Rising interest rates have made all manner of fixed income investments very attractive, including annuities. Sales of fixed, deferred, immediate and other annuity products have surged in recent years as higher rates have increased payout amounts. The added volatility of the stock and bond market hasn’t hurt either. All in all, investors can lock in plenty of high income with an annuity these days.

But what if you’ve already locked-in your annuity in previous years? Are you doomed to realize lower payout and interest rates for your lifetime?

Potentially not. With rates now high, some experts have suggested that many investors benefit from a so-called annuity swap or a 1035 exchange. While there may be some cons, the benefits might just outweigh the potential headaches.

Higher Rates, Higher Payouts

Annuities are one of the only financial products that can guarantee lifetime income or provided return amounts. Because of this guarantee, they often form the backbone of conservative portfolios or those of retirees. This is often true, no matter what the prevailing market environment is doing. There’s reasons to lock in income or a guaranteed return, no matter what.

However, for those investors who purchased annuities a few years ago, they may be feeling a bit jealous of those buying annuities today. That’s because the Federal Reserve and its path to monetary tightening has made annuities purchased today more lucrative in terms of payout rates and returns.

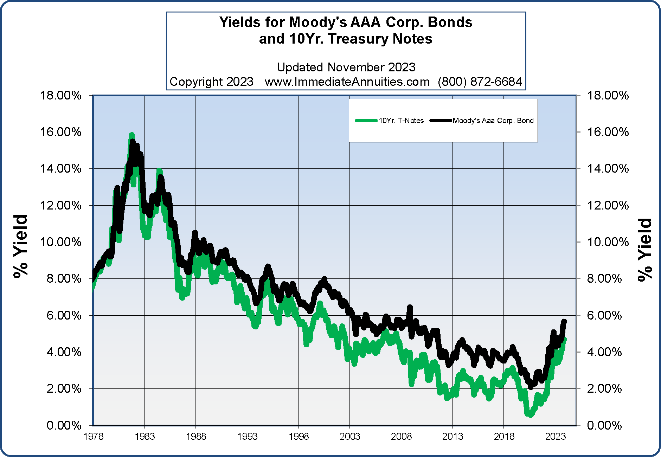

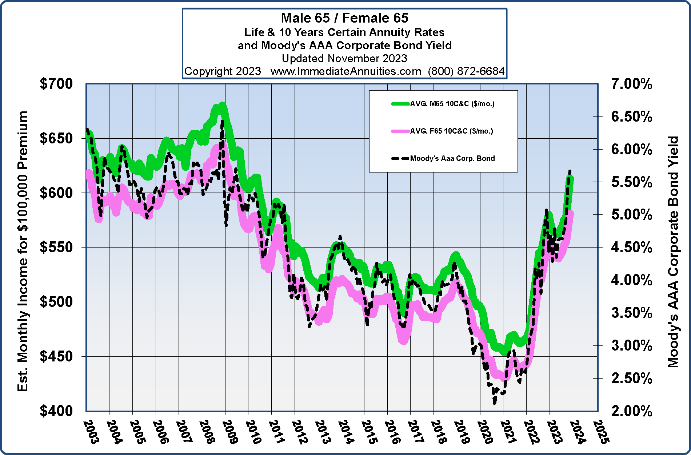

At their core, annuities are contracts with an insurance company in exchange for some promises. The insurance company takes an investor’s money and goes out and invests, hoping to earn more than the return/payout amount promised. Often, they invest these proceeds in bonds and other fixed income assets. When bond’s yield more, the insurance can pay more to the investor.

These two charts from Intermediate Annunities show the relationship between interest rates and annuity rates. You can see the rise and fall of both mirror each other.

Source: Immediate Annuities.com

The key price is the end of the chart. As the Fed has tightened, bond yields have risen alongside annuity rates. Depending on the product, investors can literally score income nearly 30% to 60% higher than just two years ago.

Enter the 1035 Exchange

For many investors who purchased annuities during the COVID-19 pandemic, or in the year after, seeing current purchasers score more income on their investment stings. But all hope isn’t lost. There may be a way to get those higher rates: Enter the 1025 exchange.

A 1035 exchange is line in the tax code that allows investors to swap a life insurance product or annuity for one of a similar type. The beauty is that by conducting a 1035 exchange, investors don’t have to pay taxes on the swap because the funds transfer from one contract to another, bypassing the investors hands.

Not all annuities make sense or are ineligible for a 1035 exchange. Immediate and longevity annuities are considered “irrevocable” products, which are set in stone, once purchased. Likewise, variable annuities, which are eligible, invest in mutual fund-like subaccounts move along with markets.

But for investors who have purchased fixed annuities or deferred annuities, an exchange may make sense. Here, payouts and crediting rates are directly tied to interest rates and now offer plenty of extra income/returns than a year ago. The key is that the jump in income may outweigh surrender fees on the exchange. Most annuities feature a so-called surrender period that lasts for three to eight years. During this time, investors looking to get out of their contracts, pay that fee to the insurance company. Swapping for only a slight bump in payout doesn’t often cover the surrender fee difference. But these days, many investors will be better off paying the fee and gaining the higher crediting amount.

Making a Change

Given the higher crediting rates currently available, it may make a ton of sense for investors with certain annuities to make a 1035 exchange and score higher crediting/income amounts. But they need to do the math and understand what producst they really have to offer to raise a portfolio.

First, would be able to see the fee hurdle. There’s no point in swapping if surrender fees would eat up any difference. At the same time, going from one low-cost annuity provider to a product that costs more may not make a ton of sense and not be be worth the hassle.

Another potential fee hurdle would be so-called market value adjustments. As we said before, the insurance company will generally purchase bonds with your money. However, older bonds are now trading for lower prices than newly issued bonds based on their lower coupon payments. For older issued annuities, this is a problem. Sometimes, insurance companies will adjust an annuities value when surrendered to reflect current market conditions. When you trade in your annuity, it may be worth less than what you purchased it for.

Knowing your fee schedule is critical in making the 1035 decision.

Secondly, just because you have a lower crediting rate fixed product doesn’t mean it will be low tomorrow. Many fixed annuities offer a guaranteed crediting rate for a period of time. After which, they pay the prevailing market rate. At that point, investors can buy a new annuity, annuitize for income or keep their money in the product. With rates high, many annuities heading towards the end of their guaranteed periods may convert over to the new higher rates anyway. Therefore, rendering an exchange useless.

Finally, client relationships could impact the decision. Multiline insurers often give discounts on other products when you have a multitude of business acquisitions with them. Will your homeowners, auto, renters, life insurance, etc. costs change if you swap to another provider? Again, this needs to be included in the decision-making process.

At the end of the day, making an exchange could provide more income and returns potential. Investors need to weigh all the costs and scenarios before doing so, however.

Fixed Deferred Annuity Providers

These issuers were selected based on their issuer rating, which ranges from A to A++. The lowest minimum investment required ranges from $5,000 to $25,000.

| Insurer | AM Best Rating | Lowest Minimum Investment |

|---|---|---|

| New York Life | A++ | $5000 |

| TIAA | A++ | $5000 |

| Prudential | A+ | $5000 |

| Nationwide | A+ | $10000 |

| Pacific Life | A+ | $25000 |

| Lincoln Financial | A | $10000 |

The Bottom Line

Annuities have exploded in popularity over the years as a way to lock in guaranteed income and returns. But those returns are tied to interest rates. For investors who bought an annuity in the last couple of years, the rise in rates may have them feeling left out. Luckily, a 1035 exchange could make sense to help them dial-in higher current rates. Bu,t they need to weigh the costs first before doing so.