the Social Security Administration lets you pay back benefits for up to a year. You can then restart benefits at a later date and benefit from a higher payout. There are no fees or interest charged for the repayment, so there’s little downside to changing your mind.

The Bottom Line

Social Security provides a foundation of retirement protection for nearly everyone and is responsible for lifting millions of elderly Americans out of poverty. In general, it’s a good idea to delay Social Security benefits for as long as possible in order to maximize your benefits unless your life expectancy is below your breakeven age.

Be sure to check our News section to keep track of the latest updates around income investing.