One of the biggest tenants of modern portfolio theory (MPT), long-term investing and building a retirement portfolio is asset allocation. The basic gist is that investors are able to cobble together a portfolio of different asset classes in order to drive better long-term returns. Stocks, bonds, real estate, precious metals, etc., all move in different directions and magnitude. This lack of correlation provides strong returns in both up-, down- and sideways-moving markets.

Or at least that’s the theory.

In recent years – and with the Great Recession and Coronavirus Pandemic – correlations for many of the major asset classes have been similar. This has prompted many investors to look for various alternatives and other strategies to get the needed non-correlation.

With recent legislation and new rules from the U.S. Department of Labor, liquid alts could be coming to a retirement plan near you. The question is do you need them?

Be sure to check out the Retirement Channel to learn more about retirement planning concepts and strategies.

Liquid Alts: The Real Basics

When we are designing portfolios, diversification (aka correlation) is what it all comes down to.

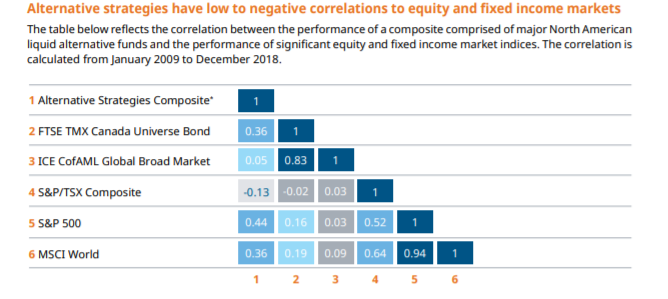

In a nutshell, correlation measures the strength of the relationship between the returns of two investments: For example, how two asset classes such as U.S. stocks and Treasury bonds move together. Perfectly correlated investments – often rated as +1 – will always increase or decrease in value at the same time and at roughly the same rates. On the flipside, two negatively correlated assets will always move in opposite directions. If you hold a portfolio of 40 different asset classes and their correlations are similar then it really doesn’t matter that you hold a diverse basket of assets.

Real diversification means that your portfolio’s holdings move in different directions and magnitudes under various conditions. The idea is that while this can’t guarantee zero losses, it does help impact longer-term returns in a positive way. Losses in foreign stocks are buffered by gains in gold, for example.

The problem is that traditional asset classes used for diversification are now getting more and more correlated. Stocks and bonds are moving in the same directions as low interest rates switch up the relationship. A more interconnected global economy is limited by the effect of holding international stocks. Even commodities and real estate assets aren’t producing the same level of non-correlation that they once did.

Which is why, investors – especially institutional ones – have been drawn to alternatives. Retail investors may not be familiar with strategies like 130/30, market neutral, event driven or merger arbitrage, but these techniques could be key in solving the diversification dilemma. These strategies have been packaged into mutual funds, ETFs and other vehicles, and also dubbed as liquid alternatives.

While a long-short credit fund is really a separate asset class, in this context it can be still considered as a bond. The strategy tends to produce uncorrelated returns; as does the rest of liquid alts. This allows them to be powerful and attractive diversifiers for portfolios. You can see that from this chart by asset manager Mackenzie.

Source: Mackenzie Guide to Liquid Alts

Getting Into Your Retirement Plan

Despite the potential benefits of liquid alts, adoption by retail investors has been slow. Part of the reason has been the lack of availability in defined contribution plans like 401ks. According to a recent PGIM survey of defined-contribution (DC) plans, only about one in ten 401ks offer alternative investment options as part of their target-date fund line up. The number is even less when looking at stand-alone alternative mutual fund options. The data gets even more pessimistic when many plan sponsors consider real estate/REITs as an alternative.

However, all of this may be changing.

Back in June of 2020, the U.S. Department of Labor (DOL) created rules that would allow DC plans to include private equity assets in their mix. The department argued that this would not “violate the fiduciary’s duties under section 403 and 404 of ERISA.” The DOL also made it known that the best way to add this component could be via “customized asset allocation strategy funds.” Target-date funds (TDFs) and similar funds fall under this umbrella.

Other roadblocks are starting to be removed as well. Currently, the Securities and Exchange Commission rules dictate that alternatives be limited to accredited investors. However, the SEC is looking at drafting proposals that allow liquid alts to be available to all investors. Meanwhile, new proposals to modify the Employee Retirement Income Security Act (ERISA) on the competitive fee provision could help bring alts into more TDFs and DC Plans. Alts are typically one of the most expensive classes of mutual funds out there. Fear of fee-related litigation is one of the main reasons cited by plan sponsors for not including alts in their line ups.

Sooner or later, alts could be a part of your portfolio.

Be sure to check out our previous take here on the scope of alts during volatile markets.

Do You Need Them?

The real question is do you need them at all? The answer right now is mixed.

Given the market’s surge and high fee hurdle, many liquid alternatives funds have been poor performers. But that’s kind of the point. They really are non-correlated assets. So, they shouldn’t do “well” during periods of high stock performance.

However, during the dot-com crash of 2000/2001 and the Great Recession of 2008, a basket of alts did their jobs. During the recent pandemic-induced panic, alts performance was good as well. Nonetheless, the top performance was not as widespread as previous crashes.

And in this, alts provide some of the only real diversification “bang for your buck” these days. Given the severity of recent market downturns and rise in volatility, investors may want to consider them in their investment menu. With more DC plans moving to include them, many retail investors will have an opportunity to add these diversifiers to their portfolio. Even better is that adoption in 401ks could help drive down fees and make the “asset class” a stronger return element overall.

The Bottom Line

Diversification is losing its luster, thanks to continued correlation among asset classes. With that, liquid alternatives could be a portfolio’s saving grace. With new rules allowing them to be considered for DC plans, regular investors will soon have the opportunity to add alts to their investment mix.

Be sure to check out MutualFunds.com’s News section for next week’s trending news.