Every four years, market participants get a major jolt. That’s because it becomes U.S. presidential election time. Shifts in leadership and the uncertainty caused by new administrations can have a huge impact on policy, laws and foreign relations. For investors, this can also create plenty of volatility. After all, if there’s no clear easy winner, uncertainty grows.

The question then becomes what do we do with our investment portfolios?

Does it make sense to allocate assets differently during a presidential election cycle, or just after? Or should we keep the course steady? The answer may come down to a slight tweaking rather than a major shift in holdings.

Don’t forget to check out our Portfolio Management Channel to learn more about portfolio management concepts and trends.

Elections & Market Returns

These days, Republicans and Democrats mix like oil and water. Both parties have a very defined set of ideals and attitudes toward various economic, social and governance policies. So it’s easy to understand why traders and investors get worried around election time. Because of the key differences, we could see a huge shift in policy points depending on the election outcome.

Questions will arise for investors, such as: what new costs will businesses endure? And what kind of regulations will there be?

Historical data shows that returns for the market in an election year leading up to election day tends to be muted and full of volatility spikes. Going back to the 1930s and examining election-year returns, equities averaged just a 6% total return. Bonds provided similar results, returning 6.5% in the year leading up to an election. This compares to an average 8.5% and 7.5%, respectively for the two asset classes.

According to analysts at U.S. Bank’s Wealth Management Division, overall returns for the market in the year after an election are lower than average, while bonds slightly outperform. The key isn’t which party is in charge but whether or not the party’s policies change the economic outlook. Data shows that when a new party comes into power, the stock market gains on average around 5%. When the same president is re-elected to the White House, returns are slightly higher at 6.5%.

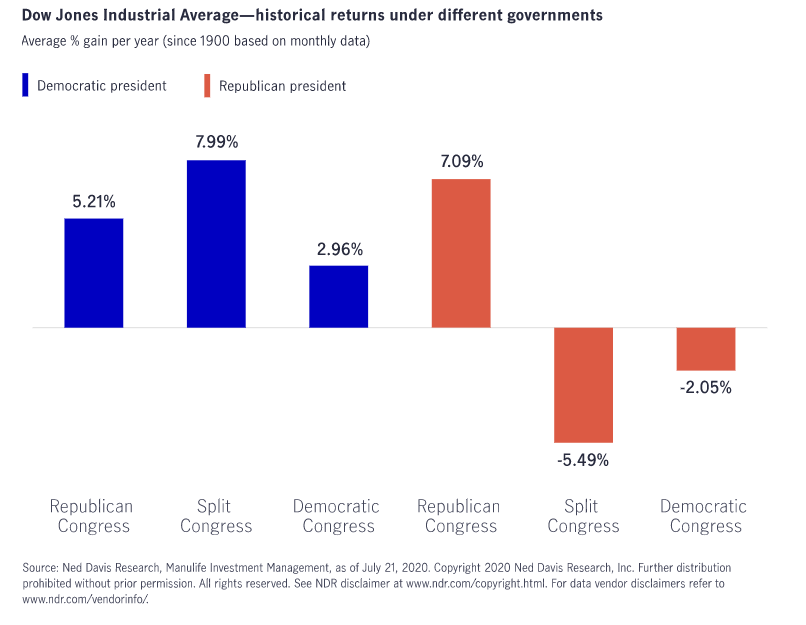

And this chart from Ned Davis Research shows that the breakdown matters more when it comes to who is in Congress when the change happens.

Source: Ned Davis/Manulife

Check out our Asset Allocation Category section to learn more about funds that can help you diversify your portfolio.

Changing Our Allocations

The question is: What about after the election? Given the potential for change, do investors need to switch up what they are doing? The answer may be a big nothing with an asterisk.

The reality is that even a Democratic sweep doesn’t mean wide policy changes like investors may fear. Data shows that the view is often cited as a market negative, but it doesn’t function that way when it comes to returns.

So, what to do? Ideally, doing nothing may be in order. If the bulk of your portfolio is in diversified index funds like the Vanguard 500 Index Investor (VFINX ) or iShares US Aggregate Bond Index (BMOIX ), you may not need to do anything – returns have historically been lower both before and just after U.S. presidential elections. A diversified portfolio of assets has typically done just fine during these time frames.

However, a little tweaking may be in order.

Elections have historically been volatile times. This year is no different. For investors looking to smooth out their rides, claim their portfolios and, perhaps, limit some of the short-term market risk, a few changes could be in order.

Dividends have long been a great way to fight market risk while smoothing out returns. After all, getting 2 to 4% in cash can go a long way, and actually turn losses into gains. This is true even during presidential election years. Even better is that dividends have continued to receive favorable tax advantages even when income taxes have risen under Democratic administrations. This could make a having a swath of dividend stocks very advantageous in the year ahead. Investors have plenty of choice in this area, both in indexed and active funds. The Vanguard Dividend Growth (VDIGX ) and Franklin Rising Dividends (FRDTX ) are two great examples of dividend funds.

Other tweaks could include focusing on sectors and segments of the market that have great long-term catalysts which are pretty immune from any presidential meddling, namely tech, healthcare and defense. Wide-sweeping changes in any of these sectors is pretty hard to pass through in federal law, and there have only been a few instances in history where one party has controlled both the presidency and Congress. This means big policies against these sectors will be slim, making stocks like Microsoft (MSFT) or funds like the Invesco Health Care (GTHCX ) interesting election-year bets.

What about globally?

These days, investors are very international with their holdings. However, this is one area where they may want to trim back. According to Dimensional Fund Advisors, international stocks have been a mixed bag during election times and regime changes. Since the 1970s, developed international stocks grew 100% of the time under Democrats, but only 50% of the time under Republicans. The reverse is opposite for emerging market names – winning under Republican control all of the time, but not during Democratic presidential changes. There could be too much uncertainty and risk for many investors, especially for those near or in retirement. Trimming back international exposure could be prudent during election cycles.

The Bottom Line

Election cycles cause plenty of uncertainty as policy changes are unknown. However, the reality is that the market is still able to take these changes in stride. For investors, it means doing absolutely nothing could be the best policy. However, slight tweaks could also be in order to ensure better returns and risk reduction.

Be sure to check out our News section to be up-to date with trending funds and market updates.