There are many ways for investors to generate income in retirement from a portfolio. Dividend stocks, bonds, real estate and even cash holdings can be used to pay for retirement. Another overlooked option could be annuities.

While complex and available in many forms, the contracts – sold by insurance companies – can provide a steady stream of income payments and potential growth to retirees during their golden years. For investors, these products could be the answer to the recent market hiccups depending on how you use them in your portfolio.

Annuity Basics

Annuities have a reputation for being a terrible product, or a security type that only enriches those insurance agents who sell them. And while there are some unscrupulous ones out there, the majority of agents can serve investors well if they know exactly what they are buying with their savings.

In essence, annuities are contracts between an investor and an insurance company. In exchange for a lump-sum payment or series of payments, investors can receive regular disbursements now or in the future. Some annuities promise growth tied to market returns or a fixed amount. Others promise immediate payouts based on interest rates. Depending on individual scenarios, goals and market conditions, one or more annuity types could make sense for an investor to use.

To learn more about retirement topics, visit our Retirement Channel.

Today’s Market Conditions & Annuities

And we’ve seen how market conditions can change the way in which investors use annuities in their portfolios. This has been especially true during the coronavirus pandemic and resulting economic downturn.

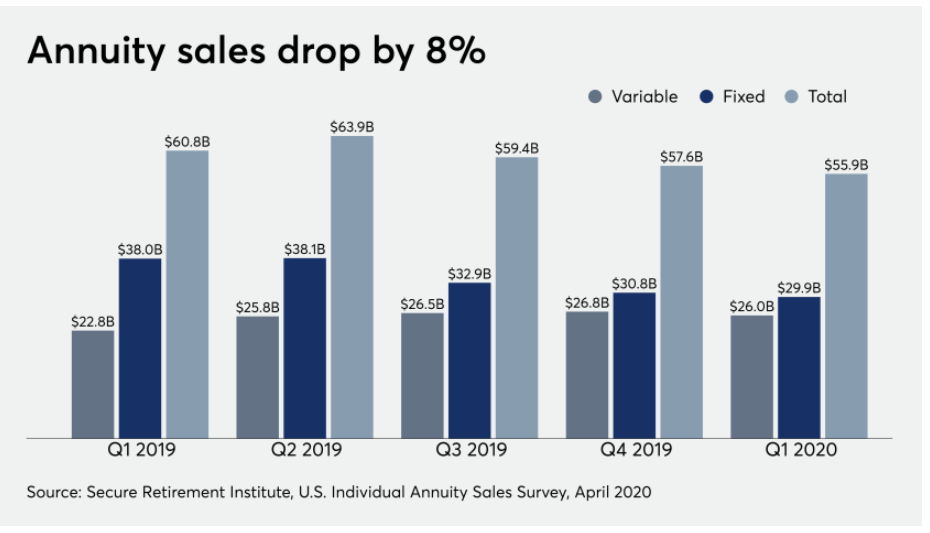

Just take a look at this chart from the LIMRA Secure Retirement Institute – total annuity sales slipped by 8% during the first quarter of 2020.

Source: Financial Planning.com

As the coronavirus pandemic has created economic havoc, record unemployment and volatility, investors have been flocking to certain segments of the annuity market while shunning others. Exacerbating this fact was the continued low-rate environment. In order to jump-start the economy, the Federal Reserve has once again enacted a zero-interest rate policy (ZIRP). Many forms of annuities are tied to interest rates. With rates being low, locking in a 1% payout or a guaranteed return doesn’t make much sense at all.

All of this affected annuity sales so far this year. Digging into LIMRA’s data shows that what investors were buying was not at all even. Some products did better than others given the conditions. A big winner was so-called indexed variable annuities.

Sales of these products rose by 8% during the quarter, and it’s easy to see why. Also dubbed “buffered annuities,” these products offer the ability to lock in a fixed floor on an investor’s principal while still getting growth. This is different from a complete and full variable annuity, which is tied to a portfolio of assets and could lose money based on returns. Sales of those products sank by 24% during the quarter. Also seeing falling sales were so-called Indexed annuities – dropping by more than 41%.

Staying flat were products in the fixed annuity category. While the product offers a steady rate of return that is “fixed” at the time of purchase, lower interest rates mean that these products are offering rates that are close to nothing. The sales data suggests these low rates were still tantalizing for some investors looking to protect assets and receive steady certificate of deposit (CD)-like returns for a portion of their money. However, the low rates also mean that the product may not make sense for everyone these days. Likewise, sales of immediate annuities – in which investors exchange a lump sum of money for payouts today or at a later date – also fell as lower interest rates hinder their distributions.

Check out this article to learn how the passage of the SECURE Act can impact annuities.

Using This Information

The recently observed annuity trends can help investors today when it comes to adding the products to a portfolio or beginning a discussion with advisors and insurance agents. Clearly, there are some winners and losers given the current market conditions.

So far, none of the pandemic’s issues have cleared up. Unemployment remains high; there’s plenty of uncertainty surrounding the presidential election; volatility is rising; economic data remains poor; and the virus itself is still prevalent. To that end, many of the reasons why some products are still in demand, while others are shunned, will continue for the foreseeable future. Buffered annuities could be a decent bet for investors with larger nest eggs who are looking to shield some downside risk in their portfolios.

However, when comparing many of the other annuity varieties, they just don’t add up against regular stocks and bonds. Indexed and variable annuities have histrionically underperformed when compared to mutual funds, dividend stocks and exchange-traded funds (ETFs). And given an ETF’s tax efficiency and rock-bottom fees, the outperformance is becoming even greater.

Elsewhere, fixed and immediate products may not make much sense either these days. The Fed’s recent stance on inflation averaging means rates will stay low for the foreseeable future. This means that fixed and immediate products aren’t paying nearly as high as this time last year. This could make dividend stocks a better option, which is especially true when you consider taxes. Annuity payouts are taxed at an investor’s ordinary-income rate vs. a max. of 15% for dividends. And we can’t forget that dividend stocks have the ability to grow their payouts over time. With an annuity, you’ll pay for that privilege by adding a so-called rider to the contract. This results in higher fees than just the base contract.

So, is it the right time to consider annuities for your portfolio?

Ultimately, it depends on your goals and risk spectrum. Given the uncertainty, the popularity of buffered annuities that offer downside protection makes some sense. However, elsewhere, investors may be better suited to a portfolio of tax-efficient dividend stocks and/or ETFs. Investors seriously need to consider the effects of taxes and fees/charges before making a real decision. Often, the protections and guarantees may not make sense when there are other options – like dividend stocks or municipal bonds – that can generate steady and growing income in a tax-efficient manner.

The Bottom Line

Annuities are complex financial instruments that shouldn’t be bought without serious considerations. The latest sales data highlights that not all products make sense for investors. Often, changes in interest rates and market conditions mean that most annuity products may not make much sense for many investors.

Use the Dividend Screener to find the security that meet your investment criteria.