Both versions of the SECURE Act set the stage for one of the biggest changes to retirement plans in decades. That would be the addition of annuities to plan menus. With many Americans facing retirement shortfalls and market forces helping spur guaranteed income options, demand is growing for these products.

And it looks like financial advisers are getting on board with these in-plan annuity options.

That’s the gist according to a new survey by Plan Adviser Magazine. Advisers continue to discuss these options with clients even though the market is still in its infancy. That’s a good sign as longer retirements will require such options.

Big Changes From the SECURE Act(s)

Solving the income equation during retirement has long been an issue for many advisers and investors. Compounding this problem has been troubles with Social Security and recent woes. Annuities have been seen as an answer to the issue. The two Setting Every Community Up for Retirement Enhancement (SECURE) Acts added plenty of provisions for investors and their ability to use annuities.

The original SECURE Act included a set of rules designed to remove hurdles and get annuities/lifetime income options into retirement plans. This included adding legal protections to plan sponsors with regard to suitability. Prior to the Act, an employer was legally responsible and subjected to lawsuits if an insurer went out of business and was unable to pay the promised income to annuity owners.

However, with the passage of the law, annuities could now be placed inside a retirement plan as long as plan sponsors still met their due diligence requirements, including healthy reserve ratios, top financial ratings, a clean bill of health with state regulators, etc. Moreover, it removed the lawsuit potential.

These rules made it easy for plan sponsors to add annuities of various kinds as an investment option with 401(k)s, 403(b)s, and other similar savings vehicles. The SECURE Act 2.0 added additional tax benefits with regard to certain deferred annuities and required minimum distributions (RMDs).

With this, investors now have a way to directly turn their retirement savings into income in retirement.

Advisers Like the Idea

The idea of turning a pool of dedicated retirement savings into lifetime income is appealing to financial advisers and many are beginning to discuss these options with their clients. That’s the latest message from a survey by Plan Adviser Magazine.

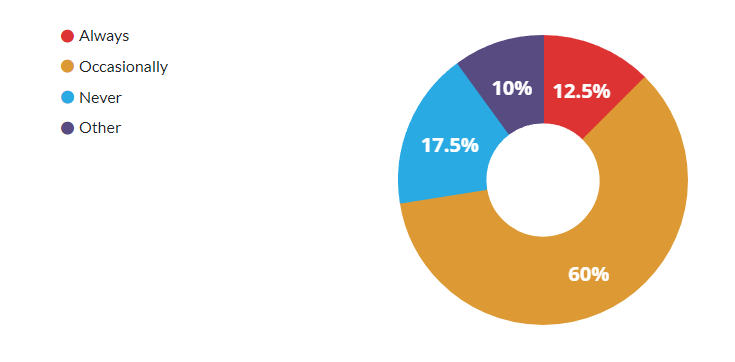

According to its latest PLANADVISER Top Retirement Adviser Pulse Survey, taken in the third quarter, 73% of advisers chat with their clients about in-plan annuity options. Digging in further, 60% of respondents said they occasionally talk about in-plan retirement income with clients, while another 12.5% say they always do. 1

_Source:Plan Adviser

Moreover, a full 100% of advisers plan on potentially discussing annuity options with clients within the next two years as part of their planning practice.

As for the annuity options themselves, advisers are leaning toward ease of implementation when it comes to adding them to their clients’ portfolios. This includes having annuities be part of an overall target-date suite of funds within a 401k or 403b, as well as being able to purchase institutionally-priced (i.e., very low cost) annuity products from a full menu of options embedded within the plan as investment choices.

Not Ready for Prime Time… Yet

Clearly, advisers and clients like the idea of having in-plan annuities for helping drive the income issue and converting savings into a paycheck. If only there were more options. Industry group LIMRA shows that nine out of ten retirement plans currently don’t offer any sort of annuity option despite the SECURE Act changes and allowances. This was echoed in the Plan Adviser survey, with many advisers suggesting that the market isn’t mature enough to have a real discussion or pull the trigger on purchasing.

Product developers have been slow as well with regard to in-plan annuities.

BlackRock was first out of the gate with its LifePath Paycheck suite of target-date products back in 2021. TIAA’s Nuveen unit also recently unveiled its Lifecycle Income Series of target-date funds. Other than that, choices have been slim, with Capital Group being the only other target date series to include some annuity options. But assets and available plans for all these target date fund suites are small.

The good news is that demand and options for in-plan annuities could be growing and hitting a tipping point. According to LIMRA, 75% of defined contribution (DC) sponsors are considering adding annuities to their plans within the next 12 months. Moreover, moves from some of the largest record keepers like Fidelity to add annuities to their in-plan retirement platforms could force other smaller record keepers to start offering annuity options.

Good News for Investors

Ultimately, the SECURE Act delivered on its promise to bring more retirement options for workers and the ability to use annuities in their retirement plans is a step in the right direction. And that advisers want to use them and understand how they can translate into retirement security is a great step in the right direction. Now, we just need more retirement plans to get on board and offer these solutions. With major retirement investment providers such as Capital Group, BlackRock, Fidelity, and T. Rowe Price now exploring annuity-based investment options, odds are good we’ll see more in the future.

In the meantime, investors looking to add annuities to their portfolios have to do so outside their retirement plans or during the process of a rollover.

Registered Index-Linked Annuities (RILA) Issuers

These issuers are selected based on their credit rating.

| Insurer | AM Best Rating | Option of Indices/Funds |

|---|---|---|

| Allianz | A+ | S&P 500 | Russell 2000 |

| Prudential | A+ | S&P 500 Index | Russell 2000 Index | MSCI EAFE Index | Nasdaq-100 Index | Dimensional International Equity Focus Index | AB 500 Plus Index |

| Nationwide | A+ | S&P 500 Index | Russell 2000 Index | MSCI EAFE Index | Nasdaq-100 Index |

| AXA Equitable | A | S&P 500 Price Return index | Russell 2000 Price Return Index |

| Brighthouse | A | S&P 500 Index | Russell 2000 Index | MSCI EAFE Index | Nasdaq-100 Index |

| Lincoln | A | About 30 different active mutual funds |

Fixed Deferred Annuity Providers

These issuers were selected based on their issuer rating, which ranges from A to A++. The lowest minimum investment required ranges from $5,000 to $25,000.

| Insurer | AM Best Rating | Lowest Minimum Investment |

|---|---|---|

| New York Life | A++ | $5000 |

| TIAA | A++ | $5000 |

| Prudential | A+ | $5000 |

| Nationwide | A+ | $10000 |

| Pacific Life | A+ | $25000 |

| Lincoln Financial | A | $10000 |

The Bottom Line

The SECURE Act added plenty of annuity muscle to retirement plans. And it looks like advisers are starting to seriously consider those options for investors. That’s the gist according to a new Plan Adviser survey of top financial advisers. Now, we just need plans to catch up to adviser and investor interest.

1 Plan Adviser (October 2023). Survey: 73% of Top Advisers Chat In-Plan Annuities With Clients